- The Weekly Buzz 🐝 by Blossom

- Posts

- 😰 Market Has Its Worst Week Since April As Nvidia Falls 10% (US)

😰 Market Has Its Worst Week Since April As Nvidia Falls 10% (US)

Plus, 'Big Short' Michael Burry Bets $1.1B Against the Market, Medicare expands to obesity drugs, and more...

TOP STORY

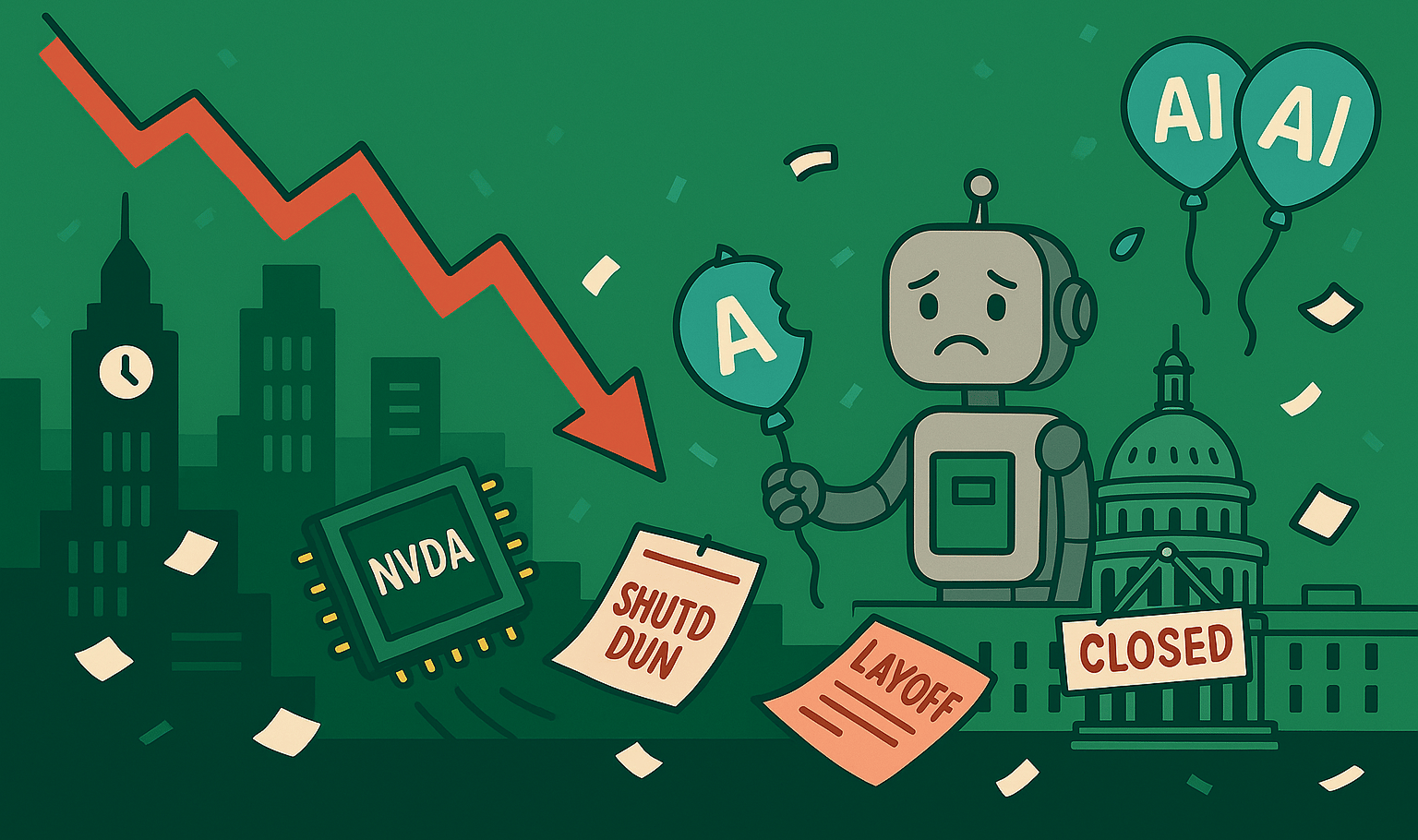

😰 Stock Market Has Its Worst Week Since April

😬 Last week, I wrote about how Amazon ‘saved the market’ with its strong earnings report… but I might have spoken too soon, as this week the markets had their worst week since April:

