- The Weekly Buzz 🐝 by Blossom

- Posts

- 📈 2025 Stock Market Rewind (US)

📈 2025 Stock Market Rewind (US)

The top 7 stories of 2025 and what analysts are prediciting for 2026...

TOP STORY

📈 Stock Market Rewind: The 7 Top Stories of 2025

🎄 Merry Christmas and an early Happy New Year everyone! I hope you had a restful holiday break with your family and loved ones! 😊

🎆 With 2026 just around the corner, rather than my typical deep dive into the top stories of the week, I want to pause to look back at the rollercoaster of a year we’ve had with a ‘Stock Market Rewind,’ breaking down the top 7 defining stories of 2025…

🥁 But first, let’s take a look at how the markets performed this year:

🇺🇸 S&P 500: +18.1%

🤖 Nasdaq 100: +22.3%

🍁 TSX: +28.5%

🪙 Bitcoin: -10.9%

✨ Overall, an incredible year, continuing the amazing momentum we’ve had since 2023, when the market climbed 24.2%, and last year, when the market climbed 23.3%. Not too shabby considering the average return of the S&P over the past 50 years is only ~12%.

🏆 And while the stock market was flying high this year, a different asset class flew even higher: gold and silver.

👑 Gold and Silver had one of their best years ever, with gold prices jumping +73% and silver jumping 174%, the biggest gains for the minerals in the past 40 years. Investors holding Gold ETFs like $GLD or Silver ETFs like $SLV are ending the year with a big smile on their face.

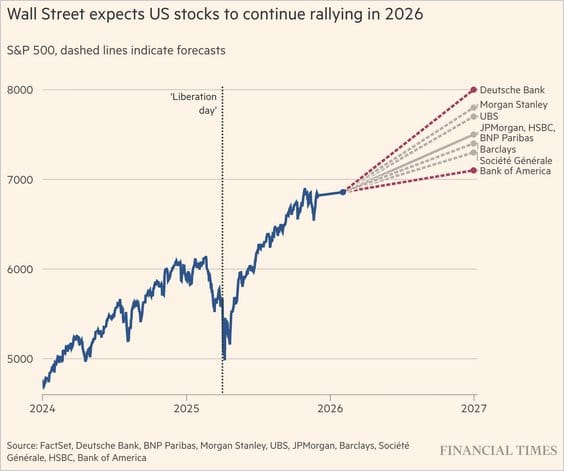

🔮 So what does the market have in store for us next year? Well, analysts are projecting another solid year, with an average forecast of ~8-12% growth, citing ‘continued strength in AI investment.’

😅 But it’s worth noting analysts are notoriously bad at predicting the future. This year for instance, the average forecast was for only ~11% growth. 2024 was even worse, with analysts predicting only 5-7% growth when the market returned over 24%.

🎆 So rather than focus on trying to predict the future, let’s take a look back at the top stories this year and what we can learn from them as we kick off the new year!

1) 🐳 Deep Seek Drives Panic, Crashing Nvidia 17%

😰 This one may feel like ancient history, but our first big story of 2025 was the panic driven by DeepSeek.

📉 Overnight, Nvidia ($NVDA) crashed 17% and took the whole AI market down with it after the Chinese competitor to OpenAI released its R1 AI model and claimed it spent just $6M training it, calling into question the billions being spent on Nvidia GPUs.

😬 Nvidia would continue to sink right up until the April ‘Liberation Day,’ falling -30% before turning around and soaring nearly 100% in the last 8 months of the year.

💡 The important lesson from this one is really just not to panic. What seemed like the end of the world back in January is barely even talked about today, and the fears were wildly overblown…

In fact, it would later turn out that DeepSeek’s claims about it’s $6M spending were false, and that DeepSeek likely used 50,000+ Nvidia chips to build the model, but couldn’t disclose this as it violated US export controls

😱 And speaking of overblown fears - the next story on our rewind is April’s Liberation Day, which drove even more fear in the markets… but first, a quick word from this week’s sponsor, Quantify Funds!

