- The Weekly Buzz 🐝 by Blossom

- Posts

- 🛢️ Venezuela Stock Market Doubles After US Invades - Should You Invest?

🛢️ Venezuela Stock Market Doubles After US Invades - Should You Invest?

Plus, Nvidia annouces 'ChatGPT Moment' for Self-Driving Cars...

TOP STORY

🛢️ Venezuela Stock Market Doubles After US Invades

👀 The first full week of trading turned out to be very interesting…

👷♀️ On one hand, the US jobs report reported only 50,000 new jobs in December, well below the 73,000 expected, making 2025 the worst year of hiring since 2020.

👩⚖️ The long-awaited tariff ruling from the US Supreme Court was also postponed, causing retail stocks to fall.

📈 But despite this bad news, the stock market soared:

The S&P 500 rose 1.57%

The Nasdaq 100 rose 2.22%

The TSX rose +2.29%

✨ Why? Well, one reason is rising optimism about the economy, with consumer sentiment inching higher and Trump instructing Fannie Mae and Freddie Mac to buy $200B in mortgage bonds, causing mortgage rates to fall.

😮 But perhaps the bigger and more surprising reason was last weekend, the US launched a military strike on Venezuela, capturing the President, and saying that America would run the country and have American oil and gas companies “spend at least $100B of their own money to rebuild the capacity and the infrastructure necessary”.

😳 I certainly didn’t have that on my 2026 bingo card…

✅ Usually, wars and geopolitical uncertainty cause markets to fall, but in this case, the market clearly viewed it as a positive, with markets betting that a more stable Venezuela will benefit the US markets.

🚨 The news also sent Latin American stocks into a frenzy, with the Venezuela Stock Market Index jumping +169% and drove US Oil stocks like Chevron ($CVX) and Halliburton ($HAL) up around +4% and 10% respectively.

🔍 So let’s break down the full story, take a look at what this means for Venezuela and oil stocks, and see whether there are any interesting investment opportunities that have come out of this chaos…

🤔 Why Venezuelan Oil Matters So Much to America

🏆 For decades, Venezuela was a top oil producer, with a peak production of 3.5 million barrels per day (bpd). Its oil industry thrived with help from American companies such as ExxonMobil ($XOM) and ConocoPhillips ($COP) investing billions in building up infrastructure and know-how.

⚖️ But in 1976, Venezuela nationalized its oil industry under a single company, and starting in the 2000s, forced foreign investors to give up control of their assets in the country. This led to billions in losses for American companies (~$17 billion in asset and investment loss).

📉 Since the 2000s, Oil production has fallen to 1/3 of its peak to ~1 million barrels per day. This hurt the US, driving up oil prices as supply fell.

🛢️ But with the US taking over, many believe production could ramp back up quickly:

“Industry estimates suggest production could recover toward 2 million barrels per day within one to two years under favourable conditions.”

🤔 So, should we be investing in Venezuela? Or US Oil stocks that stand to benefit from the ramp back up in oil production?

Before I answer that, a quick word from this week’s sponsor, Harvest ETFs!

🇨🇴 P.S. Fun Fact, I’m actually writing this from Colombia where I am working remotely to escape the Toronto winter for a few months. Fingers crossed there are no invasions here 🤞 😅

PRESENTED BY HARVEST ETFS

🎆 New Year 2026 | HHIS in Review

🎂 The Harvest High Income Shares ETFs™ suite turned a year old this last August.

📈 Since debuting in the summer of 2024, the suite has grown rapidly in the number of offerings and assets under management. Today it features single stock ETFs covering 19 leading US companies and has accumulated over $4 billion in AUM. This includes healthcare giants like Eli Lilly, tech players like Nvidia, Microsoft, and Meta, and other stalwarts like Palantir and Netflix.

🚀 The Harvest Diversified High Income Shares ETF (TSX: HHIS) launched in January 2025. This ETF provides unitholders diversified exposure to top US companies by investing in a portfolio of Harvest single stock ETFs.

🗓️ As we approach the one-year anniversary of the HHIS launch, it’s worth looking back on the year that was. How HHIS has been managed, how it balances its growth and income factors, and its approach going forward.

*See Harvest ETFs Disclaimer at the end of the newsletter

TOP STORY CONTINUED

🤑 So, Should You Invest in Venezuela or Oil Stocks?