The S&P fell -2.2%

The Nasdaq-100 fell -4%

The TSX fell -1.3%

🤔 So before we dive into some of the other big stories this week (like Medicare expanding to obesity drugs, Apple’s partnership with Google for Siri, and rumours of an OpenAI IPO), let’s talk about what’s going on with the market and the reasons behind the drop:

👎 Weakening Consumer Sentiment

⚠️ Due to the government shutdown, investors haven’t been getting the important employment data they usually use as a pulse on the economy, but a few data points this week showed some red flags:

Layoffs have reached their highest level since 2009, totalling 153,074 in October, 175% higher than October last year. Companies in the tech sector led the charge, announcing 33,281 cuts, 6x the number in September.

A survey from the University of Michigan revealed Friday that consumer sentiment is nearing its lowest level ever

❌ The government shutdown, which is now the longest in American history, is also starting to pose a threat to economic activity, hurting consumer sentiment even more:

“With the federal government shutdown dragging on for over a month, consumers are now expressing worries about potential negative consequences for the economy. This month’s decline in sentiment was widespread throughout the population, seen across age, income, and political affiliation.”

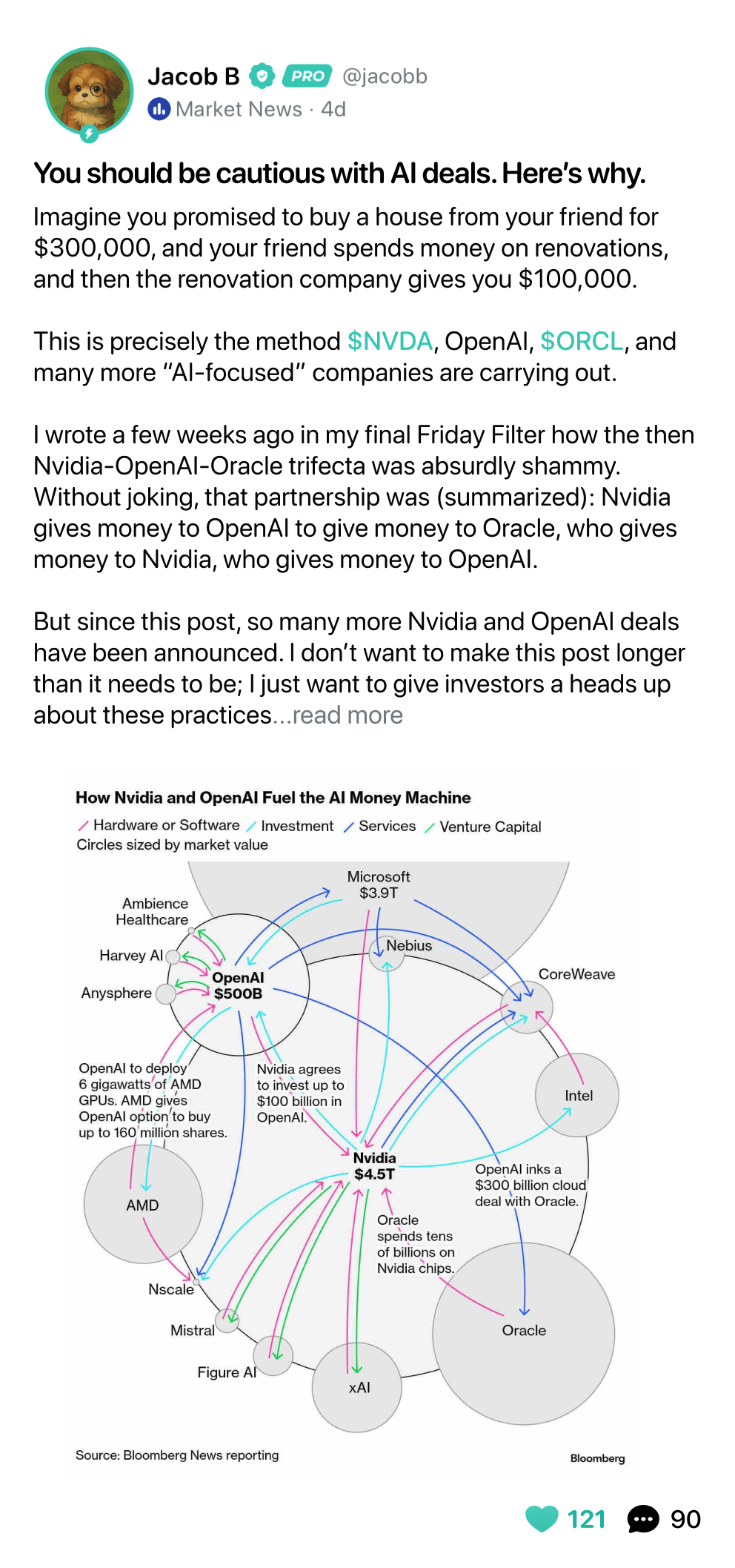

🫧 Continued Worries About An AI Bubble

🤖 Another reason for the rough market this week was drops across the AI players, which pulled down the market as a whole:

Nvidia fell -9.6%

AMD fell -9.9%

Oracle fell -9.7%

🧼 These drops erased all of last month’s gains, but it’s worth noting that all of the above are still well overperforming the S&P 500 year-to-date.

🫧 I’ve talked extensively about whether we’re in a bubble, and some of this drop is likely due to continued worries about AI stocks being overvalued.

🔄 But as far as I can tell, there wasn’t anything ‘new’ that happened this week to spark the sell-off, with some analysts saying that it’s likely just a healthy ‘rotation’ from the high-flying AI stocks to other sectors:

“You have had a bit of a rotation, which has been helpful in the value stocks, which kind of leads me to believe that the sell-off isn’t overly concerning. AI spending is still here.”

💡 Bennett’s comments are a good reminder not to panic in times like this. With tech stocks outperforming the market so aggressively this year, and valuations soaring, it’s natural, and probably a good thing to see a bit of a pullback (especially if you’re well diversified), with one expert saying:

The Nasdaq’s gone up 40% off the bottom in April. The market was kind of looking for a reason for a breather. This week, what you saw across the market is everybody looking for an excuse to sell the trade. I think it’s healthy. We’re taking some of the air out of the bubble.

🫧 But even with the drop this week, many commentators fear the ‘bubble popping’ is just beginning.

🎰 Michael Burry, for example, made famous by his prediction of the housing market crash in 2008, revealed a $1.1B bet against Nvidia and Palantir this week in a massive bet against AI.

❓ The question of ‘are we in a bubble’ has become a bit of a never-ending debate, and is something I’ve already talked about in the Buzz again and again, so I won’t rehash the same points. But if you want to watch more on the topic, check out this awesome video by the Plain Bagel that mirrors a lot of my thoughts.

🔦 A Light At the End of the Tunnel?

📈 While it was a rough week overall, the second half of Friday showed some hope as stocks recovered slightly on news of a proposal to end the government shutdown.

👨⚖️ The Senate even held a rare weekend session yesterday and is expected to reconvene today, with the Senate Majority Leader saying they will continue meeting until the government reopens.

🤞 An end to the shutdown would be good news for investors as it would likely lift consumer sentiment and ease some of the uncertainty plaguing the market, so fingers crossed on a speedy resolution.

🤿 All right, now that we’ve covered the drop this week, let’s dive into some of the other big stories this week, but first, a quick word from this week’s sponsor Quantify Funds!

SPONSORED BY QUANTIFY FUNDS

💵 Currency Debasement Has Just Begun: The Case for Stacked Leveraged Bitcoin & Gold (BTGD)

🏅The STKd 100% Bitcoin & 100% Gold ETF (BTGD) provides 200% exposure to Bitcoin and Gold strategies. Bitcoin is just beginning its adoption phase in the institutional world as well as with central banks, but gold is equally in its infancy stages of ownership.

📄 In our most recent paper, “Why Gold Now,” we show that the institutional world remains significantly under-exposed to gold. Meanwhile, central banks continue to increase their gold holdings at a growing pace, while reducing their exposure to dollar-based assets. As of now, they still hold more dollar-based assets than gold.

