- The Weekly Buzz 🐝 by Blossom

- Posts

- 🎢 Markets Rollercoaster After Trump Tariff Threats Over Greenland

🎢 Markets Rollercoaster After Trump Tariff Threats Over Greenland

😰 Plus, SaaS stocks have their worst January since 2022 as AI fears hit a record high...

TOP STORY

🎢 Markets Rollercoaster After Trump Tariff Threats Over Greenland

Trump points to a map with Greenland, Canada, and Venezuela as part of the US

🧘♂️ Last week, I talked about how investors stayed calm amid the political chaos involving the Federal Reserve's independence and Trump’s threats to slap tariffs on countries that didn’t support the US ownership of Greenland…

😰 Well, this week, that calm turned into panic after Trump officially announced a 10% tariff on 8 European countries that opposed the US claims to Greenland.

📉 On Monday and Tuesday, both the S&P 500 and the Nasdaq-100 fell 2%, bringing the market officially into the red for the first time this year.

🌮 But many investors kept their cool and bought the dip, following the ‘TACO’ strategy. This strategy is basically the belief that Trump's hardline tariff threats are mostly negotiation tactics, and are often rolled back or softened before full implementation.

✅ And this week, the TACO strategy paid off, after Trump said he would retract his proposed tariff after reaching a ‘framework of a deal’ and also ruled out the use of military force in his bid for Greenland. The markets quickly bounced back, ending the week mostly flat:

The S&P 500 fell -0.35%

The Nasdaq fell -0.06%

The TSX rose +0.16%

😬 But while a Greenland deal solves the immediate problem of tariffs, it doesn’t solve the core issue of ‘increasing alienation of the US from its allies.’

💡 So before we talk about some of the other major story this week (SaaS stocks posting their worst January since 2022), let’s talk about why Trump even wants Greenland in the first place, and what this could mean for the markets moving forward.

🇬🇱 Why Trump Wants Greenland

🗺️ Since the beginning of January, Trump has repeatedly talked about acquiring Greenland, an autonomous territory of Denmark, saying it’s “needed for U.S. national security.”

