- The Weekly Buzz 🐝 by Blossom

- Posts

- ☢️ Trump Media Jumps 53% After Merging With Nuclear Fusion Firm

☢️ Trump Media Jumps 53% After Merging With Nuclear Fusion Firm

Plus, Nike sinks another 11% after earnings... is the once great shoe giant now dying?

MARKET OVERVIEW

📊 The Market Snaps a 4-Day Losing Streak After Micron Saves the Day

📉 At the start of the week, things continued to look rough for AI stocks, with Broadcom ($AVGO) and Nvidia ($NVDA) falling amid ongoing concerns about AI overspending.

📉 Oracle ($ORCL) (which fell 14% last week) added to the fears after reports that one of its largest lenders, Blue Owl Capital, had pulled out of a $10B data centre project.

🚀 But Thursday & Friday turned things around when Micron Technologies ($MU) jumped 21% after reporting a 167% surge in profit, helping lift the AI trade out of its slump and snapping a 4-day losing streak for the markets:

The S&P 500 ended the week up +0.10% (but jumped 0.9% on Friday)

The Nasdaq 100 ended the week up +0.48% (but jumped 1.3% on Friday)

The TSX rose +0.72%

✨ New data also showed annual inflation had slowed to 2.7% (below expectations), adding to an optimistic end of the week.

🎅 It’s also possible that Wall Street Santa had something to do with the gain, giving us a bit of his famous ‘Santa Claus Rally’ just in time for Christmas 😉

✍️ Trump Issues the Executive Order to Loosen Restrictions on Weed

🌿 Last week, we covered weed stocks jumping 50%+ after reports that Trump could be issuing an executive order to dramatically loosen federal restrictions on the drug.

✍️ Well, this week, Trump issued the order, marking the biggest shift in pot regulation since 1970.

💸 And while stocks like Tilray Brands ($TLRY) and Canopy Growth ($WEED) got a boost at the start of the week, jumping another +25%, they erased most of the gains over Thursday and Friday as the hype around the executive order died down and investors who ‘bought the rumour’, then ‘sold the news’.

📈 Still, the stocks remain +30% above where they were before the order, so we’ll see whether they stay there or lose all the Trump-driven gains.

💡 Speaking of Trump, while this isn’t a political newsletter, Trump had another big stock market story this week, so we’ll be covering him again, just this time with a little less weed…

TOP STORY

📈 Trump Media Jumps 53% After Planned Merger With Nuclear Fusion Firm

📱 Trump Media & Technology Group ($DJT), parent company of Truth Social, was one of the most notable stocks in 2024 following its listing on the Nasdaq (via a merger with a public company) last March.

🎢 The stock soared 260% after going public, then sank 80%, then soared 170% when Trump became President, then sank 70% again.

👀 Given the company’s <$1M quarterly revenue (which, for reference, is less than Blossom’s revenue now), and $4B valuation, many investors had written off the stock as widely overvalued…

😮 But this week, to the market’s surprise, Trump Media announced a $6 billion all-stock merger with a private nuclear fusion company called TAE Technologies, backed by companies like Google ($GOOG), Chevron ($CVX), and Goldman Sachs ($GS).

🤝 This deal would create one of the world’s first publicly-traded fusion companies, with shareholders of the existing companies each owning about 50% of the final entity.

📈 Trump Media shares surged 53% upon the news, but it has many analysts and investors talking, so let’s break down what it means for the stock, and whether it’s worth taking a second look at Trump Media…

🤿 But before we dive in deeper, a quick word from this week’s sponsor Harvest ETFs!

🎄 P.S - this is our last Weekly Buzz before Christmas so I’d like to wish you all a very happy holiday season with your families and loved ones! It’s been such a pleasure writing for you all this year and I appreciate all of you so much for tuning in every week!

PRESENTED BY HARVEST ETFS

🏆 The World’s Biggest Brands Plus Monthly Income | HBF ETF

✨ What makes an iconic brand? World-renowned brands are characterized by a concrete identity. These companies provoke an emotional connection with the audience.