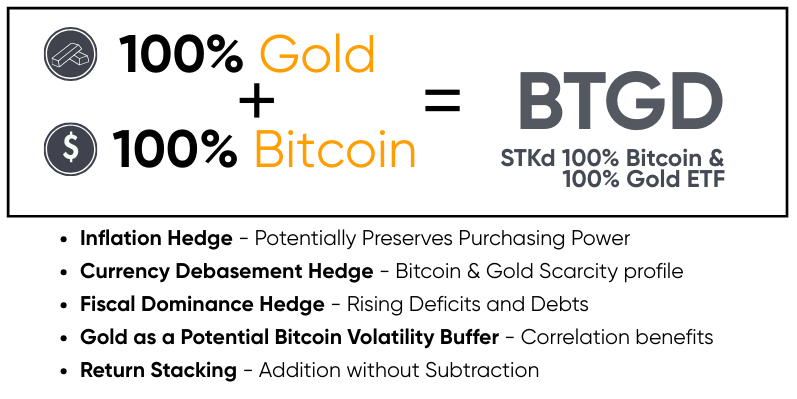

PRESENTED BY QUANTIFY FUNDS

🏅Bitcoin & Gold Exposure without Sacrificing One for the Other

🚀 2x Leveraged & Stacked Exposure to Digital and Physical Scarcity

🪙 Governments and central banks can't print Bitcoin or Gold. The U.S. left the gold standard in 1971. Since then, the world has leveraged almost every asset imaginable.

💵 The likely outcome of a future recession is even more printing.

The Fund does not invest directly in Bitcoin or any other digital assets. BTGD does not invest directly in gold or gold bullion. The fund uses leverage to "stack" the total return of holdings in the Fund's Bitcoin strategy together with the total return of holdings in the Fund's Gold strategy.

TOP STORIES OF 2025

📈 Stock Market Rewind Continued

2) 💥 April’s Liberation Day Tariffs Crash the Market

😳 If DeepSeek seems like ancient history, this story feels like it happened yesterday… on April 2, 2025, Trump announced a ton of surprise tariffs, leading to the worst 5 days in the stock market since the COVID crash in 2020 (with the S&P 500 falling 12%)

🫣 Even more than DeepSeek, this drove panic across the market, as investors feared the worst. But like DeepSeek, with the power of hindsight, we can now see the fears were overblown, and the market has since climbed over 39% since then to all-time highs.

📉 But while the market has recovered, the tariffs did have a real impact on certain stocks. Back in April, I wrote about how investors should not just blindly buy the dip, but first try to understand whether the dip was justified, using the example of Nike and Lululemon as companies that would be hit particularly hard by the tariffs.

Turns out I was right, with Nike ($NKE) ending the year down -27% and Lululemon ($LULU) ending the year down -50%, with tariffs playing a big role in the decline.

