- The Weekly Buzz 🐝 by Blossom

- Posts

- 😰 Microsoft Crashes 11%, Meta Soars 10%, and a Big Tech Earnings Recap

😰 Microsoft Crashes 11%, Meta Soars 10%, and a Big Tech Earnings Recap

Plus, Silver plummets 30% after Trump appoints a new Fed Chair...

BIG TECH EARNINGS

😰 Microsoft Crashes 11%, Meta Soars 10%, and a Big Tech Earnings Recap

📣 This week, after repeated criticism of Fed Chair Jerome Powell, Trump officially announced his pick for Powell’s replacement, choosing Kevin Warsh to take over the Fed (which is in charge of setting interest rates).

✨ Investors seemed largely relieved by Trump’s pick, viewing the new chair as a ‘credible steward of monetary policy’. But while good for the economy overall, this sent Gold and Silver into a freefall, as the choice helped ease concerns of ‘US currency debasement’.

📉 Since Thursday:

📊 But this news was largely overshadowed by Big Tech earnings, with Meta, Microsoft, Tesla, and Apple all reporting earnings this week.

🏆 While for the past few quarters, it’s seemed like Big Tech has moved largely up/down together, this week we saw clear winners and losers. As a summary:

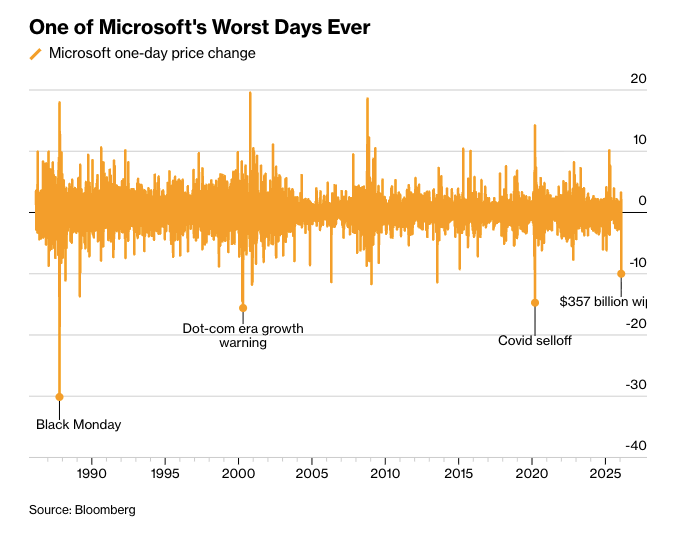

📉 Microsoft ($MSFT) fell -11% after earnings, its worst drop since 2020, ending the week down -7.7%

📈 In contrast, Meta ($META) jumped 11% after earnings, ending the week up +8.8%

📉 Tesla ($TSLA) ended the week down 4.2%

📈 Apple ($AAPL) ended the week up 4.6%

🟢 But despite Microsoft’s brutal decline, the S&P surprisingly ended the week in the green, showing the value of diversification:

The S&P jumped +0.34%

The Nasdaq-100 fell -1.2%

The TSX fell -2.82%

🤿 So let’s dive into each of the Big Tech earnings reports and see what they mean for each of the tech giants and the market at large…

📉 Microsoft Falls 11% After Slowing Azure Growth, One of Its Worst Days Ever

📉 There’s no way to sugarcoat it: Microsoft got crushed this week, falling 11% after earnings, chopping $300 billion+ off its market cap in its single biggest drop since 2020, and one of its 4 worst days since its IPO in 1986.

📊 A summary of the numbers:

✅ Revenue hit $81.3 billion vs. $80.23 billion expected, up 17% year-over-year

✅ Earnings per share hit $4.14 vs $3.93 expected, up 28% year-over-year

🔮 For the next quarter, Microsoft expects revenue between $79.5 billion and $80.6 billion, which beats expectations.

☁️ But despite Microsoft beating earnings and reporting great year-on-year growth, investors turned their focus to its AI-driven Azure Cloud segment.

