- The Weekly Buzz 🐝 by Blossom

- Posts

- 📉 Nvidia Dips 10% Following Earnings Surge

📉 Nvidia Dips 10% Following Earnings Surge

Is Big Tech's growing debt binge a bad sign for the markets? Plus, a Walmart earnings recap...

TOP STORY

📉 Nvidia Dips 10% Following Earnings Surge

😰 The pre-Christmas stock market rally ended abruptly this week after Nvidia ($NVDA) dipped big following its blockbuster earnings (which we covered on Wednesday), taking the market down with it…

Across the major indexes this week:

The S&P 500 fell -1.95%

The Nasdaq-100 fell -3.07%

The TSX fell -0.55%

Plus, Nvidia ended the week down -6%

🤔 Interestingly, the post-earnings drop wasn’t because of anything new from Nvidia, which by all accounts smashed expectations.

🎢 In fact, on Thursday morning the market was riding high, and then took a sharp turn around noon, ending the week sharply in the red… so what happened?

🤔 While it’s always tough to say for certain, it mainly seems to be continued investor jitters over AI-spending. With the market firmly in ‘extreme fear’, there’s been a ‘bubble’ of calls that the market is in a bubble, spreading a lot of worry throughout the market.

🫧 And there’s some merit to it, in a video I posted Thursday morning (before the correction), I called out why I thought Nvidia’s incredible earnings didn’t necessarily mean we’re not in a bubble, and it seems a lot of the market agrees.

💡 The reason is, it’s not Nvidia people are worried about - it’s Nvidia’s customers, and the recent rise in debt financing for AI spending is a new risk for Nvidia and the AI-bull market that came under the spotlight this week… so let’s talk about what’s going on and why it’s something worth keeping an eye…

🫣 Big Tech’s Growing Debt Binge

💰 One of the major concerns leading to a decline this week was big tech’s rising debt.

🤑 According to Bloomberg, the five biggest AI spenders (Amazon $AMZN, Alphabet $GOOG, Microsoft $MSFT, Meta $META, and Oracle $ORCL) have raised a record $108 billion in debt in 2025, more than triple the average over the previous nine years.

🫵 Of these five, Oracle (which has the weakest balance sheet of the 5) has been the target of the most criticism after its recent sale of $18B of bonds, growing it’s debt to roughly $104B.

🧐 But Meta ($30 billion), Alphabet ($38 billion), and Amazon ($15 billion), are also issuing billions worth of debt, with Microsoft being the only large hyperscaler that hasn’t issued any.

According to some experts, this is ushering in a new era of risk:

“I view this as the AI story maturing and entering a new phase, one that is likely to be marked by more volatility and additional risk.”

🤖 There seems to be no limit to what big-tech will spend on AI, with spending expected to reach over $600 billion by 2027 and $2.8 trillion by 2029, as all the big players engage in an arms race to be the first to reach ‘AGI’ aka Artificial General Intelligence.

🤔 What’s All This Mean for the Stock Market?

⁉️ The question is, if these companies have the cash flow to invest, why are they taking on so much debt?

💰 Well with AI infrastructure, the cost is enormous, and growing quickly. Looking at the chart above in 2025 we can see that Capex (aka AI spending) has grown far faster than cash flow, meaning to keep up the pace they need to get more money from one of two places: debt or equity.

💸 With big tech, their access to credit is so strong that they can access capital via debt at rates far below the cost of issuing equity. Since their bonds are AA/AAA rated, they can typically issue debt at 3-5% interest rates.

😥 The challenge is, this sudden surge in attractive public debt investments steals demand away from the stock market.

🔄 The big institutional investors only have so much capital to allocate, and so many will need to shift out of stocks to buy these bonds, leading to downward pressure on the market:

"You need capital to come from somewhere to finance this. What's happening is a recognition that you need money almost coming out of stocks into bonds."

🤑 The ‘Show Me the Money’ Phase

⁉️ On top of that of course, is the question of whether this massive debt will pay off, and to many experts, all this debt raises the bar for big tech to start showing returns on investment:

“When companies that don’t need to borrow are borrowing to make investments, that sets a bar for the returns on those investments.” “We’re in a ‘show me the money’ phase.”