🌐 Brands like Apple, McDonald’s, Walmart, and Coca-Cola have built global recognition. These companies can dominate the markets they compete in, demonstrating the ability to survive and even thrive through various economic cycles.

🏆 The Harvest Brand Leaders Plus Income ETF (TSX: HBF) targets the world’s biggest brands that possess global reach, strong financials, and dominant market shares. HBF targets brands in a portfolio that seeks to offer three crucial elements: quality, growth, and income.

*See Harvest ETFs Disclaimer at the end of the newsletter

TOP STORY CONT.

📈 So, What is TAE Technologies?

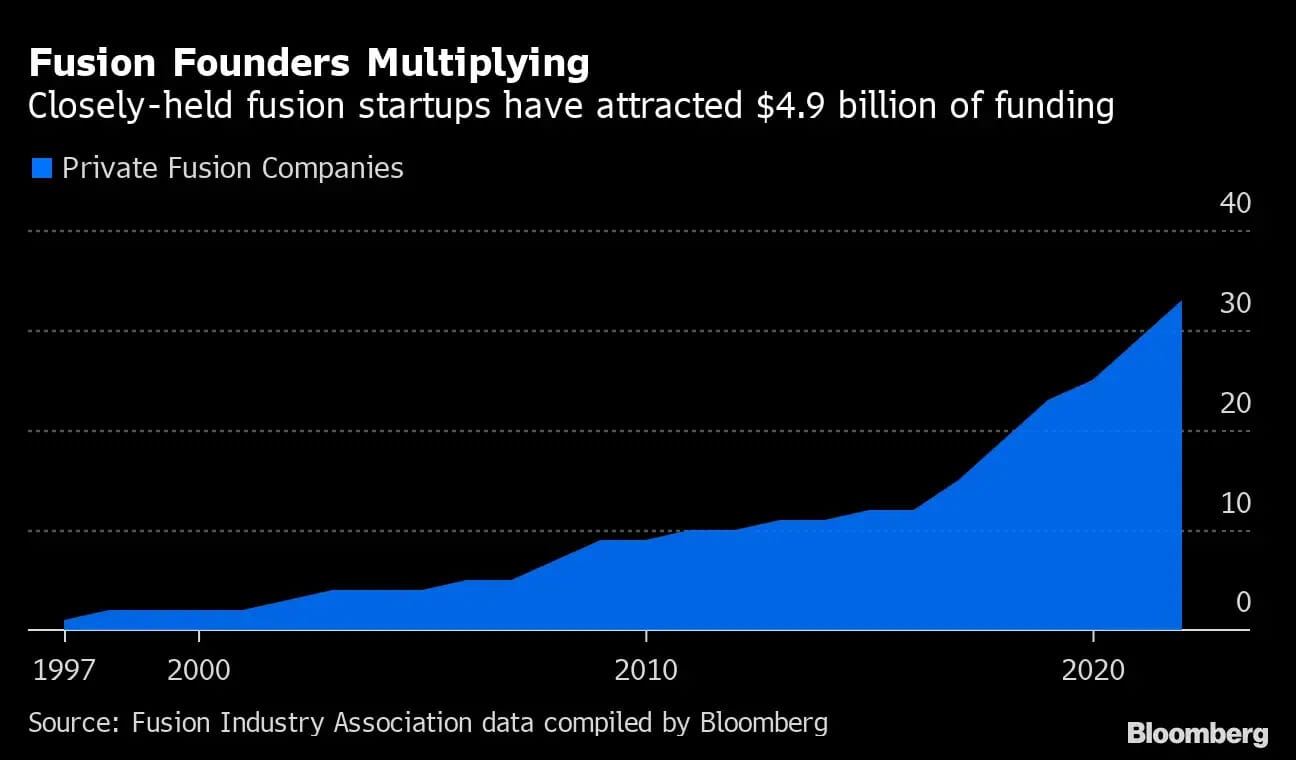

☢️ TAE has been developing nuclear fusion technology for 27 years, a process that mimics the sun’s energy production, fusing hydrogen atoms to create large amounts of emission-free power (which is different than nuclear fission, which was the technology behind the Chernobyl disaster). TAE currently runs five reactors, all for research, with its first plant expected by 2031.