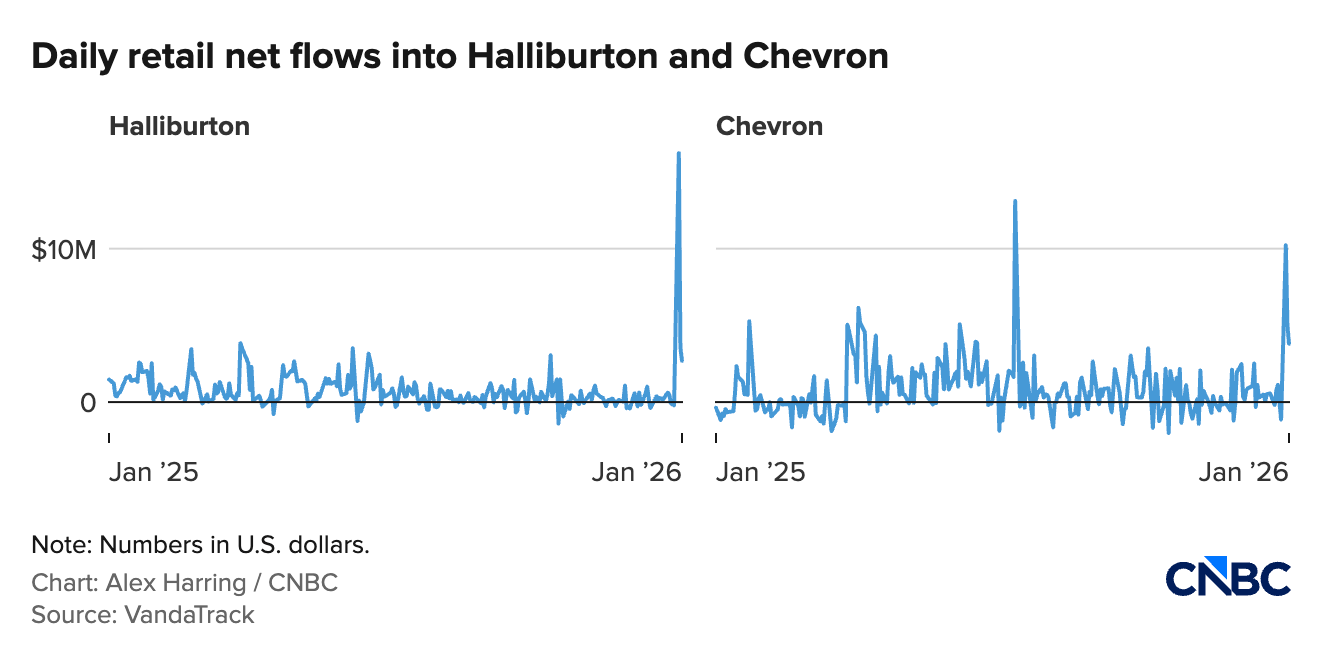

💰 With all the news swirling around Venezuela, many retail investors started investing heavily in energy stocks that could profit from the shake-up.

📈 Halliburton ($HAL), an oil service company that would benefit from rebuilding Venezuela’s oil infrastructure, jumped 11% and saw its largest inflows from retail investors in the past 4 years.

🔍 Many investors also searched for Venezuela ETFs to benefit from the surging market, but unfortunately, no such ETF exists - yet. Teucrium, a US ETF provider, filed for the launch of the first Venezuela exposure ETF, so a way to invest in the market could be coming very soon.

🤔 But is all this just hype? Or is Venezuela a good long-term investment?

🐻 📉 The Bear Case

⭐️ We already talked about the best-case scenario: a credible political transition brings back US oil giants, potentially tripling output back to where it was a decade ago and boosting both US oil stocks and the Venezuela market as a whole.

👀 But that’s much easier said than done for a few reasons:

❌ Vice President Delcy Rodríguez, the new interim president, has publicly rejected U.S. control, adding significant political uncertainty

❌ Venezuela's oil infrastructure has been outdated for years. It’s estimated that over $100B in investments would be needed to bring production to its former highs of 4 million bpd within a decade.

❌ US oil producers have been burned in Venezuela before and are not eager to go back, with ExxonMobil CEO Darren Woods calling the country “uninvestable” in a recent meeting with Trump.

❌ According to the International Energy Agency, global oil was oversupplied by 3.8 million bpd in 2025, pushing down global oil prices to ~$60/barrel. The estimated breakeven price for producing Venezuelan oil is around $80/barrel.

❌ Venezuela defaulted on its debt in 2017 after failing to make payments on overseas bonds issued by both the government and its state-owned oil producer, making institutional investors hesitant to invest again.

🇻🇪 As you can see, there are still tons of hurdles ahead before Venezuela becomes a good investment and I personally will be steering clear of the Venezuela exposure ETF when it lists.