Since we talked about this at length on Thursday (read my thoughts here), I won’t go into it again, so let me wrap it up with this quote about where we go from here:

“We might just be in the beginning stages of an AI capex buildout, but that sort of also implies we’re probably in the early stages of releveraging balance sheets. I would be worried that this flood of issuance is probably just the start of things to come for the next couple of years.”

⭐️ Ok, now that we have all the ‘bad news’ out of the way, let’s talk about the some of the good news this week, including Walmart’s strong earnings report (which is a promising sign for consumer spending), and the jump in likelihood of a December rate cut…

But first, a quick word from this week’s sponsor Fidelity Investments Canada!

SPONSORED BY FIDELITY INVESTMENTS CANADA

💸 Retirement Dreams? Fidelity Could Help Make Them $10,000 Closer!

🤩 An extra $10,000 could make a big difference to your retirement plan – especially if you invest it now in an RRSP account and let decades of potential growth work in your favour.

💰With an RRSP, you can lower your taxable income, achieve long-term tax-sheltered growth and build a reliable source of retirement income. Now that’s what you call a win-win-win!

🎟 Don’t miss your moment. Enter for your chance to win $10,000 courtesy of Fidelity Investments Canada!

Registration ends on December 15, 2025, at 5:00 p.m. ET.

Winner to be announced in January 2026.

*See Fidelity Investments Canada Disclaimer at the end of the newsletter.