💸 Rising AI Spending, Slowing Azure Growth

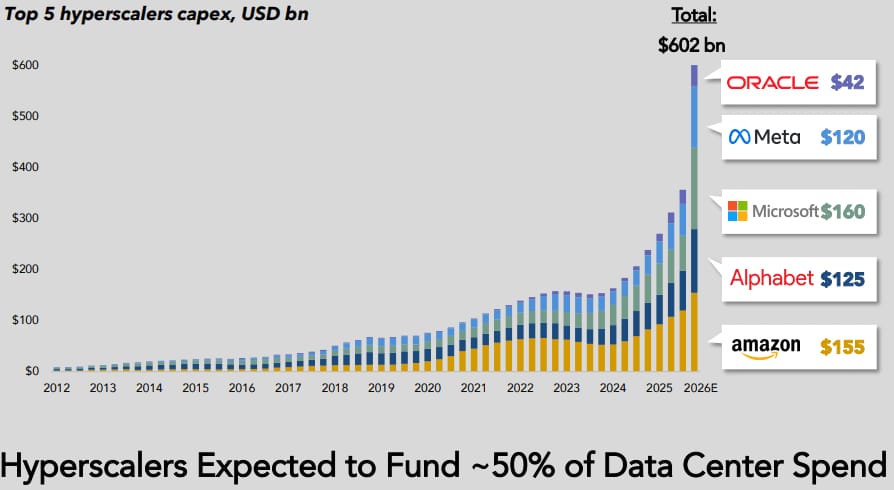

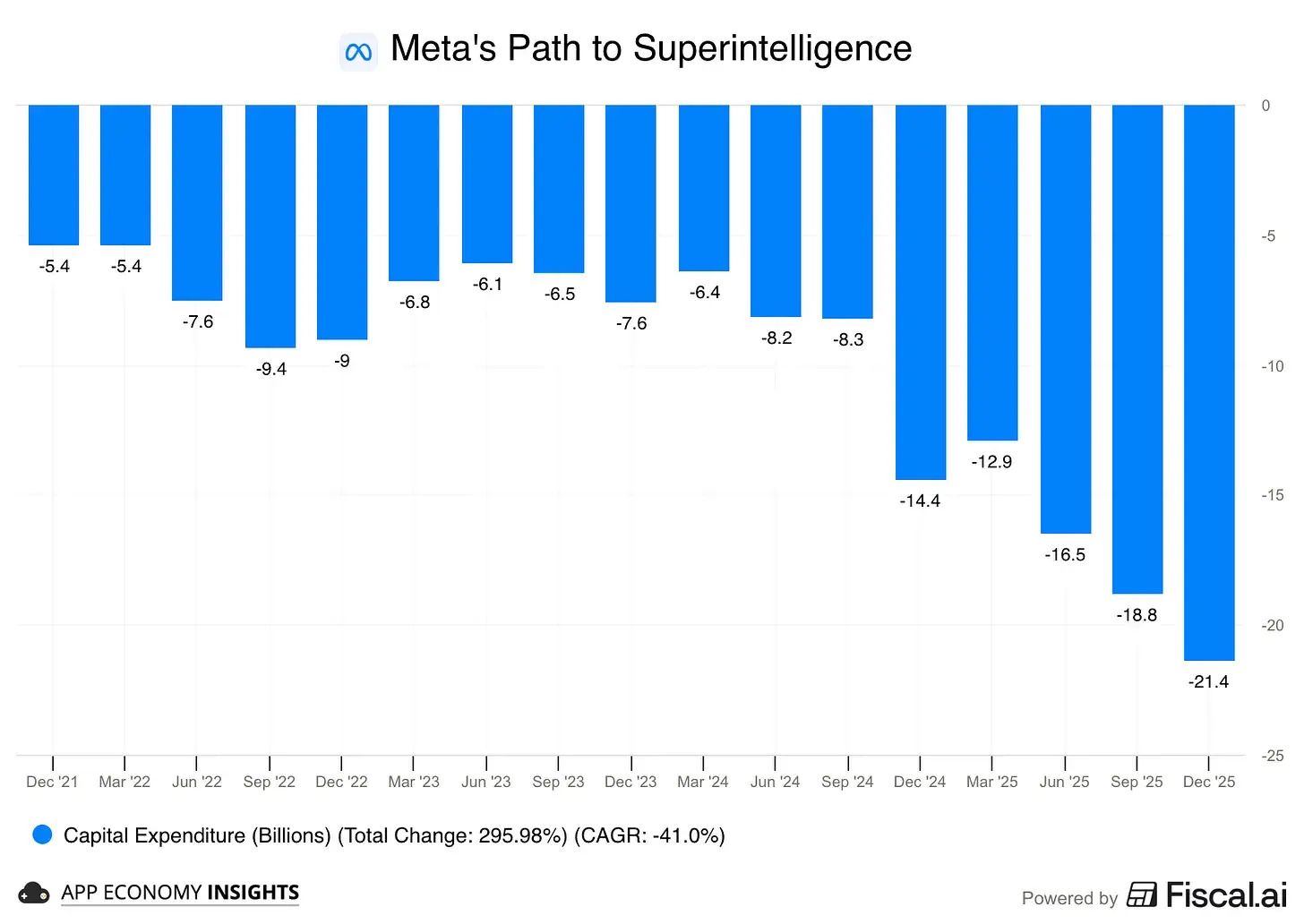

🔍 Big Tech has been under increasing scrutiny for its ever-growing AI spending, and this quarter, that scrutiny turned to fear after Microsoft recorded record AI spending but slowing growth for its AI-driven Azure Cloud revenue.

☁️ Azure is Microsoft’s cloud computing platform and the company’s primary “AI driver,” and this quarter the segment grew 39% year-over-year, beating expectations, but coming in 1% lower than last quarter, with guidance of 37-38% growth for next quarter.

💰 In contrast, Microsoft’s AI spending rose 66% in the most recent quarter to a record $37.5B. This contrast increased fears that the massive spending was a bad investment, with one analyst saying:

“Since it is becoming even more evident that Microsoft is not going to garner a strong ROI from their massive AI investment, their shares need to be revalued back down to a level that is more consistent with its historic fair value”

😰 Scary Levels of Dependence on OpenAI

🫣 Another somewhat scary revelation this quarter was Microsoft reporting for the first time that OpenAI accounts for nearly 50% of the backlog for Azure cloud computing, showing how dependent Microsoft’s AI revenue is on OpenAI.

🤑 And with increasing fears that OpenAI doesn’t have the money to pay for its commitments, this puts a lot of risk on Microsoft and led to a lot of Wall Street analysts expressing concerns on Microsoft’s earnings call.

✨ Microsoft’s Response to Fears

🤔 So what did Microsoft have to say about all this? Well, CFO Amy Hood said the main issue was supply constraints, meaning demand continues to outpace supply, which has led to stalled growth.

💻 In fact, according to Hood, Azure would have grown 40% if Microsoft had been able to funnel all of its new GPU supply into the Azure business during Q1 and Q2.

🏗️ As a result, Microsoft is scrambling to build out infrastructure to meet demand, with plans to double its data centre footprint over the next 2 years, while increasing AI CapEx to ~$140 billion annually for 2026…

💸 Some analysts agree with Hood’s assessment and say that this sell-off is simply an overreaction amid an uncertain environment involving AI spend:

“While we believe the stock reaction is due to Azure growth & elevated Capex, we view the second quarter as fundamentally strong beneath the surface.”

