- The Weekly Buzz 🐝 by Blossom

- Posts

- 🇻🇪 Venezuela Stock Market Doubles After US Invades - Should You Invest? (US)

🇻🇪 Venezuela Stock Market Doubles After US Invades - Should You Invest? (US)

Plus, Nvidia annouces 'ChatGPT Moment' for Self-Driving Cars...

TOP STORY

🛢️ Venezuela Stock Market Doubles After US Invades

👀 The first full week of trading turned out to be very interesting…

👷♀️ On one hand, the US jobs report reported only 50,000 new jobs in December, well below the 73,000 expected, making 2025 the worst year of hiring since 2020.

👩⚖️ The long-awaited tariff ruling from the US Supreme Court was also postponed, causing retail stocks to fall.

📈 But despite this bad news, the stock market soared:

The S&P 500 rose 1.57%

The Nasdaq 100 rose 2.22%

The TSX rose +2.29%

✨ Why? Well, one reason is rising optimism about the economy, with consumer sentiment inching higher and Trump instructing Fannie Mae and Freddie Mac to buy $200B in mortgage bonds, causing mortgage rates to fall.

😮 But perhaps the bigger and more surprising reason was last weekend, the US launched a military strike on Venezuela, capturing the President, and saying that America would run the country and have American oil and gas companies “spend at least $100B of their own money to rebuild the capacity and the infrastructure necessary”.

😳 I certainly didn’t have that on my 2026 bingo card…

✅ Usually, wars and geopolitical uncertainty cause markets to fall, but in this case, the market clearly viewed it as a positive, with markets betting that a more stable Venezuela will benefit the US markets.

🚨 The news also sent Latin American stocks into a frenzy, with the Venezuela Stock Market Index jumping +169% and drove US Oil stocks like Chevron ($CVX) and Halliburton ($HAL) up around +4% and 10% respectively.

🔍 So let’s break down the full story, take a look at what this means for Venezuela and oil stocks, and see whether there are any interesting investment opportunities that have come out of this chaos…

🤔 Why Venezuelan Oil Matters So Much to America

🏆 For decades, Venezuela was a top oil producer, with a peak production of 3.5 million barrels per day (bpd). Its oil industry thrived with help from American companies such as ExxonMobil ($XOM) and ConocoPhillips ($COP) investing billions in building up infrastructure and know-how.

⚖️ But in 1976, Venezuela nationalized its oil industry under a single company, and starting in the 2000s, forced foreign investors to give up control of their assets in the country. This led to billions in losses for American companies (~$17 billion in asset and investment loss).

📉 Since the 2000s, Oil production has fallen to 1/3 of its peak to ~1 million barrels per day. This hurt the US, driving up oil prices as supply fell.

🛢️ But with the US taking over, many believe production could ramp back up quickly:

“Industry estimates suggest production could recover toward 2 million barrels per day within one to two years under favourable conditions.”

🤔 So, should we be investing in Venezuela? Or US Oil stocks that stand to benefit from the ramp back up in oil production?

Before I answer that, a quick word from this week’s sponsor, XTrackers!

🇨🇴 P.S. Fun Fact, I’m actually writing this from Colombia where I am working remotely to escape the Toronto winter for a few months. Fingers crossed there are no invasions here 🤞 😅

PRESENTED BY XTRACKERS

🤖 Invest in the Architects of AI’s Future

📊 The Xtrackers Artificial Intelligence and Big Data ETF (XAIX) provides investors with targeted exposure to global companies at the forefront of artificial intelligence, machine learning, and advanced data analytics.

📈 XAIX doesn’t just follow trends, it proactively analyzes millions of newly approved patents, uncovering the firms that are pioneering AI innovation at its core, not merely riding its coattails.

📚 From established leaders to specialized firms building deep-learning tools, XAIX captures the full spectrum of companies turning AI innovation into business impact.

🏗️ If AI is shaping the future, XAIX is your opportunity to invest in the builders behind it.

Discover XAIX and start investing in tomorrow’s AI leaders today.

*See Xtrackers Disclaimer at the end of the newsletter

TOP STORY CONTINUED

🤑 So, Should You Invest in Venezuela or Oil Stocks?