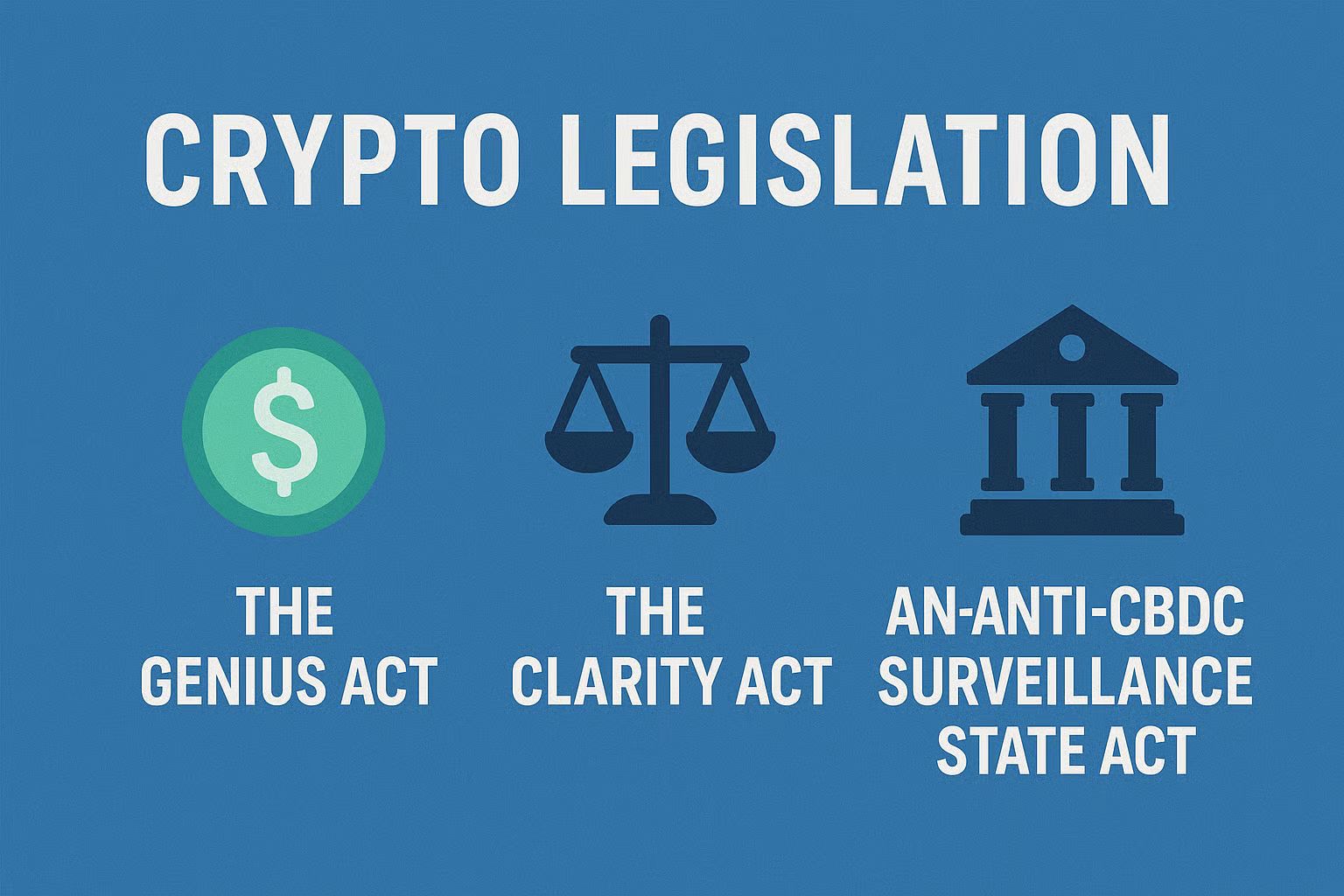

3) 🎢 The Crypto Regulation Rollercoaster

🪙 While the whole market had a bit of a rollercoaster this year with DeepSeek and Liberation Day, it was nothing compared to Crypto.

From January to April, Bitcoin fell -26%

From April to October, it soared +53%

And from October to today, it’s fallen -27%, ending the year down -18% year-to-date

🤯 But even those swings pale in comparison to stocks and cryptos like Microstrategy, Coinbase, Ethereum, and especially Circle, which soared over 600% shortly after its IPO, before falling 70% and erasing all the gains.

🏆 The reason for all this madness? Pro-crypto regulation, which legitimized stablecoins and classified crypto ‘without individual control’ as commodities… a huge win for the crypto ecosystem that drove a massive rally.

😭 Then, in around October, fortunes for crypto investors took a sharp turn when a flash crash destroyed a ton of highly leveraged traders, wiping out $19B in just 24 hours, after Trump reignited a trade war with China, prompting a wave of panic selling that snowballed out of control.

💡 The lesson I took away from all this is that in the long run, stocks generally return to fundamentals.

After Circle’s ($CRCL) massive rise, there was a time when the stock price made no sense. Circle had a 50% revenue share with Coinbase, but after the surge, Circle was trading at nearly the same valuation, despite Coinbase having nearly 4x the revenue.

Likewise, Microstrategy ($MSTR) was trading at 2.4x the value of its Bitcoin, and a big reason for its crash was this massive premium (which many argued also made no sense), going away.

🚩 To me, these serve as good case studies of red flags that a fundamental investor could notice to avoid getting swept up in the hype.

🤷♂️ As for where the crypto markets will go in 2026, the market definitely has some challenges ahead, with some saying crypto may be entering another ‘crypto winter’. According to CoinDesk, the crypto market is facing big headwinds after MSCI (the second-largest index provider) signalled that it will reconsider how DATs (which drive a lot of automatic crypto buying through ‘index inclusion’) are treated in their indices. Still others think another bull run is just around the corner.

🧐 This is all a bit too complex to cover today, so if you want to dive deeper, check out CoinDesk’s article here.