💧 Given Earth’s almost limitless supply of water, fusion is being regarded as the next best thing in energy because of its many advantages and limited risk, being brought to light (in part) by the rise in AI energy consumption.

🤖 Due to rising AI build-out, companies have created a massive energy crunch, with hyperscalers like Google and Amazon scrambling to power their energy-hungry data centres. Fusion represents a potential solution to this that’s clean, safe, and nearly infinite.

🧩 A Breakdown of the Deal

💰 One of the main problems with nuclear fission is that it’s very expensive to build (upwards of $10 billion per plant, depending on size, with costs repeatedly running over budget). And while TAE has raised over $1.3 billion in private capital to date, that’s not nearly enough for long-term build-out of large-scale plants or reactors.

🎤 Analyst Dan Ives puts it well:

“The US is facing major energy shortages/issues to fuel the AI data centre transformational buildout over the next decade. While the US is ahead of China from an AI technology perspective, China is clearly leading on the energy front. If there’s a US answer for fusion, it’s TAE. The biggest thing missing is capital.”

💼 With this merger, Trump Media brings $3.1 billion to the table (largely from crypto) and public market access, and will be supplying TAE with $300 million in immediate capital ($200 million upon signing + $100 million after filing with the SEC).

🤔 But is the new company worth $4.5B?

🚀 Since news of the deal, Trump Media jumped 54% to a $4.5B valuation… so the question is, is the company still overvalued at the new valuation?

😅 Well… valuing the company is, to put it lightly, a bit challenging, as according to Fortune, TAE Technologies doesn’t plan to bring its first power plant online until 2031 to start generating revenues… so it’s a big bet on the promise of the future technology.

🤨 One analyst called it “a ridiculous merger” and argued that markets are betting on “direct federal government payments to a company whose leading shareholder is the president.”

⭐️ Still, many experts think the long-term potential for fusion power remains huge, with a breakthrough moment for the technology happening at the end of 2022, when scientists achieved “first ignition,” fusing atoms through extreme heat to generate more energy than the setup consumes for the first time ever. But even these experts think 2031 is a bit ambitious for a commercial rollout.

😬 So the challenge for investors is that it will be tough to tell whether this was a good move for 5+ years, and until then, it looks like Trump Media will continue to trade mostly on hype. Yahoo Finance sums it up best:

Given fusion's history of overpromising and delay, and the merger's execution risks, the deal carries a high probability of complications, setbacks, and failure. Investors should avoid buying into the hype. If TAE and Trump Media can actually succeed in the effort, there will be plenty of opportunity to buy in afterward.

PRESENTED BY QUESTRADE

🎁 Questrade is Giving Away the Chance at Three Life-changing prizes.

🚀 Imagine waking up to find your biggest financial goals are already met. Questrade is offering you the opportunity to fast-track your future by decades. From now until December 29, you can enter to win one of three grand prizes¹ designed to fully fund the milestones that matter most:

The TFSA Prize: $175,000, equivalent to 25 years of your annual contributions.

The RESP Prize: $50,000 to fully fund your child’s education.

The FHSA Prize: $40,000 to secure a down payment on your first home.

🌟 This isn't just about winning cash. It's about winning the freedom to focus on the present, knowing your future is secure. To enter, open a new TFSA, RESP, or FHSA at Questrade and fund it with $250 or more. If you’re an existing customer, you can contribute at least $250 to your existing TFSA, RESP, or FHSA to enter. See full contest rules and details here.

💰 Ready? Open a Questrade TFSA, FHSA or RESP today for a chance to win and get a $50 bonus.

🤝 Use the promo code ‘Blossom’ and get $50 when you open a new Questrade account.