💡 But regardless of which side you fall on, one thing is clear. Investors are growing tired of the ‘spend now, profit later’ mentality that has driven the AI bull market for the past 3 years, and are increasingly raising the bar on the returns expected from the truly staggering amounts Big Tech is spending on AI infrastructure.

✨ And one company that hit that bar this week was Meta… but before we shift gears to talk about the biggest winner this week, a quick word from this week’s sponsor Harvest ETFs!

SPONSORED BY HARVEST ETFS

⭐️ Harvest Premium Yield ETFs | 2x Portfolios, 2x Monthly Income

🚀 Harvest Premium Yield ETFs offer two distinct portfolios of leading Canadian banks, and large-cap US equities, that seek to enhance distribution yield from dynamic puts and covered calls. They are designed to pay distributions two times per month.

🎯 The Harvest Premium Yield active equity income strategy dynamically adjusts to markets. It aims to generate income by selling put and call options, potentially entering positions through put assignments and exiting positions through call assignments.

⚖️ The Objective: Generating income using a dynamic option strategy, which also allows for buying and selling at predetermined price levels.

An equal-weight portfolio of the Big Six Canadian banks

Actively managed puts & call options to generate income

Distributions paid TWICE every month

Tax efficient income

A core portfolio of dominant, industry-leading mega-cap US equities

Twice monthly income from actively managed puts & calls

Adaptive equity exposure

Reduced volatility from an innovative option strategy

*See Harvest ETFs Disclaimer at the end of the newsletter

BIG TECH EARNINGS CONT.

🚀 Meta Crushes Earnings, Surging 10% After AI Spending Increase

🏆 When Microsoft reported slowing AI growth, many worried it could cause the AI bubble to ‘pop’… but then Meta came to save the day, proving that investors are willing to stomach increased AI spending so long as it’s leading to a clear return-on-investment.

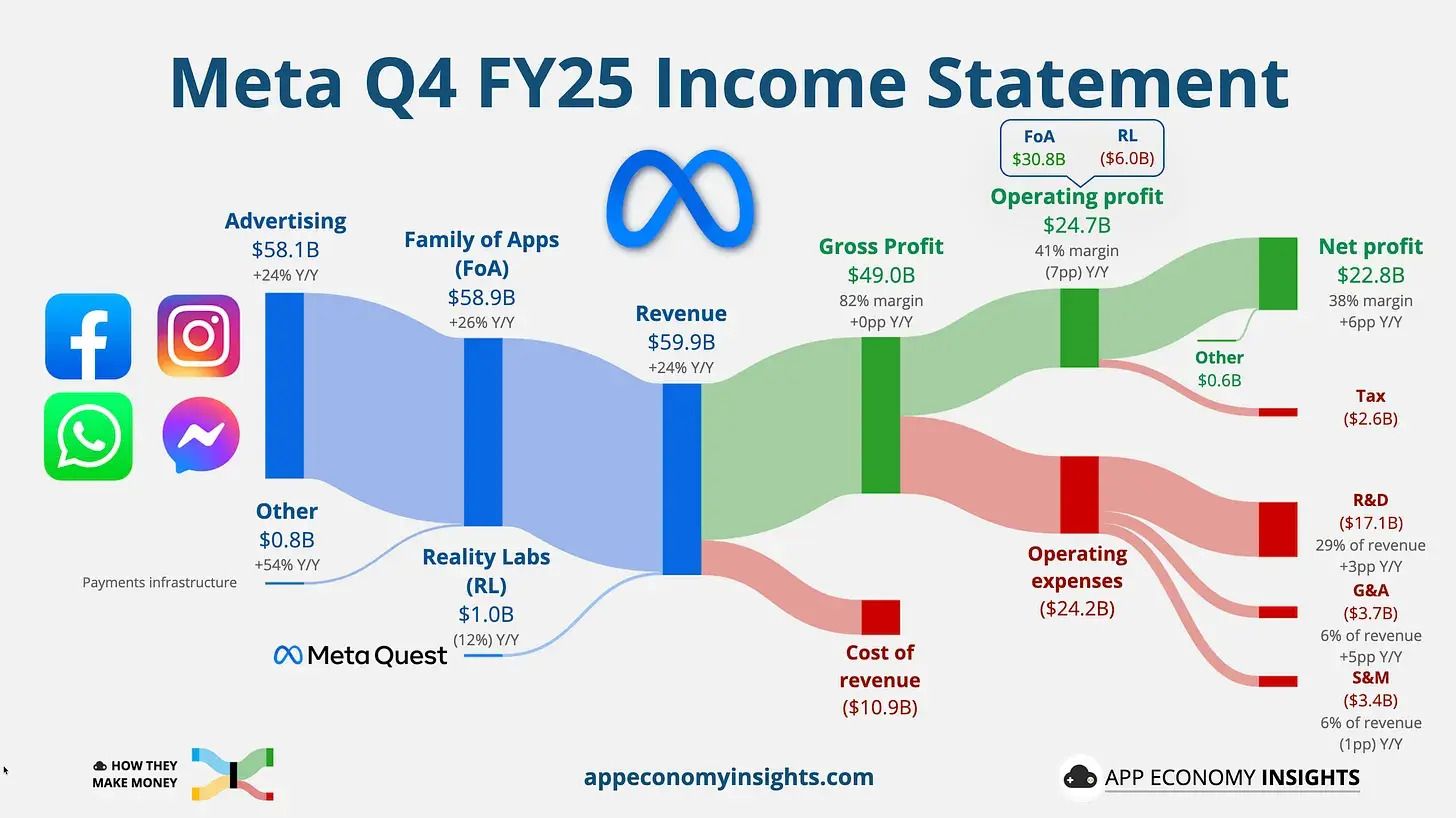

📊 By the numbers:

✅ Revenue hit $59.9 billion vs. $58.4 billion expected, up 24% year-over-year, beating expectations

✅ Earnings per share hit $8.88 vs $8.23 expected, up 11% year-over-year

✅ Daily Active Users (DAU) grew to 3.58b, 7% higher than last year

🎯 For Q1 2026, Meta expects revenue between $53.5 billion and $56.5 billion, also higher than expectations.