🇺🇸 The United States left the gold standard in 1971. Since then, the world has leveraged almost every asset imaginable. The likely outcome of a future recession is even more printing of dollars. At a certain point, all that matters is scarcity. The government can’t print more bitcoin or gold.

⭐️ BTGD offers 2x leveraged exposure to digital and physical scarcity assets, while addressing traditional leveraged ETF flaws intended just for daily use, removing some of the path dependency through a process called “return stacking” creating a leveraged ETF designed to be bought and held.

For fund disclosures and standardized performance, please visit https://quantifyfunds.com/stackedbitcoingoldetf/btgd/.

IN OTHER NEWS

🗞️ Top Headlines of the Week

✨ Outside of the market dip this week, there was actually a ton of big headlines to cover, so here’s the rundown!

🍎 Apple to Pay Google $1B Annually to Power Siri

💰 Apple (AAPL) is finalizing a deal to pay Alphabet ($GOOG) $1 billion per year to use Gemini to power its new Siri, with Gemini winning out against OpenAI and Anthropic.

💽 The Gemini model reportedly contains 1.2 trillion parameters, compared to Apple’s in-house offering at ~150 billion parameters.

🗂️ Under the deal, Gemini will handle Siri’s “summarizer” and “planner” functions, complex tasks like synthesizing information and executing multi-step requests, while Apple continues to run other features via its own models.

😬 Apple has been under pressure to catch up in the AI race, and some see the move as a sign of weakness and as proof that it has lagged behind in AI development.

👍 But others call it a “reasonable medium-term fix” in Apple’s efforts to catch up, and most analysts reacted positively to the news, with analyst Dan Ives calling the move ‘potentially transformative’.

📉 Both Apple and Google ended the week down ~1%, but this is likely due to the mini-tech crash we talked about earlier.

💉 Healthcare Stocks Jump As Medicare Expanded to Obesity Drugs

🤝 This week Trump announced deals with Eli Lilly ($LLY) and Novo Nordisk ($NVO) to slash the prices of some of their obesity drugs, while also adding Medicare coverage for some of these drugs.

💰 The price drop is expected to be a short-term revenue hit for the drug giants, but will increase sales long term by broadening the market for the drugs and driving more private insurers to cover them.

📈 Eli Lily is up +6.7% this week on the news, but Novo Nordisk fell -8.5%, still being dragged down from poor Q3 earnings and increasing competition in the obesity drug market.

🤑 Rumours of An OpenAI IPO Squashed by CFO

❌ Despite rumours earlier this week that OpenAI was laying the groundwork for a public listing valued at up to $1T in 2026, OpenAI’s CFO Sarah Friar said this Wednesday that an “IPO is not on the cards right now.”

😰 The rumours come after growing concerns about OpenAI’s ability to pay for the massive financial commitments it has made with Nvidia, AMD, Broadcom, and others, with the CFO causing concern this week after suggesting the US government should ‘backstop’ the firm’s funding deals.

💰 When pressed on how OpenAI will pay for its massive spending commitments, Sam Altman got defensive, saying “enough" and that “revenue is growing steeply.”

🛍️ Shopify Dips 13% After Earnings Despite 32% Revenue Growth

💰 This week, Shopify ($SHOP) reported earnings, with Q3 2025 revenue up 32% from last year to ~$2.84 billion, beating expectations

😰 Despite this, gross margin slipped from 51.7% to 48.9% driven by higher research and development costs related to AI, leading to a miss on operating income (and driving the stock drop this week).

🚀 Many experts feel the drop is overblown and are bullish on Shopify’s AI investments. According to Shopify president Harley Finkelstein, Shopify's AI assistant Sidekick (which uses AI for tasks such as setting up discounts or creating sales reports) is "quickly becoming the default way merchants get things done."

🤖 Even though a 13% drop sounds like a lot, Shopify is still up 42% year-to-date, with a recent rally after the announcement of its "Instant Checkout" partnership with OpenAI in late September. Soon, Shopify merchants will be able to sell directly within ChatGPT conversations in the U.S.

🤑 Personally, I’m still bullish on SHOP and plan to continue holding the 3% of my portfolio I have invested in the stock (which has given me a +261% return since buying a few years ago).