This information is being provided to you for educational purposes only, and should not be used or construed as investment, tax or financial advice. ¹No purchase necessary. Open to Canada (age of majority). Skill testing question required. Odds depend on entries. Terms apply. See full rules here. Contests are administered solely by Questrade, Inc.

IN OTHER NEWS

📉 Nike Sinks 11% Amid Mixed Q4 Earnings Results

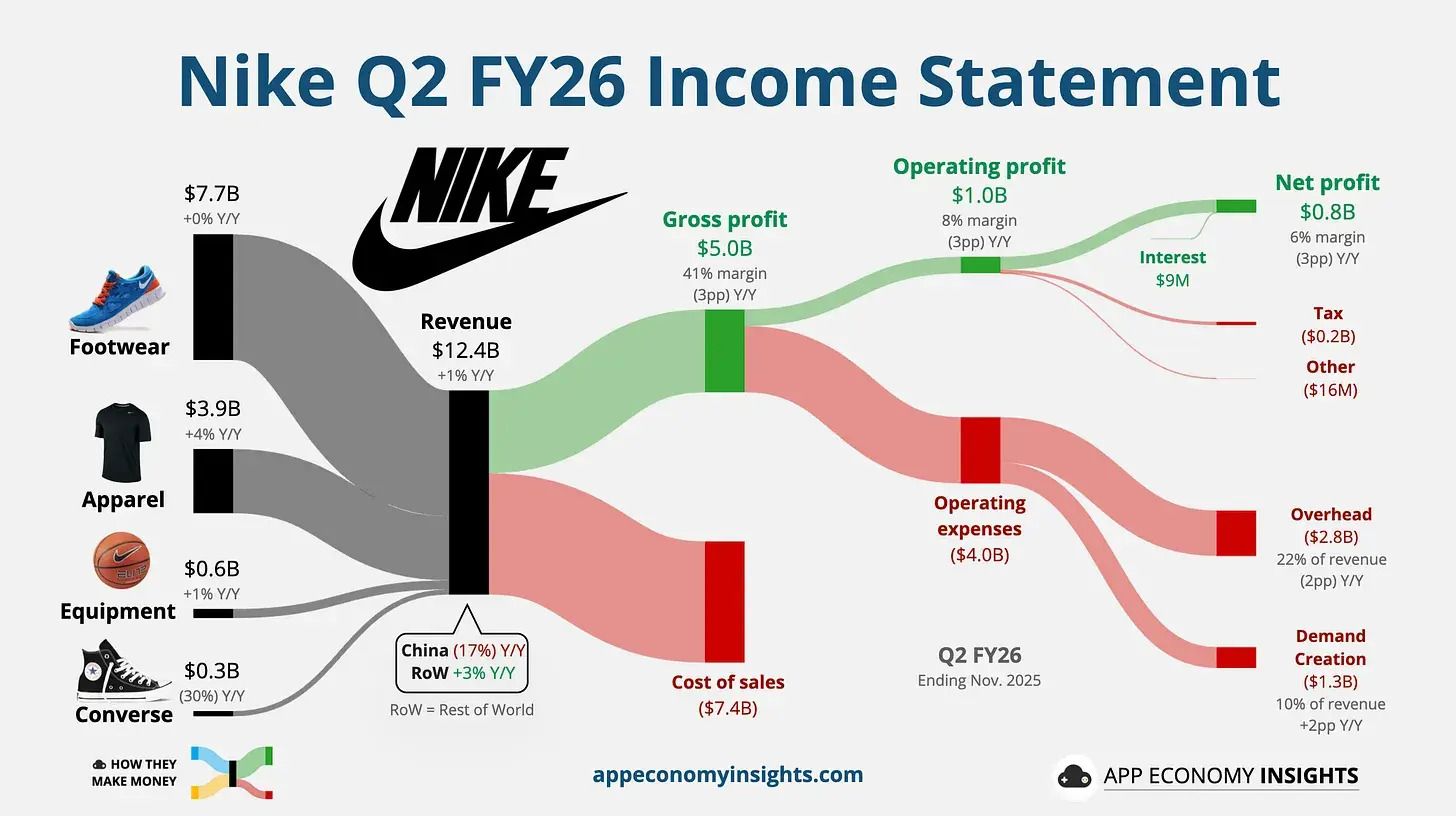

📰 Despite less coverage in the news cycle, Nike ($NKE) reported its Q2 FY2026 earnings this week, beating revenue and earnings estimates:

✅ Revenue was $12.4 billion vs. $12.2 billion expected, up 1% year-over-year

✅ Earnings per share was $0.53 vs. $0.37 expected, down 32% since last year

✅ Wholesale revenue rose 8%

❌ Direct revenue fell 8%

❌ Greater China revenue fell 17%, the sixth straight quarterly decline

🎯 While the company beat Wall Street’s top and bottom line expectations, investors turned their focus the massive gross margin drop due to tariffs and weak China performance, leading shares to drop 11% within the day.

🇨🇳 Troubles in China

🫣 One of Nike’s key markets is China, accounting for 15% of its revenue. And this quarter, alongside another sharp revenue decline, Nike’s direct-to-consumer traffic (online and in-store) declined by 36% year-on-year in the country.

😓 One analyst from Zacks called Nike’s China business a “problem child,” and even Nike CFO Matthew Friend cited it as a “complicated” turnaround effort.

“We firmly believe our growth will come through sport. But the reality is we’ve become a lifestyle brand competing on price in China.” “It's clear we need to reset our approach to the China marketplace.”

🏬 The company acknowledged that it hasn’t invested nearly as much in refreshing its Chinese stores, and noted that China’s retail landscape, where brands typically operate their own stores instead of selling through outlets, limits Nike’s ability to dominate China like it does in the U.S (Rising competition with Chinese brands such as Anta Sports is also a struggle.)

📊 Other American companies with large Chinese operations have experienced similar problems, with Starbucks also facing poor sales in the country as Chinese consumers shift to homegrown alternatives to Western brands.

🏃 A “Win Now” Strategy

👔 Elliott Hill, Nike’s new CEO who took over the reigns from John Donahoe in October 2024, has been taking his time to carry out a major turnaround for the company.

💻 Donahoe pushed Nike to prioritize e-commerce sales over wholesale partners, hurting key relationships with retailers such as Foot Locker ($FL) and Dick’s Sporting Goods ($DKS). A much-needed change was required to revive growth, and Hill was this change.

“We lost our obsession with sport… Moving forward, we will lead with sport and put the athlete at the centre of every decision.”

🏆 Hill came in with a “Win Now” strategy to rebuild wholesale relationships, slash inventory of poor-selling products, and refocus on performance categories like running and basketball.

🧐 And though there are some bright spots this quarter showing positive signs from this plan, the promised “Nike turnaround” is coming in slower than expected, and analysts feel the same way.

🎯 Analyst Reactions

⏰ While Nike leadership continues to be clear that this is a multi-year rebuild, not a quick fix, analysts didn’t buy the optimism, with firms such as Piper Sandler, Wells Fargo, Barclays, UBS, Bank of America cutting price targets by as much as 14%.

💡 While some analysts are optimistic on the turnaround, they say that while the plan is sound, execution risk is still very high:

“Nike's turnaround is still struggling to gain traction and continues to take longer. The company's issues before CEO Elliott Hill took over appear to be far deeper than we initially realized.”

⛈️ Nike is experiencing very tough headwinds. Whether with China revenue declining, tariffs hitting profits, and a declining brand image… the company faces many challenges ahead.

🙏 For the sake of the over 3,000 Nike shareholders on Blossom, I hope Elliott Hill’s Win Now strategy is the silver bullet to turn things around that shareholders are hoping for.

Harvest ETFs Disclaimer:

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The Funds pay distributions to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested available Class units/shares of the Fund. If the Funds earn less than the amounts distributed, the difference is a return of capital. Tax investment and all other decisions should be made with guidance from a qualified professional.