💰 Higher AI Spend and Positive AI Sentiment

😰 Last quarter, Meta crashed 13% after earnings as investors questioned its AI spending… but this quarter, Zuck had the answers.

💰 With AI spending now at $22 billion a quarter (over 3x what it was 3 years ago), Zuck was able to clearly show that AI was responsible for the growth of Meta’s ads business, and said that current systems for its users and advertisers were “primitive compared to what will be possible soon.”

📊 Analyst Reactions

🚀 Meta’s results led to a huge shift in sentiment about the company, with some analysts calling Meta ‘the most compelling Mag 7 catch-up trade for 2026’ (with Meta having fallen ~13% in the past year before this week’s jump).

🎯 Analysts at both Bank of America and Bernstein raised their price targets to an average of $870 (21% above Meta’s current price), with consensus estimates sitting at about $840.

“META is seeing green shoots from its massive AI investments, which are improving its recommendation models, leading to increased user engagement and monetization.”

🤖 Overall, Meta proved that investors aren’t turning their back on AI, but are increasingly demanding to see return-on-investment (which is a good thing if you ask me).

🍎 Alright, before we turn our attention to the last 2 Big Tech earnings of the week (Apple and Tesla), a quick word from our other sponsor this week moomoo Canada!

PRESENTED BY MOOMOO

✈️ Win a 3-Day Elite Trading Trip to NYC with Moomoo!

Win a 3-Day Trading Trip to NYC, or an iPhone 17 Pro - moomoo Canada’s New Client Rewards Are Live!

🔥 Moomoo Canada is kicking off 2026 with an exclusive new client campaign - and this one’s big.

Open a moomoo Canada account and fund $1,000 CAD to get a chance to win a 3-day, 2-night trading trip to New York City, where global markets come alive.

You’ll also be entered to win an iPhone 17 Pro, on top of moomoo’s generous cash rewards.

🎁 Blossom users get an extra boost: an additional $50 CAD in cash coupons, making this one of the highest new-client rewards available in the Canadian market.

🌐 With moomoo, Canadians can trade U.S. stocks and options with super low fees, 0 FX conversion fees on USD trades, and free Level 2 quotes and premium insights - all designed to help you trade smarter from day one.

And don’t forget: the #NewYearMoneyGoals community campaign on Blossom is still on! Share your investing goals for 2026 and join the conversation.

👉 Learn more about the moomoo x Blossom exclusive offer here.

Trade smarter. Dream bigger. 2026 starts now.📲 Get Invested

BIG TECH EARNINGS CONT.