🤿 All right, 3 down, 4 to go. But before we jump into our last 4 big stories of the year, a quick word from our other sponsor this week Fiscal AI!other sponsor today Vanguard!

IN PARTNERSHIP WITH FISCAL AI

🔍 Research Stocks Like a Pro

🤑 Fiscal.ai is the complete stock research platform for fundamental investors.

📊 With comprehensive data on more than 100,000 stocks, Fiscal has everything you need to track and manage your investments.

💸 From standard financial metrics like revenue and earnings per share, to company-specific metrics like Google’s Cloud Revenue or Tesla’s Deliveries, Fiscal.ai tracks everything so you don't have to.

💡 Fiscal.ai also provides conference call transcripts, custom dashboards (with portfolio news/notifications), Super Investor Holdings, and much more!

TOP STORIES OF 2025

📈 Stock Market Rewind Continued

4) 🔄 Google’s Incredible Turnaround

🏆 All right, time to shift gears from some of the macro stories and zero in on a few stocks that crushed it in 2025 and deserve a section of their own.

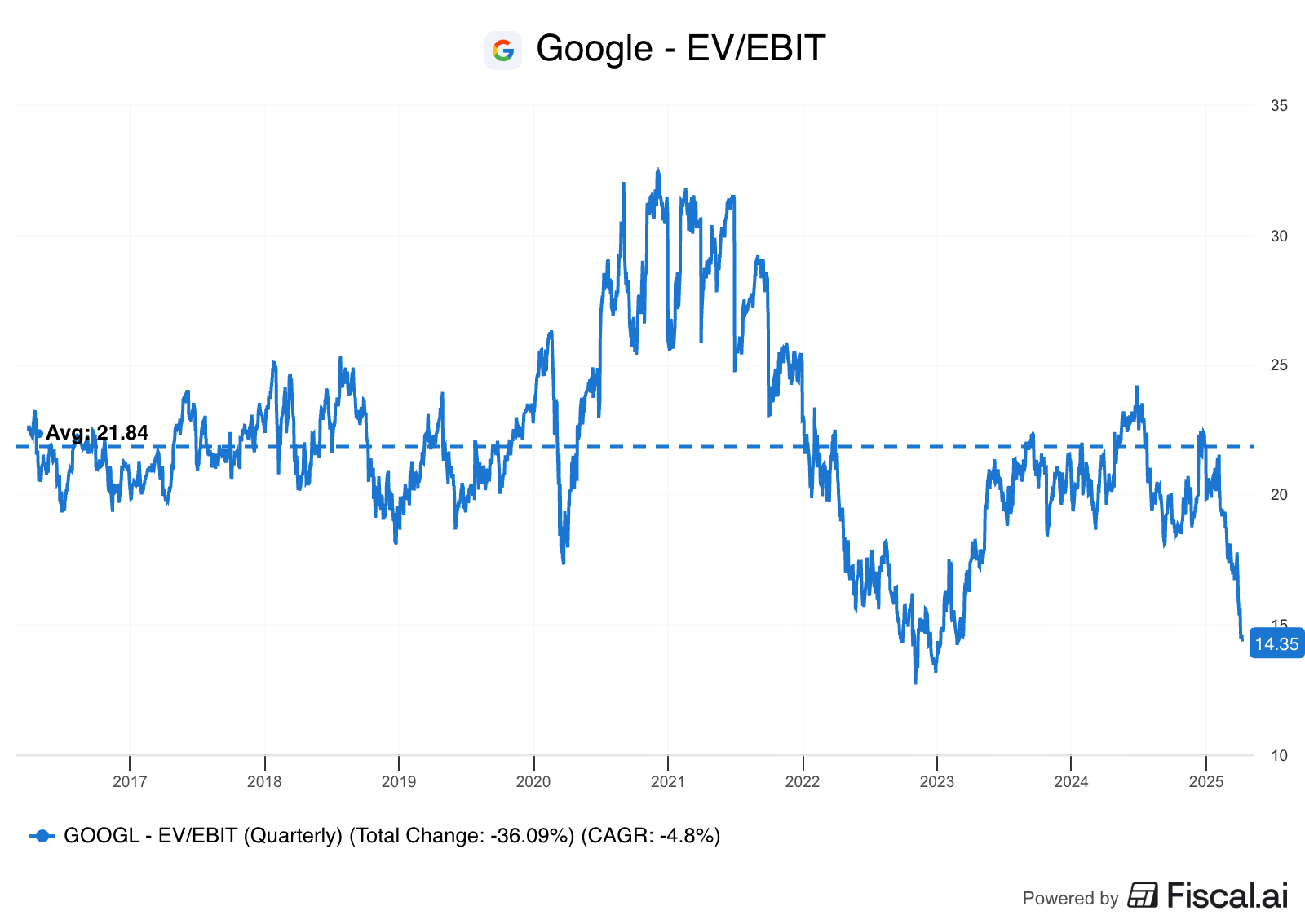

😵 Google ($GOOGL) was a stock many had started to write off. From January to May, the stock fell by over 20%, and was trading at decade low valuations, as many feared that the company’s search business would be replaced by LLMs like ChatGPT.

😬 The company's EV/EBIT ratio (which is a good measure of valuation) had fallen to 14x… essentially pricing them as a legacy tech business.

📈 But across the second half of the year, Google pulled off a remarkable turnaround (as we covered last month), soaring 106% and emerging as the only vertically integrated AI player.

5) 🚀 Palantir’s Meteoric Rise

😮 Speaking of remarkable, another stock that easily makes the list of top stories of 2025 is Palantir ($PLTR).