🎯 A Few Opportunities

👎 While I personally don’t think a Venezuela ETF or even US oil stocks like Chevron are great investments right now, there are a few areas that might have some opportunity:

🛡️ Stephen Dover, CFA, the head of Franklin Templeton Institute, believes defense stocks stand to benefit as Trump has “reinforced the perception that the US is willing to act unilaterally and to use force.” (i.e. stocks like Lockheed Martin $LMT, which jumped +9% this week)

🇨🇦 Canadian Oil stocks like Enbridge ($ENB) fell -4% this week on the news, which may be an overreaction.

🇧🇷 🇨🇴 🇲🇽 A more stable Venezuela could be a bonus for the whole Latin America region’s economy in the long run, which could benefit ETFs like iShares Latin American 40 ($ILF)

⚠️ But if you do plan to invest based on the news, keep in mind that the political situation is still very uncertain and definitely carries a high degree a risk!

👴 All right, before we cover a few other top headlines this week, a quick word from our other sponsor this week Webull Canada!

PRESENTED BY WEBULL CANADA

📊 A Closer Look at Advanced Charting and Market Analysis for Today’s Traders

📈 Having access to clear, reliable market data can make all the difference when trading and Webull Canada is built to help investors analyze the markets with confidence. The platform offers advanced charting and data analysis tools designed to support decision-making for both new and experienced traders.

💰Understanding the markets requires more than simply watching prices move. It means being able to view historical pricing, compare trends across different timeframes, and use data to add context to market behaviour. Tools such as technical indicators, drawing features, and real-time market data help investors better interpret momentum, volume, and shifting sentiment as market conditions evolve.

💻 Consistent access to this information also matters. Being able to review charts, monitor positions, and stay connected to market activity across both desktop and mobile helps investors remain informed wherever they are. Webull Canada is designed to bring these insights together in one place, supporting a more thoughtful, data-driven approach to understanding the markets.

🔎 Discover how Webull Canada’s charting and data tools can elevate your trading experience:

Webull Securities (Canada) Limited (regulated by CIRO and a member of CIPF) offers Order Execution Only securities trading. All investments involve risk. Regulatory Fees, Exchange Fees and other Fees may apply. More info: http://www.webull.ca.

ALSO IN THE NEWS

🗞️ Other Top Headlines This Week

🚗 Nvidia Announces the ‘ChatGPT Moment’ for Self-Driving Cars, Taking on Tesla

Nvidia ($NVDA) unveiled its end-to-end autonomous driving platform, calling it the “ChatGPT moment for self-driving,” as large AI models begin to handle perception, planning, and driving decisions together.

CEO Jensen Huang said autonomous vehicles are reaching an inflection point where “the entire AV stack can now be trained like a foundation model,” similar to how ChatGPT changed natural language AI.

Nvidia’s Drive Thor and new generative AI software aim to let automakers train self-driving systems using massive simulated data, directly challenging Tesla’s ($TSLA) camera-only, in-house Full Self-Driving approach.

Unlike Tesla, Nvidia is positioning itself as the picks-and-shovels provider, selling chips and software to multiple automakers, including Mercedes-Benz, Volvo, and BYD, expanding its $5B+ automotive revenue pipeline.

🔐 Crowdstrike Jumps 4% After Acquiring SGNL to “Transform Identity Security for the AI Era”

CrowdStrike ($CRWD) agreed to buy identity-security startup SGNL for $740 million in a cash and stock deal, aiming to add real-time, continuous access control to its Falcon platform.

SGNL’s tech continuously grants and revokes access based on real-time risk signals, replacing static privileges for human, non-human, and AI identities, a growing cybersecurity priority.

CRWD shares jumped +4% on the news, as investors see the move as a meaningful expansion beyond endpoint into dynamic identity protection.

Management says integration will preserve SGNL’s team and is expected to close in Q1 of Fiscal 2027, accelerating CrowdStrike’s efforts to “eliminate gaps in legacy privilege models.”

📈 Intel Jumps 11% After Trump Says $9 Billion in Federal Grants Will Convert Into a 10% Equity Stake

Intel ($INTC) shares surged +11% after President Trump said the U.S. government’s federal support for Intel would convert into a 10% equity stake, lifting the stock to near two-year highs.

The US is set to invest ~$9B in Intel, funded by previously awarded CHIPS Act and Secure Enclave grants, in exchange for a 10% passive stake, with no board seats or control rights.

This federal equity move effectively converts government grants into ownership, signaling strong political backing for U.S. chip manufacturing.

The market’s reaction reflects optimism among investors that Trump’s support may accelerate Intel’s domestic manufacturing and AI-chip ambitions, even amid broader industry competition and dilution concerns.

Harvest ETFs Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The Funds pay distributions to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested available Class units/shares of the Fund. If the Funds earn less than the amounts distributed, the difference is a return of capital. Tax investment and all other decisions should be made with guidance from a qualified professional.