🍎 Apple’s Record-Breaking Quarter, and Tesla’s First Annual Revenue Decline

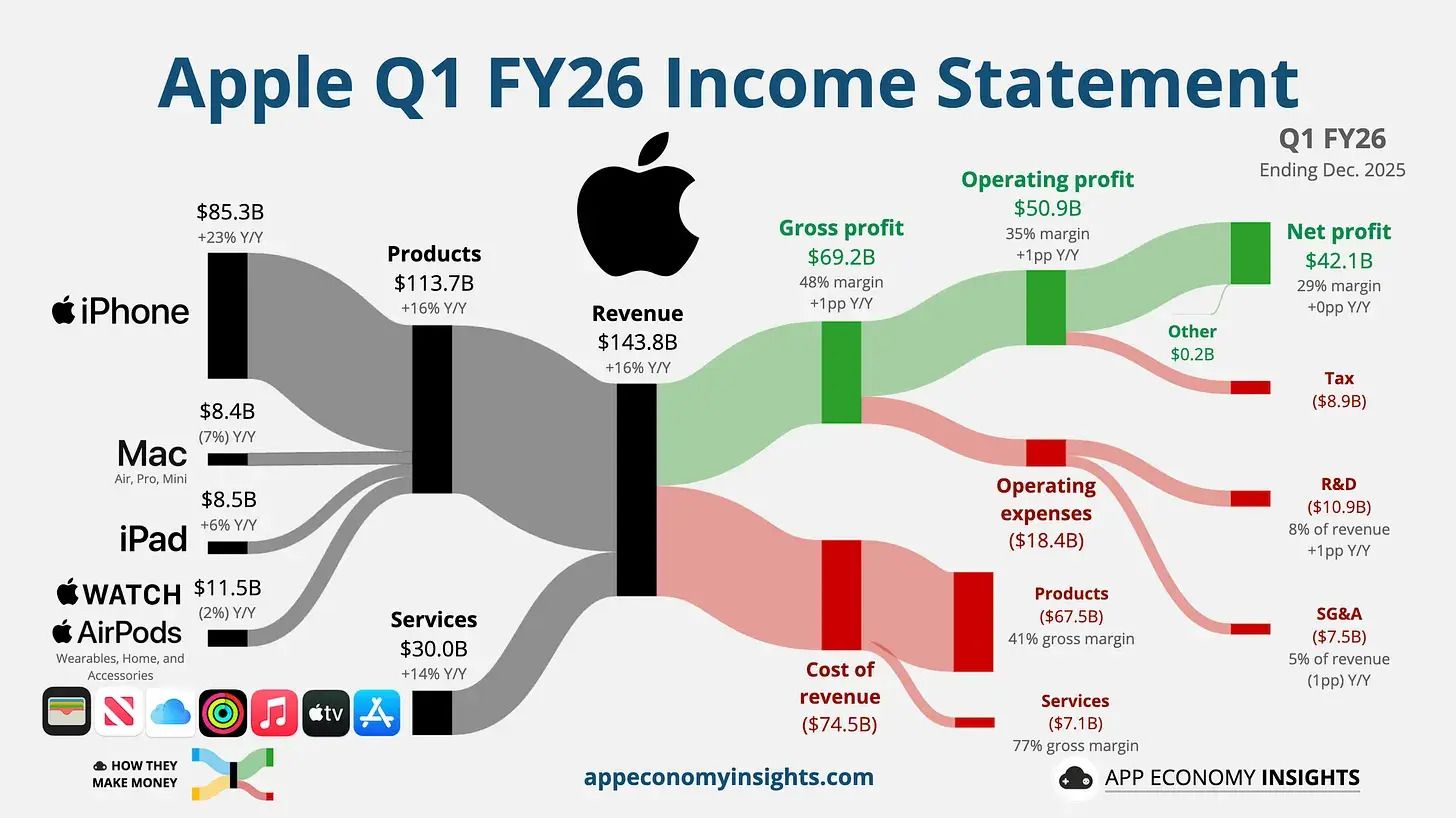

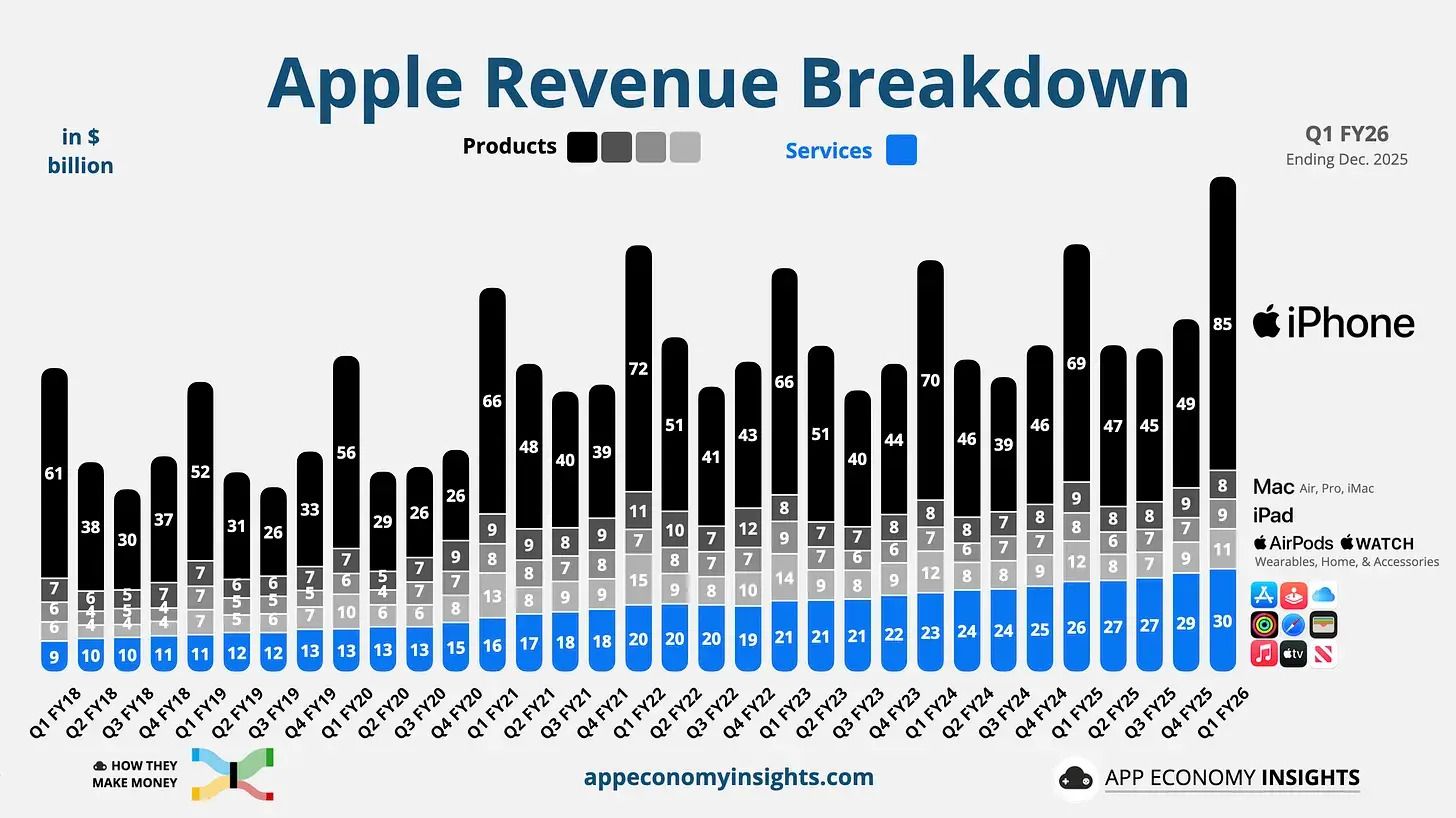

🏆 Apple reported amazing earnings this week, with revenue hitting an all-time high of $143.8 billion as iPhone sales hit a new record, with the stock jumping 4.6% as a result.