THE GOOD NEWS

🛒 Walmart Shares Rise 7% After Strong Earnings

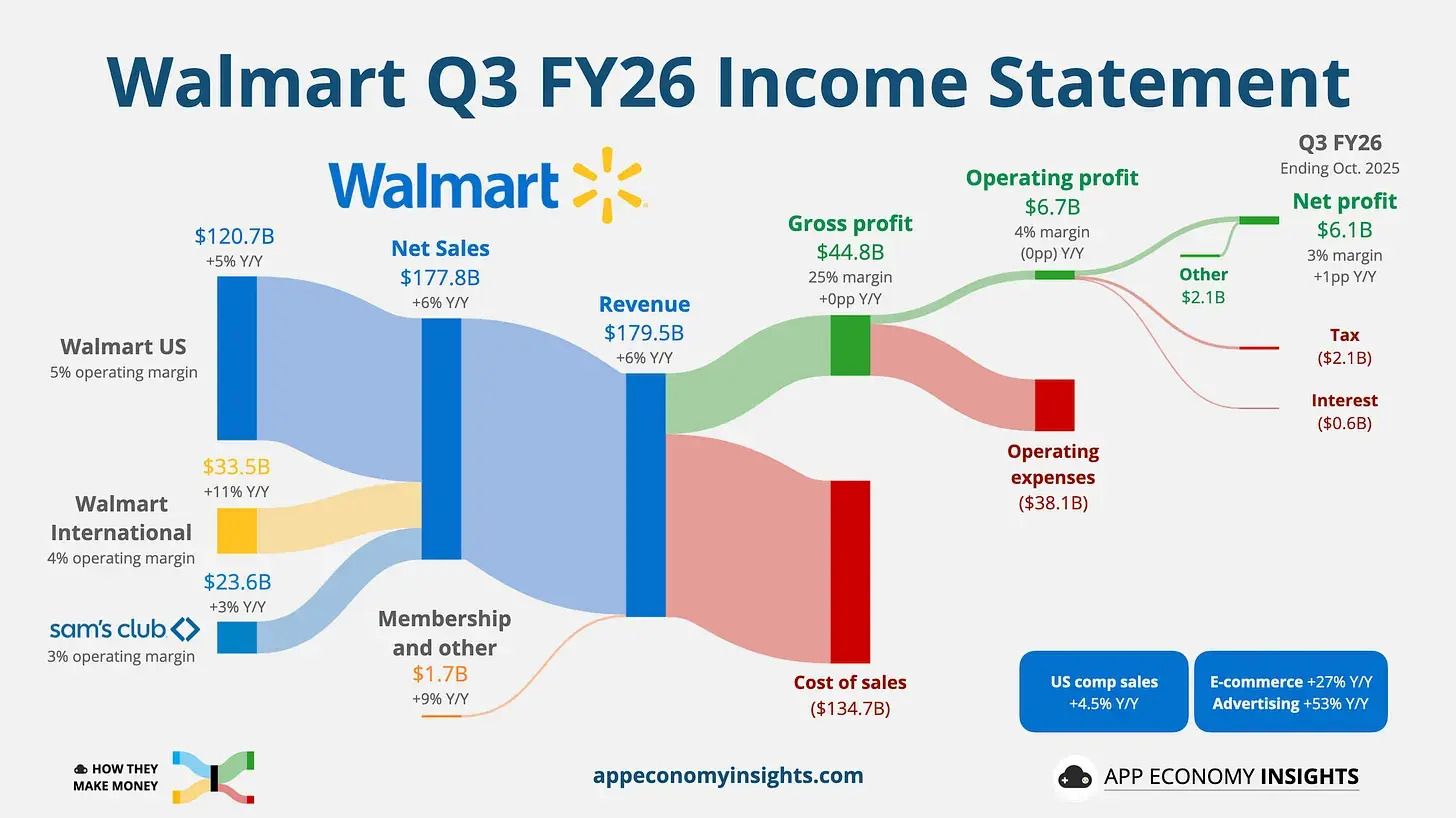

🥳 While it was overshadowed by Nvidia, Walmart $WMT also reported its earnings this week, smashing expectations on the top and bottom lines:

✅ Revenue was $179.5b vs. $175.2b expected, up 5.8% since last year

✅ Adj. earnings per share was $0.62 vs. $0.60 expected, up 7% since last year

✅ Global e-commerce was up +27%

✅ U.S. same-store sales was up +4.5%

⚡ Management noted strong growth coming from higher-income shoppers (>$100k), and a softening in lower-income shoppers, pointing to a growing disparity with the two types of consumers.

⬆️ The company also raised full-year revenue and EPS guidance for the second time this year, now expecting 4.8%-5.1% sales growth (up from 3.75%–4.75% previously).