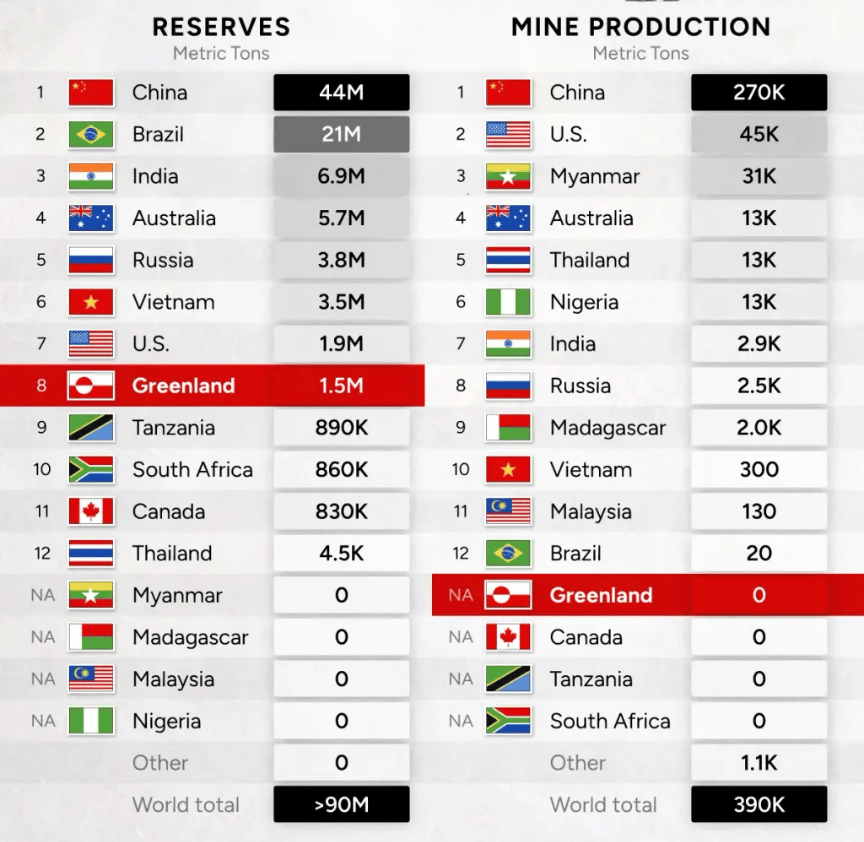

💎 Some of this security is its geographical location, but Greenland’s rich minerals also play a big role. Greenland holds the eighth-largest reserve of rare earths (minerals crucial to the development of electronics, green energy components, and military equipment), and an estimated 10-30 billion barrels of oil.

🇨🇳 With China controlling most of the world’s rare earth minerals, this poses a security risk for America, which wants to wean itself off Chinese dependence.

💡 However, while Greenland has the reserve, the country doesn’t have any mining industry, with the government passing laws against it to avoid pollution.

🧊 Plus, only 20% of Greenland is ice-free, with most of the minerals that could be mined covered in hard-to-get-to ice and frozen tundra.

💰 This means any full-scale mining development would need imported talent and would likely cost billions of dollars to begin meaningful production.

⛏️ Even so, Trump clearly sees Greenland as being of strategic importance, and according to reports, Trump’s Greenland deal includes:

🤝 It’s worth noting that Greenland and the U.S. have cooperated with American companies on mineral sector development since 2019, but this deal would give the US more ownership and control.

😰 The Growing Divide Between the US and the West

✨ Many Trump supporters on X rejoiced over the deal, with one user saying, “this is insane that he’s pulling this off,” but critics have argued the push for Greenland has further increased the divide between the US and other Western countries.

💶 The impact of this can be seen on the markets, as over the past five days, EUR/USD, the most traded FX pair in the world, has picked up nearly 2% as the euro has strengthened against the dollar.

🇨🇦 Canada-US relations have also strained, with Canadian Prime Minister Mark Carney delivering a scathing speech against the US at the World Economic Forum, saying:

There is a strong tendency for countries to go along to get along, to accommodate, to avoid trouble, to hope that compliance will buy safety. Well, it won't.

🤔 So… What’s All This Mean for the Stock Market?

🌊 Well the big takeaway here is that the markets continue to be very sensitive to political headlines, and as investors, we need to be prepared to weather the storm ahead, making sure we’re clear on our goals, time horizon, and risk tolerance, and not let the geopolitical waves knock us off our course.

🛡️ On the sector level, geopolitical risks and conflict tend to benefit hard assets and strategic industries. Defense, energy, and mining are all areas that could see sustained interest if this fragmentation accelerates.

🌮 Finally, while the “TACO trade” has worked well so far, it’s not without risk. Markets are basically betting that political brinkmanship will always stop short of real economic damage. That assumption may continue to hold, but it may not, and blindly ‘buying the dip’ isn’t a foolproof strategy. Make sure you understand the risks!

🙋♂️ For me, ~50% of my portfolio continues to be in the S&P 500, but I am starting to diversify to other geographies like Europe, China, and Emerging markets (in part due to the heightened political tension). But as always, my job here is to report on the headlines and it’s up to you to make you own decision as to what that means for your portfolio!

😎 Alright, before we jump into our other big story this week (SaaS stocks posting their worst week since 2022), a quick word from this week’s sponsor Global X Canada!

PRESENTED BY GLOBAL X CANADA

🌎 The Tokenized Economy: Investing in the Future of Finance

🪙 Stablecoins and tokenization are reshaping global finance.

Together, these technologies are bringing greater speed, transparency, and efficiency to markets that have long been held back by slow, costly, and fragmented systems.

📚 Market infrastructure is being redefined.

The convergence of blockchain technology and traditional finance is reshaping how markets function. Tokenization is gaining momentum as a more efficient method for representing and managing asset ownership, with stablecoins serving as an important layer of infrastructure for settlement and liquidity in tokenized markets.

💰Tokenization is changing how assets are owned.

Real-world assets, from real estate and bonds to private investments, can now be converted into digital tokens on a blockchain. This enables fractional ownership, faster settlement, and improved liquidity, potentially unlocking trillions of dollars in new market value.