✅ Revenue hit $143.8 billion vs. $138.4 billion expected, up 16% year-over-year

✅ Earnings per share hit $2.84 vs $2.68 expected, up 18% year-over-year

✅ iPhone revenue came in at $85.3 billion vs. $78.3 billion expected, up 23% year-over-year

🎯 The company expects revenue for next quarter to be in line with expectations, but says that the global memory crunch due to AI and the “staggering” demand for the iPhone 17 could hurt the company’s margins.

🔮 Apple CEO Tim Cook also said the company is about to launch something “never seen before,” which may have something to do with its Google/Gemini partnership with Siri announced earlier this month…

📱 iPhone Sales Record

🏆 According to Tim Cook, the iPhone 17 lineup is the most popular lineup in Apple’s history, fuelled by newly competitive features that finally pushed those who purchased near the pandemic to upgrade to new models:

“Sales were very strong during the pandemic because people weren’t spending on restaurants and travel, and there was a lot of money floating around. Now, the pandemic phone buyers have 4-plus-year-old phones. Those people were simply “due” for upgrades, which helped spur the increased demand.”

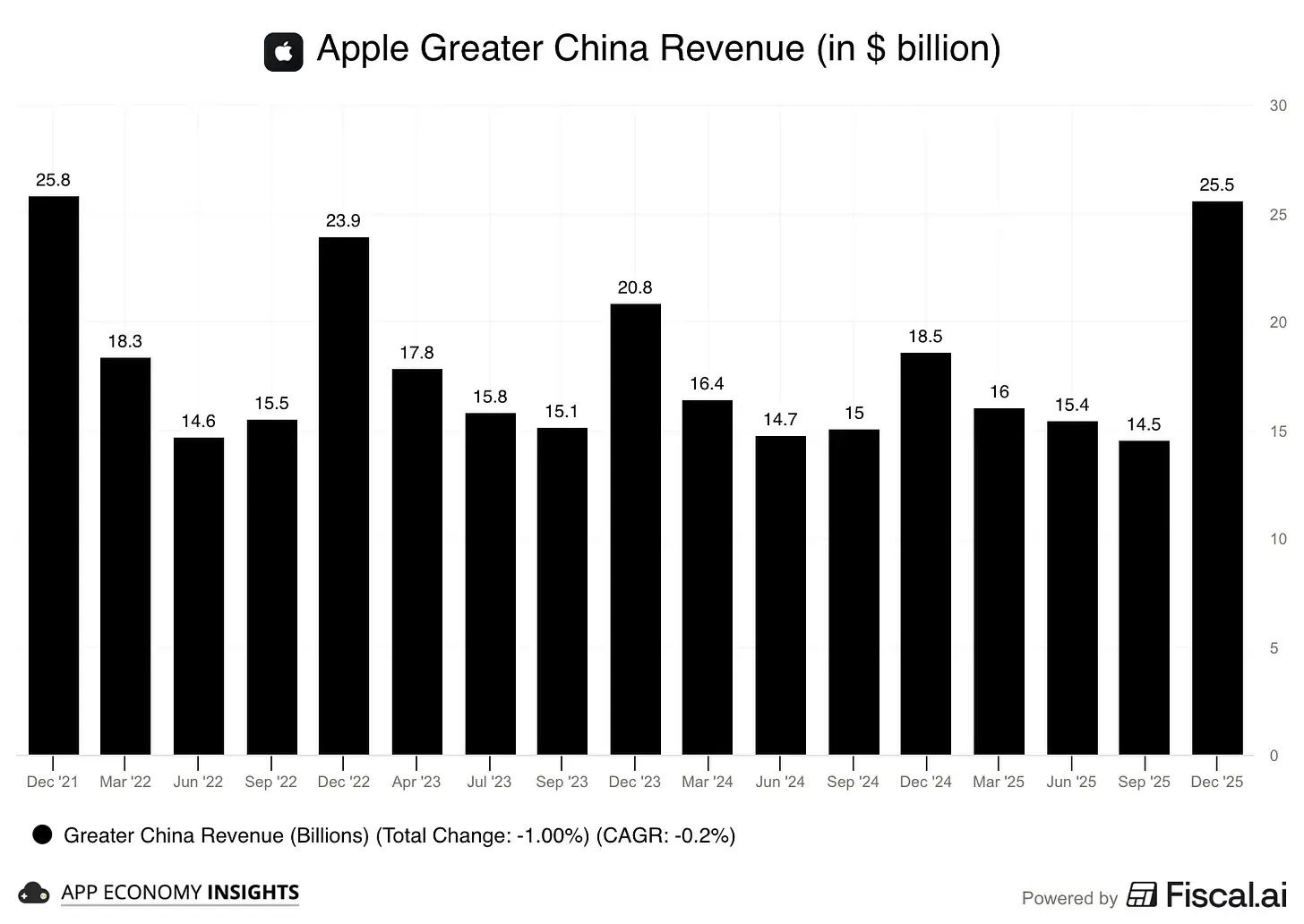

🇨🇳 China Rebound

🔄 The surge in iPhone sales was also heavily driven by a big turnaround in China sales, with China revenue hitting $25.5 billion this quarter, the highest since 2021, up 38% year-over-year following a decline in the last four quarters.

🏆 Apple set an all-time record for upgraders, and saw double-digit growth in switchers (those leaving other brands to go to Apple).

“We saw a lift [in China] that, frankly, was much greater than we thought we would see.”

📊 Analyst Reactions

🎯 Analysts were optimistic across the board, even with very little AI progress, with multiple firms raising price targets and maintaining “Buy” ratings, including JPMorgan, Goldman Sachs, and Maxim Group, all at targets above $300 (17% higher than current prices).