☁️ A Fast-Growing Digital Business

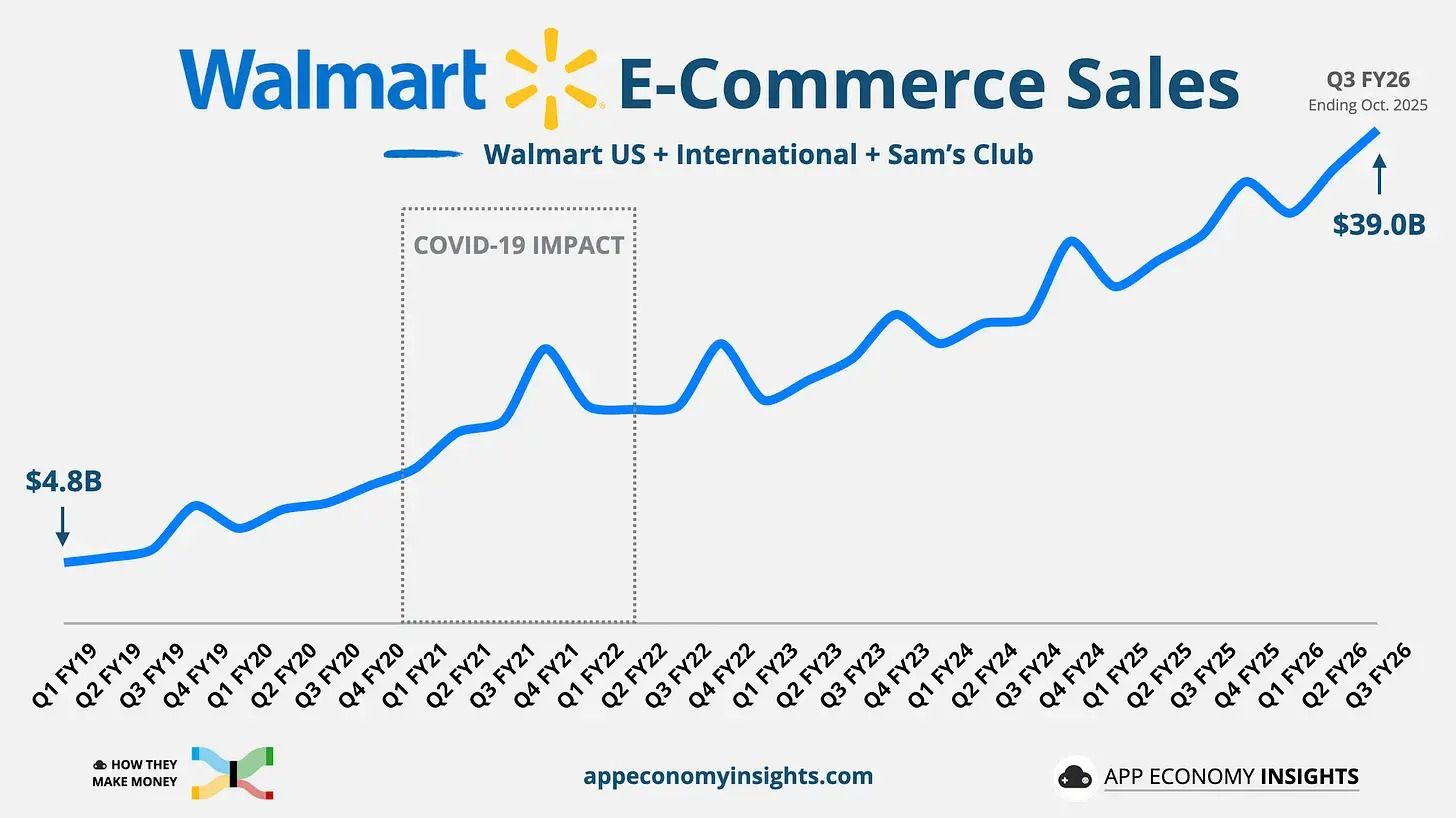

💪 Walmart’s fastest and most profitable segment is its e-commerce business, which grew at nearly 30% since last year.

“eCommerce was a bright spot again this quarter. We’re gaining market share, improving delivery speed, and managing inventory well. We’re well-positioned for a strong finish to the year and beyond that, thanks to our associates.”

☝️ While Walmart’s e-commerce business competes with Amazon, Walmart relies on Amazon for shipping its orders, meaning both companies are in a position to grow together.

💡 If Walmart can keeps this growth up, it’s on path to turn a once low-margin retail business into a high margin tech-retail business like Amazon.

👨💼 Analysts Reactions

✨ Analysts were very happy with the results, and at least two major banks upgraded price targets for the stock to above $118, with one analyst from Truist calling $WMT a “must-own for growth investors.”

📣 An analyst from JP Morgan also pointed out Walmart’s new focus on expanding earnings, its surprise CEO change, and a new aggressive pricing strategy as inflation cools, as bullish signals for shares.

🧭 What This Means for the Market

🤔 So what’s this all mean for the market at large?

🛍️ Well, Walmart earnings reports are essentially just a measure of U.S. spending, with over 90% of U.S. households shopping there.

🎯 When people are spending more at Walmart, it’s a pretty good sign not just for all of retail, but consumer spending as a whole.

🚩 But while the strong quarter from Walmart tells us that consumer spending is holding up, there are a few red flags:

Some of Walmart’s success seems to be due to ‘value substitution’ aka high income shoppers going to Walmart to save money, which is actually a bad sign for the broader economy

Lower-income consumers continue to spend less, with higher-income shoppers spending more, showing inflation and job losses are taking a toll

😬 So while certainly good news for Walmart shareholders, the results for the US economy at large are more mixed, and could actually be a bad sign overall.

✨ The Silver Lining: A Fed Rate Cut

✅ The one silver in all this is that a struggling economy = a higher probability of the Fed cutting interest rates in December, which would be good news for the stock market.

👀 A few weeks ago, I mentioned that the probability of a rate cut had fallen from 95% to 50%, well now it’s back up to 71% according to the CME Group FedWatch tracker - with the probability jumping after the results of a new jobs report that was delayed due to the government shutdown.