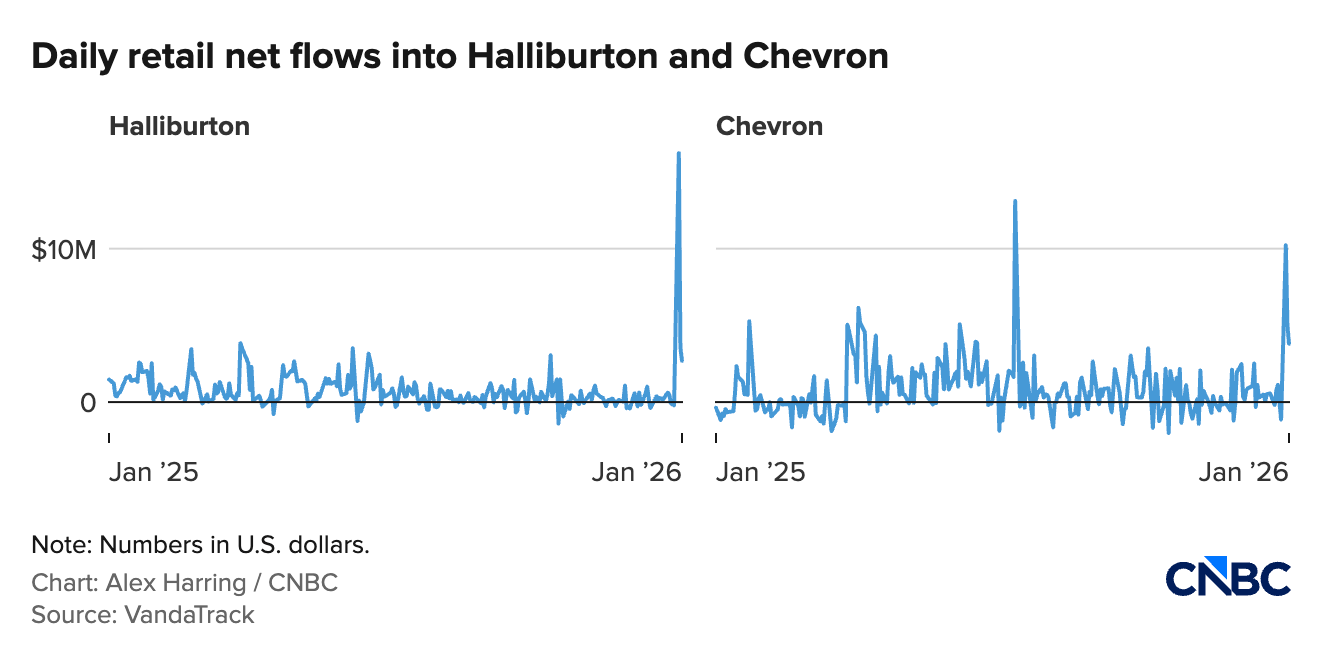

💰 With all the news swirling around Venezuela, many retail investors started investing heavily in energy stocks that could profit from the shake-up.

📈 Halliburton ($HAL), an oil service company that would benefit from rebuilding Venezuela’s oil infrastructure, jumped 11% and saw its largest inflows from retail investors in the past 4 years.

🔍 Many investors also searched for Venezuela ETFs to benefit from the surging market, but unfortunately, no such ETF exists - yet. Teucrium, a US ETF provider, filed for the launch of the first Venezuela exposure ETF, so a way to invest in the market could be coming very soon.

🤔 But is all this just hype? Or is Venezuela a good long-term investment?

🐻 📉 The Bear Case

⭐️ We already talked about the best-case scenario: a credible political transition brings back US oil giants, potentially tripling output back to where it was a decade ago and boosting both US oil stocks and the Venezuela market as a whole.

👀 But that’s much easier said than done for a few reasons:

❌ Vice President Delcy Rodríguez, the new interim president, has publicly rejected U.S. control, adding significant political uncertainty

❌ Venezuela's oil infrastructure has been outdated for years. It’s estimated that over $100B in investments would be needed to bring production to its former highs of 4 million bpd within a decade.

❌ US oil producers have been burned in Venezuela before and are not eager to go back, with ExxonMobil CEO Darren Woods calling the country “uninvestable” in a recent meeting with Trump.

❌ According to the International Energy Agency, global oil was oversupplied by 3.8 million bpd in 2025, pushing down global oil prices to ~$60/barrel. The estimated breakeven price for producing Venezuelan oil is around $80/barrel.

❌ Venezuela defaulted on its debt in 2017 after failing to make payments on overseas bonds issued by both the government and its state-owned oil producer, making institutional investors hesitant to invest again.

