- The Weekly Buzz 🐝 by Blossom

- Posts

- 🇨🇳 China's AI Frenzy Kicks Off 2026 With a Bang, With One Stock Jumping 76%

🇨🇳 China's AI Frenzy Kicks Off 2026 With a Bang, With One Stock Jumping 76%

Plus, what Warren Buffett's exit means for Berkshire Hathaway...

TOP STORY

🇨🇳 China's AI Frenzy Kicks Off 2026 With a Bang, With One Stock Jumping 76%

🎆 Happy New Year everyone! The 2025 season has come to an end, and we’ve officially wrapped up our first trading week of 2026 🥳

✅ And while the market fell -1.2% during the last 3 trading days of 2025, it opened the first day of 2026 in the green (up +0.2%), kicking off the year with some fresh optimism.

✨ A few highlights from our first week:

1) ❌ Trump Promises to Replace Jerome Powell in January

Trump has long hinted at getting rid of Fed Chair Jerome Powell, accusing Powell of moving too slowly to cut interest rates, but it looks like January might finally be the month that Trump gets to say ‘you’re fired’.

Since Trump will almost certainly appoint a new chair who’s more willing to swiftly cut interest rates, many analysts see this a good news for the markets in 2026.

I would imagine that we actually see in the second half of this year that interest rates go down substantially. And that's going to be good for all stocks, not just tech stocks."

2) 🤖 Semiconductors Lead the Charge

🏆 The biggest winner in the first trading day was semiconductors, with Nvidia ($NVDA) jumping 1.3% and ASML jumping 8.8%, a great start to the year for the AI trade.

But if we want to understand why, we have to look beyond the US markets and set our sights on Asia…

🇨🇳 China’s AI Frenzy

China kicked the year off with a huge bang, with the Hong Kong index jumping +2.8%, the best start to a trading year since 2013.

And not just China, all of Asia was soaring this week, with Samsung jumping +7.2% after the semiconductor industry reported a 22% year-on-year increase in exports in December.

🤖 A Surge In Chinese AI IPOs

Part of the reason for the soaring markets in Asia is a surge in Chinese AI IPOs. Shanghai Biren Technology, an AI chip designer, IPO’ed on Friday and closed its first trading day up 76%.

Shares of Baidu also jumped 15% after its semiconductor unit filed for an IPO, with many more IPOs on the horizon, including AI software companies like MiniMax and Zhipu, the ‘six little dragon’ AI robot makers, and many others.

P.S. An IPO is an initial public offering, and it’s when a company goes public on a stock exchange (meaning investors can buy it’s shares on the open market).

🚀 All this has led to a huge boom in Chinese AI stocks, a welcome turnaround for investors after an incredibly rough 4 years between 2021 and 2025 amid regulatory crackdowns.

💡 Now, when most of us think of AI, we probably think of ChatGPT and generative AI models, but in China, things are very different…

But before we talk about that, and whether you should invest in the Chinese AI space, a quick word from this week’s sponsor, BMO ETFs!

PRESENTED BY BMO ETFS

⭐️ Why BMO Broad Market ETFs Are a Smart Investment Solution

🔍 If you're looking for a simple, low-cost way to invest across entire markets, BMO’s broad market ETFs are a powerful solution. These ETFs offer:

📊 Instant diversification across hundreds of companies

💸 Low management expense ratios (MERs) — for example:

Transparent holdings and daily pricing

Liquidity and flexibility, traded like stocks

Trusted expertise from one of Canada’s largest ETF providers, with over $110B in AUM

Whether you're building a core portfolio or starting out as a DIY investor, BMO broad market ETFs make it easy to invest with confidence.

*See BMO ETFs Disclaimer at the end of the newsletter

TOP STORY CONTINUED

🦿 The Sprint Towards ‘Physical AI’

💪 Ok, so I mentioned that AI in China is very different, but how? The answer is ‘Physical AI’.

💡 While most of the discussion and investment around AI in the US is around large-language models (LLMs) like ChatGPT, in China, ‘embodied intelligence’ (aka AI to help robots move, steer driverless cars, or even simulate real world events like climate change) is the main focus.