👷♂️ While the report showed a rebound in jobs growth, unemployment rose slightly to 4.4%, now a four-year peak. Investors are betting that due to the rise in unemployment, the Fed will be more inclined to cut rates.

🙏 A rate cut would give a nice boost to the shaky market, which has seen the S&P 500 fall 5% since Halloween highs.

🔍 It’s worth noting though, that despite all the doom and gloom in the headlines, and the extreme fear the markets in, for long-term investors to get some piece of mind - just zoom out. While it’s fun to cover the stock market news of the week, sometimes an over-obsession on the recent news can cause us to lose sleep at night, or worse panic-sell.

📈 Even with the recent drops, over the past year the market is still up a strong +12.5% year-to-date, and +82% in the past 5 years, so while it’s important to be aware of what’s going on in the markets, the best thing you can do as an investor is stay focused on the long-term.

🗞️ For me, I use the news (especially bad news or market drops), and how I feel about it as a pulse of whether my portfolio truly matches my risk tolerance and time horizon, and make small adjustments accordingly. So if you haven’t already - use this recent dip as an opportunity to check in on your portfolio and make sure it still matches your goals!

🐝 For those new here, my name is Max, the CEO of Blossom, and I write the Weekly Buzz every week to keep you updated on what’s happening in the stock market! I hope you enjoy my weekly coverage of the markets as much as I enjoy writing it 😊 If you want to see what I’m investing in, make sure to follow me on Blossom!

SPONSORED BY HARVEST ETFS

🍁 Built Canada Strong: 3 Harvest Income ETFs for Today’s Market

📈 Canadian equity markets have performed better than their counterparts south of the border so far in 2025, with the S&P/TSX Composite also slightly outperforming the S&P 500 over a five-year period.

💪 “Building Canada Strong” was the title and focus of the country’s proposed Budget 2025. Canadian leadership is driving toward a more business-friendly approach to the economy, pushing investments into infrastructure, defence, and improving the cost of living.

🇨🇦 Building diversification in a portfolio, with Canadian equities, is something investors may want to consider right now.

Harvest “Built Canada Strong” ETF Suite

HHIC | Harvest Canadian High Income Shares ETF

A one ticket solution holding some of the “Best of Canada”, with covered calls and modest leverage to improve growth and income potential

HVOI | Harvest Low Volatility Canadian Equity Income ETF

A robust scoring framework to reduce risk while staying invested in 100% Canadian equities, with monthly income from covered calls

HLIF | Harvest Canadian Equity Income Leaders ETF

Focuses on blue-chip Canadian dividend payers with strong historical track records, with a covered call overlay to provide tax efficient income

*See Harvest ETFs Disclaimer at the end of the newsletter.

Fidelity Investments Canada Disclaimer

No purchase necessary. The Fidelity Investments Canada RRSP Contest is open to residents of Canada who are the age of majority. Financial advisors and employees of Fidelity, among others, are excluded from the Contest. Void where prohibited. Starts October 20, 2025, at 2:00 p.m. ET and ends December 15, 2025, at 5:00 p.m. ET. One prize is available to be won, consisting of a $10,000 CAD cheque to be used or invested at the winner’s discretion. Skill-testing question required. Odds depend on number of entrants. For full rules and entry details, please see the Official Contest Rules and Regulations.

This information is for general knowledge only and should not be interpreted as tax advice or recommendations. Every individual’s situation is unique and should be reviewed by his or her own personal legal and tax consultants.

© 2025 Fidelity Investment Canada ULC. All rights reserved. Fidelity Investments is a registered trademark of Fidelity Investments Canada ULC.

Harvest ETFs Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The Funds pay distributions to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested available Class units/shares of the Fund. If the Funds earn less than the amounts distributed, the difference is a return of capital. Tax investment and all other decisions should be made with guidance from a qualified professional.

HHIC is classified as an alternative exchange-trade fund: it uses a 25% leverage based on its net asset value. The use of leverage increases both the upside and downside returns and therefore introduces higher return volatility.