🇻🇪 As you can see, there are still tons of hurdles ahead before Venezuela becomes a good investment and I personally will be steering clear of the Venezuela exposure ETF when it lists.

🎯 A Few Opportunities

👎 While I personally don’t think a Venezuela ETF or even US oil stocks like Chevron are great investments right now, there are a few areas that might have some opportunity:

🛡️ Stephen Dover, CFA, the head of Franklin Templeton Institute, believes defense stocks stand to benefit as Trump has “reinforced the perception that the US is willing to act unilaterally and to use force.” (i.e. stocks like Lockheed Martin $LMT, which jumped +9% this week)

🇨🇦 Canadian Oil stocks like Enbridge ($ENB) fell -4% this week on the news, which may be an overreaction.

🇧🇷 🇨🇴 🇲🇽 A more stable Venezuela could be a bonus for the whole Latin America region’s economy in the long run, which could benefit ETFs like iShares Latin American 40 ($ILF)

⚠️ But if you do plan to invest based on the news, keep in mind that the political situation is still very uncertain and definitely carries a high degree a risk!

👴 All right, before we cover a few other top headlines this week, a quick word from our other sponsor this week Public!

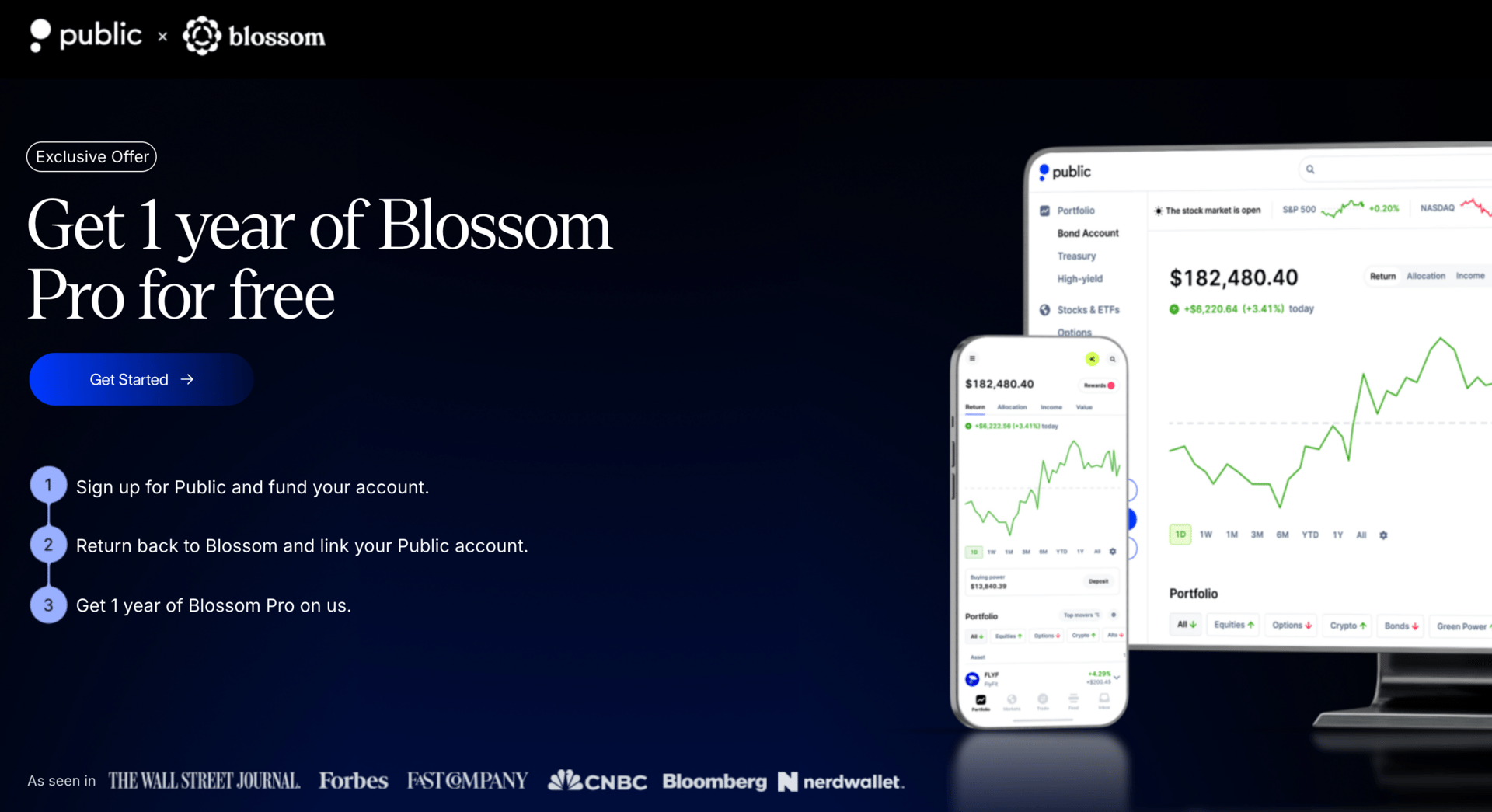

IN PARTNERSHIP WITH PUBLIC

🎁 Sign up for Public and Get Free Blossom PRO Access!

🔥 Did you know that through our partnership with Public, if you sign up for a Public account and connect it to Blossom, you unlock Blossom Pro for free?

💸 On top of that Public also has some of the best yields in the market, with a High-Yield cash account of 3.3%, a Bond Account of 5.5%, and a 1% IRA match!

⭐️ The app is also jam-packed with useful features like ‘Key Moments’, which share AI-generated summaries on the reasons behind every major stock price movement.

😎 If you haven’t signed up already, definitely check them out!

ALSO IN THE NEWS

🗞️ Other Top Headlines This Week

🚗 Nvidia Announces the ‘ChatGPT Moment’ for Self-Driving Cars, Taking on Tesla

Nvidia ($NVDA) unveiled its end-to-end autonomous driving platform, calling it the “ChatGPT moment for self-driving,” as large AI models begin to handle perception, planning, and driving decisions together.

CEO Jensen Huang said autonomous vehicles are reaching an inflection point where “the entire AV stack can now be trained like a foundation model,” similar to how ChatGPT changed natural language AI.