🎯 So much so that Beijing identified “embodied intelligence” as one of China’s future priorities in its upcoming Five-Year Plan.

💽 This approach is actually very different than the approaches taken for LLMs. While LLMs are trained on vast amounts of internet data to generate text and images, training AI for the physical world requires real-world inputs.

🧮 While for LLMs a lot of the breakthroughs came from feeding the models more and more data, for Physical AI, many experts believe that using AI methods to calculate the data points will make the process much easier.

🇺🇸 What Does This Mean for US AI Companies

🤔 So all this may have you wondering… what does all this mean for US tech?

👀 Well, it’s worth noting that in November, the US-China Economic and Security Review Commission urged Washington to step up investment and regulatory approvals for autonomous systems and robotics… warning that China is making rapid advances in physical AI.

👷♀️ All of China’s AI efforts used to be powered by Nvidia chips, but due to sanctions from both the Biden and Trump administrations, China has been rapidly building its own chip makers to power its AI ambitions. According to one analyst:

"Nvidia's once-dominant position in China's AI chip market has effectively evaporated in 2025, marking a seismic shift in the global intelligent-computing landscape"

✨ But not everyone is so pessimistic. One writer from Barrons argues that “while many hot Chinese chip stocks have been dubbed ‘China’s Nvidia,’ none are real technical competitors to the world’s most valuable public company.”

💰 Nvidia has also essentially written off China and hasn’t assumed any revenue from China in its current financial guidance.

🤔 Should You Invest In Chinese AI Stocks?

🤑 But enough about the risks and threats, let’s talk about the opportunity.

😰 The Mag 7 (Nvidia, Google, Microsoft, Meta, Apple, Amazon, Tesla) now make up 34% of the S&P 500, up from just 12% 10 years ago.

📊 This means that the S&P 500 is less diversified than ever, increasing the appetite of investors (including myself) to diversify outside of the US market.

🇨🇳 And with China’s AI Boom, you might be thinking what I’m thinking - should I invest in China?

🫧 Or in other words, is this rally sustainable? Or is the Chinese AI market in its own bubble ready to burst? Well, here are a few things to consider:

With China, there is quite a significant regulatory risk. In late 2020, when the government cracked down on tech after CEO Jack Ma criticized the government, the Chinese tech sector got crushed (however, this risk is lessened imo since AI has become such a massive strategic priority for the government)

There is a rise of ‘physical AI slop’ in China, aka businesses simply patching AI features for marketing appeal, which is a little bit like the dot-com bubble behaviour when every company was adding ‘dot-com’ to it’s name to boost its valuation.

🙋♂️ My Thoughts

😶🌫️ One thing that stood out to me while writing the Buzz this week is how hidden this story was. So hidden that it didn’t even make the front page of Reuters (see above).

👀 To me, a big AI chip company IPO surging 76% and the Hong Kong index hitting its best trading day since 2013 is pretty big news, and makes me wonder if China’s AI space has been a bit of a ‘blind spot’ of opportunity for the North American investor. I also am bullish on the ‘Physical AI’ approach to AI after following Jensen Huang’s comments about the space over the past year.

💸 As a result, I have made the decision to reallocate 6% of my portfolio from the CASH ETF (Fixed Income) to CHQQ, the Hang Seng TECH Index ETF and start paying a much closer eye on China in 2026.

⚠️ Now, as always, please don’t blindly follow me and make sure to do your own research! I’ll share this trade on Blossom on Monday, and I look forward to reading your thoughts. Make sure to follow me to get notified and join the discussion.

👴 All right, before we switch gears to the retirement of the legendary Warren Buffett, and what it means for Berkshire Hathaway, a quick word from our other sponsor this week CIBC CDRs!

PRESENTED BY CIBC CDRS

🎊 The Resolution That Lasts Longer Than January: CDRs

🌟 🍾This New Year, set a resolution you’ll actually keep. With CIBC’s CDRs, you can access shares of top global brands - like Google and Netflix - right from your online brokerage, all in Canadian dollars. No currency conversion, no international hurdles, just straightforward investing.