🎯 The Global X Tokenization Ecosystem Index ETF (TOKN) offers access to this shift.

By tracking the Mirae Asset Stablecoins and Tokenization Index, TOKN provides diversified exposure to companies building the infrastructure behind blockchain-based payments, trading, and asset management.

⭐️ Looking ahead.

As digital finance continues to evolve, stablecoins and tokenization are helping bridge traditional markets with next-generation technology, and TOKN aims to capture the growth of this emerging financial ecosystem.

*See Global X Canada Disclaimer at the end of the newsletter

TECHNOLOGY

📉 Software Stocks Crash Amid AI Fears

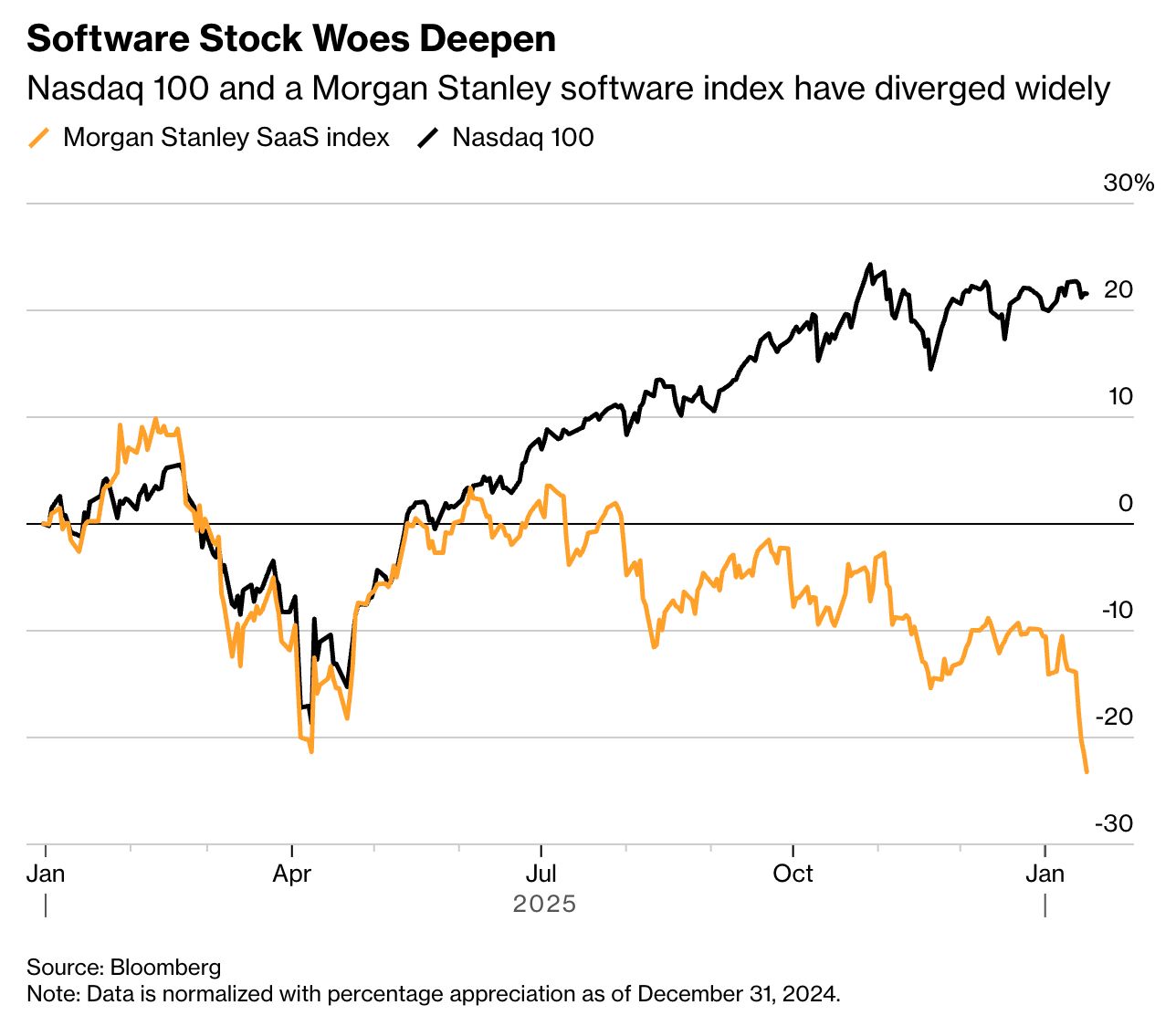

📉 2025 was a brutal year for software as a service (SaaS) stocks, finishing the year down close to 20% collectively. And 2026 isn’t looking to be much better.

📊 Since the start of the year, shares of SaaS behemoths like Salesforce ($CRM), ServiceNow ($NOW) and Adobe ($ADBE) have traded down about 11% so far, underperforming the S&P 500’s year-to-date gain of +0.86%.

🤖 The reason for this downturn? A fear that AI is going to decimate the legacy software business model as AI agents become more able to automate tasks, and as companies need to employ fewer people.

📉 In other words, the per-seat model could collapse, and with it, SaaS companies.

💺 A “Per-Seat” Collapse

🖼️ Software fears have been bubbling since AI coding tools emerged, but the panic truly came around when AI agents hit the scene, most recently with Anthropic.

😨 On January 12th of this year, Anthropic launched Claude Cowork, an AI agent built for enterprise customers that can autonomously handle workflows that SaaS companies charge for.

📉 While this offering is currently in the research preview stage, that didn’t stop the market from reacting to the news, leading to SaaS stock’s worst January since 2022.

💰 Most enterprise SaaS companies like Salesforce or Adobe charge on what’s known as a “per-seat” basis. This means that for any enterprise using Salesforce’s Sales Cloud, Salesforce charges per person. Say, $100 per month, per sales rep.

🧮 If a company has 1,000 sales reps all using Sales Cloud, that’s costing the company $1.2 million per year (1,000 x $100 x 12). But if this same company can use AI (like Cowork) to replace 200 of those reps, Salesforce has less seats to charge for, and its revenue would decline. To put it in perspective:

“AI changes the unit of work. In plain English: Even if you successfully raise prices by 25%, if your customers need 40% fewer seats because AI makes their workers more productive, you still lose a quarter of your revenue.”

🤔 Are Concerns Overblown?

😱 So, does this mean you should sell all your SaaS stocks?

🎢 Well, as we’ve seen repeatedly in the past, quick drops in price following the news of a breaking AI development, usually aren’t thought-out rationally by the market, and are often a quick knee-jerk reaction to a future that hasn’t arrived yet.

🏢 In fact, even though Cowork and other AI agents like it are a real threat, the market seems to be missing a big part of what makes large enterprise SaaS companies large companies, and that’s their scale and distribution.

💡 Despite all the doom and gloom, some analysts say AI is more likely to be an opportunity for major software businesses, not a killer of the SaaS business model:

“If you want to see wide adoption in the enterprise of AI, these [large SaaS] are the companies that will do it. These are the companies that hold the key. Many of our companies just finished their year in December, and we saw a big boom in the quarterly bookings of these companies, partly because of take off in AI.”

🤝 For enterprises, “Sales Cloud + AI,” or “Creative Cloud + AI” could be more valuable than “replace it all with Claude.” Based on early indications, we’re seeing a “SaaS plus AI” adoption currently, not an “AI minus SaaS” revolution. At least for now.

⏳ So while I definitely wouldn’t discount AI’s threat to SaaS, the jury’s still out as to whether AI will help boost the sector, or continue to drag it down.

Global X Canada Disclaimer

Commissions, management fees, and expenses all may be associated with an investment in products (the "Global X Funds") managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The Global X Money Market Funds are not covered by the Canada Deposit Insurance Corporation, the Federal Deposit Insurance Corporation, or any other government deposit insurer. There can be no assurances that the money market fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the Funds will be returned to you. Past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Global X Investments Canada Inc. ("Global X") is a wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. ("Mirae Asset"), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2026 Global X Investments Canada Inc. All Rights Reserved.