Nvidia’s Drive Thor and new generative AI software aim to let automakers train self-driving systems using massive simulated data, directly challenging Tesla’s ($TSLA) camera-only, in-house Full Self-Driving approach.

Unlike Tesla, Nvidia is positioning itself as the picks-and-shovels provider, selling chips and software to multiple automakers, including Mercedes-Benz, Volvo, and BYD, expanding its $5B+ automotive revenue pipeline.

🔐 Crowdstrike Jumps 4% After Acquiring SGNL to “Transform Identity Security for the AI Era”

CrowdStrike ($CRWD) agreed to buy identity-security startup SGNL for $740 million in a cash and stock deal, aiming to add real-time, continuous access control to its Falcon platform.

SGNL’s tech continuously grants and revokes access based on real-time risk signals, replacing static privileges for human, non-human, and AI identities, a growing cybersecurity priority.

CRWD shares jumped +4% on the news, as investors see the move as a meaningful expansion beyond endpoint into dynamic identity protection.

Management says integration will preserve SGNL’s team and is expected to close in Q1 of Fiscal 2027, accelerating CrowdStrike’s efforts to “eliminate gaps in legacy privilege models.”

📈 Intel Jumps 11% After Trump Says $9 Billion in Federal Grants Will Convert Into a 10% Equity Stake

Intel ($INTC) shares surged +11% after President Trump said the U.S. government’s federal support for Intel would convert into a 10% equity stake, lifting the stock to near two-year highs.

The US is set to invest ~$9B in Intel, funded by previously awarded CHIPS Act and Secure Enclave grants, in exchange for a 10% passive stake, with no board seats or control rights.

This federal equity move effectively converts government grants into ownership, signaling strong political backing for U.S. chip manufacturing.

The market’s reaction reflects optimism among investors that Trump’s support may accelerate Intel’s domestic manufacturing and AI-chip ambitions, even amid broader industry competition and dilution concerns.

Xtrackers Important Disclosures

All investments involve risk, including loss of principal. Information on the fund’s investment objectives, risk factors, charges, and expenses can be found in the fund’s prospectus at Xtrackers.com. Read it carefully before investing.

For current holdings and more info Xtrackers Artificial Intelligence and Big Data ETF | XAIX. Distributed by ALPS Distributors, Inc.

© 2026 DWS Group GmbH & Co. KGaA. All rights reserved. 108692-1 (1/26) DBX007086 (1/27)