Why Choose CIBC’s CDRs?

💰 Affordable Access: Own a piece of the world’s largest companies at a fraction of the cost.

🤝 Ease of Trading: Buy and sell CDRs just like any stock or ETF.

💵 Liquidity You Can Rely On: CDRs pull liquidity from their underlying global stocks, just like ETFs. With market makers ensuring fair pricing, you can trade with confidence.

🌎 Manage Currency Risk: The built-in notional currency hedge protects your returns from exchange rate movements.

Start investing in global giants, without leaving home.

THE END OF AN ERA

🥲 Berkshire Dips 2% As Warren Buffett Officially Retires

📉 Shares of Berkshire Hathaway ($BRK-B) slipped ~2% this week after Warren Buffett officially retired as CEO, marking the end of one of the most legendary tenures in market history.

✨ Buffett redefined long-term investing with a focus on buying high-quality businesses at reasonable prices, and over the past 6 decades, nearly doubled the market's compound annual return, growing Berkshire to an over $1 trillion company spanning insurance, railroads, energy, and consumer brands.

🤝 Buffett hands the reins over to Greg Abel, who joined Berkshire in 2000 and has served as vice chairman overseeing Berkshire's non-insurance businesses since 2018.

💰 The Struggle to ‘Move the Needle’

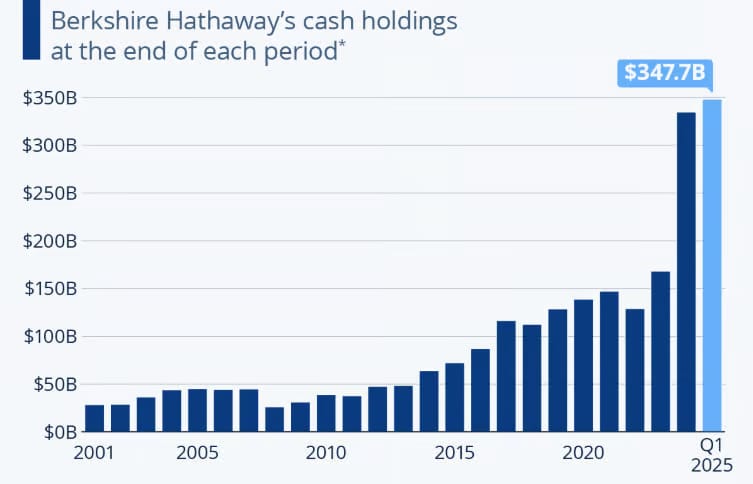

In 2025 Berkshire underperformed the market with its cash pile growing ever larger and larger (now at $358B), with Buffett saying that “it is difficult to find an acquisition capable of moving the needle” for the conglomerate.

The challenge for Abel will be the same - finding what to do with this massive war-chest that will move the needle.

🔮 What the Future Holds for Berkshire

Cash aside, Brian Jacobsen, Chief Economic Strategist at Annex Wealth Management, sums up the main worry about Abel:

"It's hard to imagine that there will be the same cult following”

It’s not that analysts don’t think he’s competent. It’s that Buffett had an iconic status among investors that Abel will likely never come even close to.

📊 Still, since Berkshire is much more fundamentals driven than hype driven, perhaps it won’t matter. Despite the leadership change, Investopedia Editor-In-Chief Caleb Silver listed Berkshire as one of his top stock picks for 2026 and many remain optimistic about Abel, with one Money Manager who’s owned Berkshire Shares since the 1980s saying:

“I think he’s been trained well, and he knows it well, and he’s a smart guy”

With Abel making it clear that a change in leadership does not mean a change in direction:

“We will remain Berkshire, how Warren and the team have allocated capital for the past 60 years, it will not change.”

👀 In any case, it’s certainly the end of an era, and it will be interesting to watch what Abel does with all that cash…

BMO Exchange Traded Funds Disclaimer

This communication is sponsored by BMO Exchange Traded Funds.

This communication is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.© Fidelity Investments is a registered trademark of Fidelity Investments Canada ULC.