🤑 Soaring a massive +151% this year, and now up over +1000% in the past two years, the stock has made many investors a LOT of money, and made many experts scratch their heads in disbelief.

🏔️ The company now trades at a forward price-earnings ratio (a measure of how ‘expensive’ a stock is) of 189x, over 7x higher than Nvidia, with many saying the stock had reached ‘Mount Everest valuations.’

👎 The stock has also attracted a ton of haters, with Michael Burry (made famous by his ‘Big Short’ of the housing market in 2008) taking out a ~$1B bet against the company. But despite the detractors, the company has continued to climb.

⚠️ That said, it’s important to note that the stock has become extremely speculative, so proceed with caution if you’re feeling FOMO of the stocks massive gains this year.

6) 🏦 The Banks Have Been Crushing It

💸 It’s maybe not too surprising that some tech stocks like Google and Palantir have outperformed the market, but outside of tech, another sector has been quietly crushing it this year: Banks.

😮 While Nvidia climbed 38% this year, $TD (Canada’s 2nd largest bank) soared an incredible 69%. US Banks like JPMorgan ($JPM) also climbed 37%.

💰 The reason? An incredible surge in capital markets revenues, driven by trading volume, AUM advisory fees, and underwriting for M&A. As the markets rebounded since April, the banks directly benefited as investment portfolios increased and dealmaking ramped back up.

✨ A great reminder that there are big pockets of value in other sectors of the market, not just big tech, and it can pay to be diversified!

7) 🫧 AI Jitters to End Off the Year

🫧 Last but not least, an overarching theme of the year (and especially the last few months) has been the big question of ‘are we in a bubble’. A few big arguments have driven the fear:

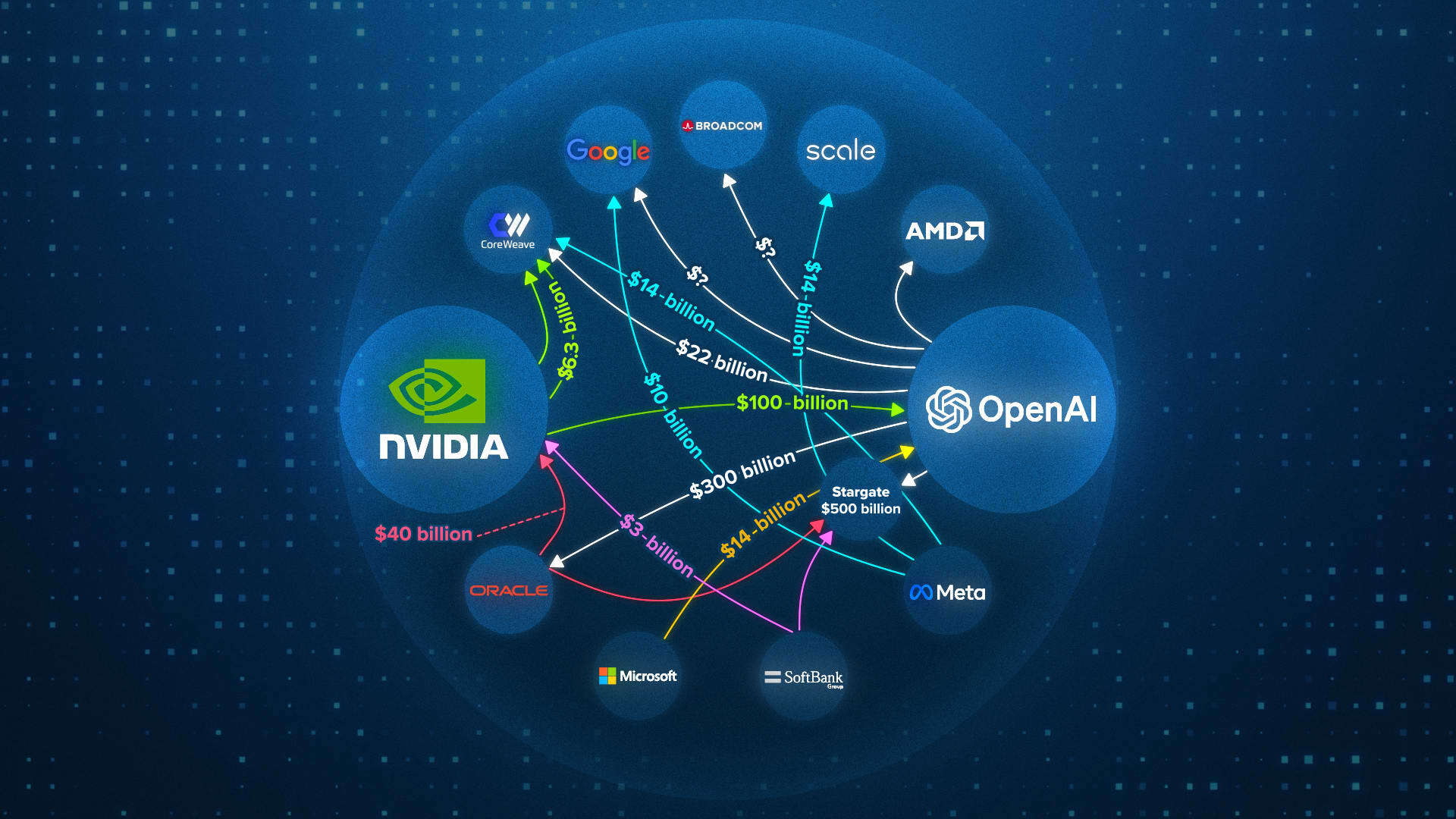

Circular deals between Nvidia, OpenAI, and other players (which to some are reminiscent of similar deals in the run-up to the 2000 dot-com bubble)

Big Tech’s growing use of debt to finance AI spending

Increasing scrutiny on the ROI of AI investments (with Meta in particular falling in the crosshairs)

😰 All this plunged the market into a state of Extreme Fear for a few months, but the market has seemed to get over most of these jitters and is back to a state of ‘greed’ according to the Fear/Greed index.

❓ As we enter into the New Year, no doubt this will continue to be the big question of the year. AI has completely dominated the market for the past 3 years, contributing to the amazing gains we’ve seen while also increasing the risk, as even diversified indexes like the S&P 500 are becoming increasingly dependent on the AI rocketship to continue.

📊 As for me, I’ve been slowly diversifying outside of the S&P 500 by investing in specific sectors like Healthcare, Emerging Markets, and Fixed Income… and as you’re setting your 2026 resolutions, I encourage you to also take some time to evaluate your own portfolio and make sure it’s matching your risk tolerance, time horizons, and goals!

🐝 And that’s a wrap! What a year it’s been. A huge thank you to everyone who’s tuned into the Weekly Buzz. I hope you’ve enjoyed reading as much as I’ve enjoyed writing! 😊

🎆 I hope you all have an incredible New Year, and I’ll see you in 2026, when there’ll no doubt be more big stock market stories to cover 🫡

🎁 P.S. As a thank you for reading to the end, the first 10 people who reply to this email will receive a small gift!