👀 Looking forward, all eyes will be on the new Siri upgrade expected to be announced at Apple’s WWDC26 this June, in partnership with Google’s Gemini.

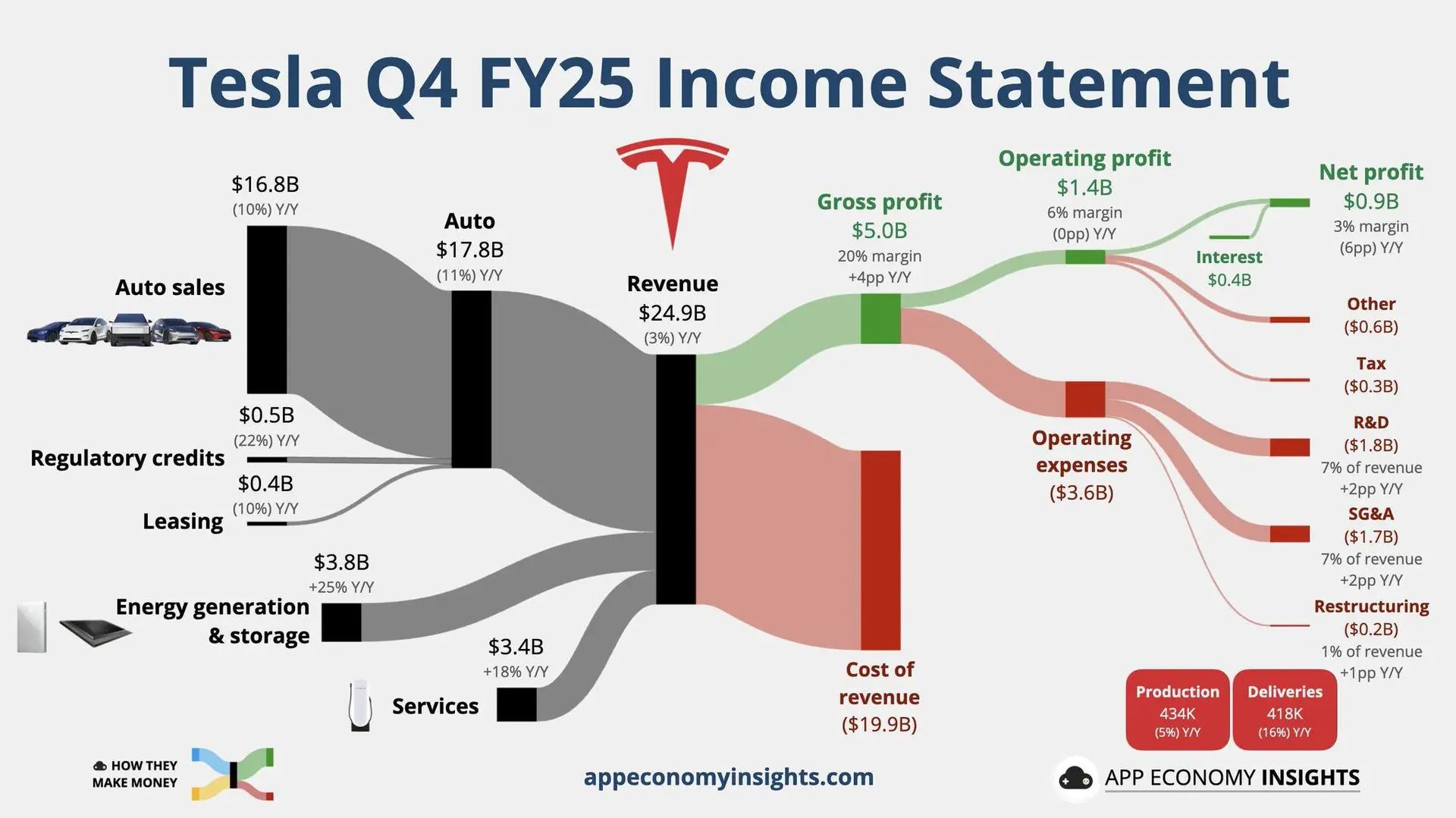

🚗 → 🤖 Tesla’s Shift to AI

😰 As Apple saw strong growth in its core business, Tesla showed the exact opposite, reporting its first annual revenue decline ever. A summary of the numbers:

❌ Revenue hit $24.90 billion vs. $25.11 billion expected, down 3% year-over-year

✅ Earnings per share hit $0.50 vs $0.45 expected, down 64% year-over-year

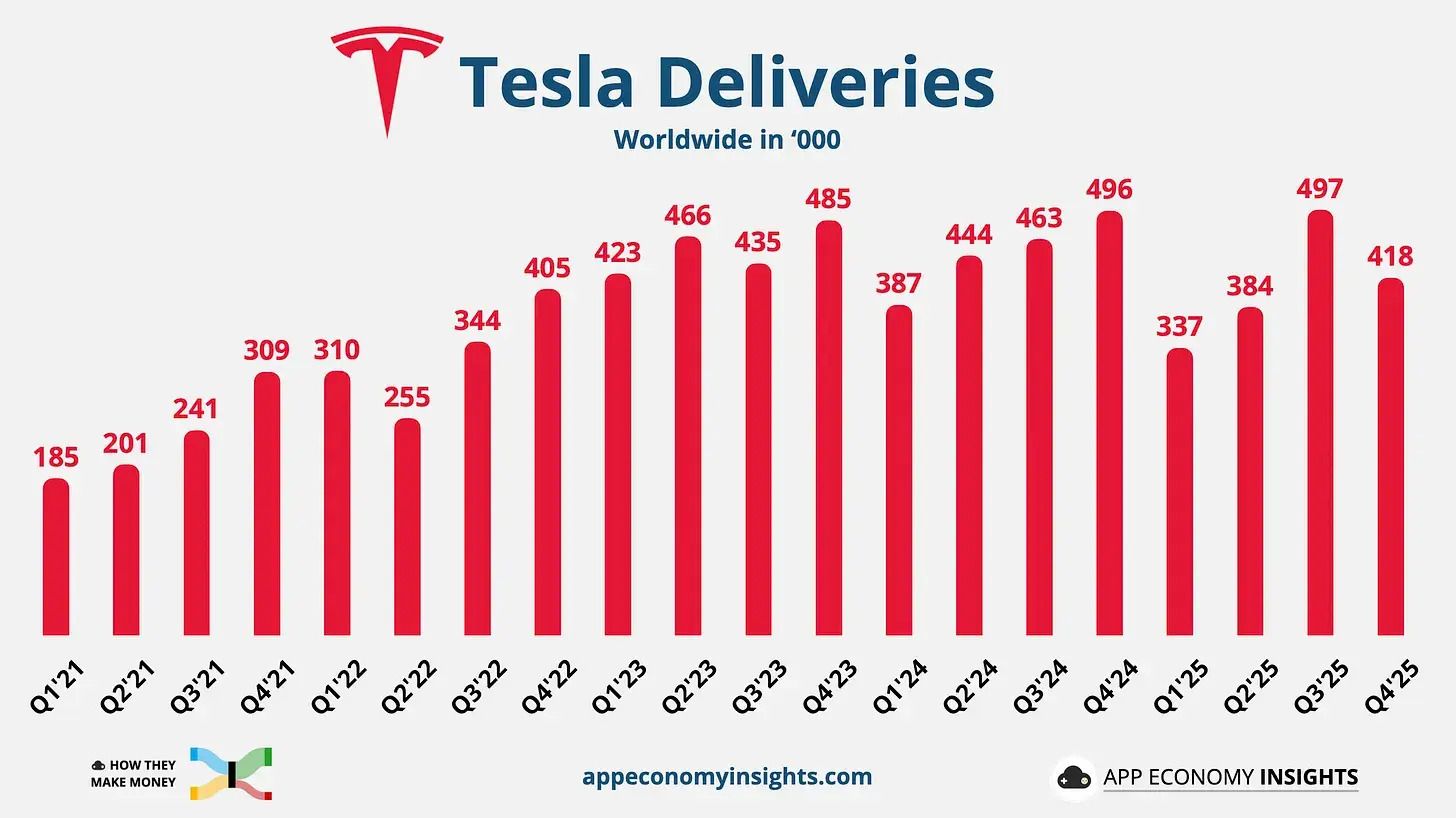

❌ Total full-year deliveries came in at 1.64 million, down 9% year-over-year

😮 Despite possibly Tesla’s worst earnings report as a public company (fuelled by political backlash and growing competition from China), the stock only fell 4%, after CEO Elon Musk doubled down on the company’s transformation from an automaker to an “AI robotics company.”

🚗 Pivoting to Robotaxis and Robots

🤖 At this point, Tesla is no longer a car company. The market is valuing Tesla at an insane 400x price-earnings ratio, which would usually be tied to soaring revenue growth. But with Tesla’s revenue declining, it’s clear that basically all of the stock’s valuation is based on Elon’s future promises of Optimus robots and self-driving.

❌ In fact, Elon announced that Tesla would discontinue production of the Model S and Model X to convert those production lines to manufacture Optimus humanoid robots.

🚕 Tesla also revealed it had 1.1 million paying FSD (Full Self-Driving) subscribers this quarter and announced plans to launch “unsupervised Full Self-Driving as a paid service” in Austin by June 2025. The company said it’s already removed safety drivers (people who sit in the car) from some robotaxi rides in Austin.

😬 But despite some progress, both business lines are yet to drive any meaningful revenue, and with a declining car business and a $1T valuation, there is very little room for error.

🤝 SpaceX, xAI, and Tesla in Merger Talks

📣 But despite the rough week, one announcement that had investors excited this week was reports that SpaceX, xAI, and Tesla are in talks for a potential merger or, at the very least, xAI and SpaceX ahead of SpaceX’s planned IPO this year.

🪐 If this happens, it would bring ~$15B in SpaceX revenue and a lot stronger growth story under the Tesla umbrella.

💰 In any case, one thing is clear. Tesla is executing a complete pivot, with plans to ramp CapEx from $8 billion in 2025 to over $20 billion in 2026 for AI and robotics infrastructure, with a $2 billion investment into xAI the the future of the company (and the stock price) is banking heavily on Musk’s ability to stick the landing.

🎁 And that’s a wrap! I hope you enjoyed this earnings recap. For those new here, my name is Max (aka @maxstocks), and I’m the CEO of Blossom and author of the Weekly Buzz! Over the past month, I’ve also been supported by the awesome @jacobb who I recommend dropping a follow if you enjoy deep dive fundamental analysis on some of the biggest stocks on Blossom.

👋 See you next week when we’ll be covering the earnings of Palantir, Google, Amazon, and, time permitting, maybe AMD and Microstrategy as well!

Harvest ETFs Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The Funds are categorized as liquid alternative ETFs. This means they have the ability to use leverage and can invest more than 10% of their assets in a single issuer. The Funds employ modest leverage using written puts and potential cash borrowing.

The Funds pay distributions to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested available Class units/shares of the Fund. If the Funds earn less than the amounts distributed, the difference is a return of capital. Tax investment and all other decisions should be made with guidance from a qualified professional.