- The Weekly Buzz 🐝 by Blossom

- Posts

- 💰 Meta to Spend Billions on Google Chips, Threatening Nvidia's Dominance

💰 Meta to Spend Billions on Google Chips, Threatening Nvidia's Dominance

Plus, a breakdown of Google's remarkable AI turnaround...

TOP STORY

🚀 Google Rises 7% After Reports of Meta Chip Deal

😰 Last week the market sank as Nvidia fell 10% and the market got spooked by the rising debt levels of big tech (which we covered here)… with many investors worried that the tech bubble was starting to pop…

📈 Well this week, the markets rebounded sharply, giving us one of our best weeks so far in 2025:

The S&P 500 jumped +3.7%

The Nasdaq 100 jumped +4.9%

The TSX jumped +4%

🏦 One of the reasons for this was a jump in the likelihood of an interest rate cut, which at one point had fallen to just 50%, but investors now have at an 86% chance. A record-breaking Black Friday also drove optimism in a shaky economy.

🏆 But across the market, one stock stood out as the biggest winner this week: Alphabet $GOOG (aka Google), which jumped 7% after reports of a potential chip deal with Meta ($META).

🤝 In the deal, Meta would spend billions on Google’s TPUs, which Google previously used just for it’s own data centres.

💸 And while TPUs aren’t the same as Nvidia GPUs, they are very efficient at specific tasks and can cost up to 65% less than Nvidia GPUs while providing similar functionality for specific workloads… so while Google was soaring this week, Nvidia sank 2.3% this week, now down over 14% in November, as investors question whether this deal threatens Nvidia’s dominance.

⭐️ But before we dive into the potentially landmark deal, and how it may hurt Nvidia, let’s take a step back and talk about the incredible turnaround Google has had from the ‘laughing stock’ of the AI race to one of the front runners, and how they ended up here today...

✨ Google’s AI Turnaround

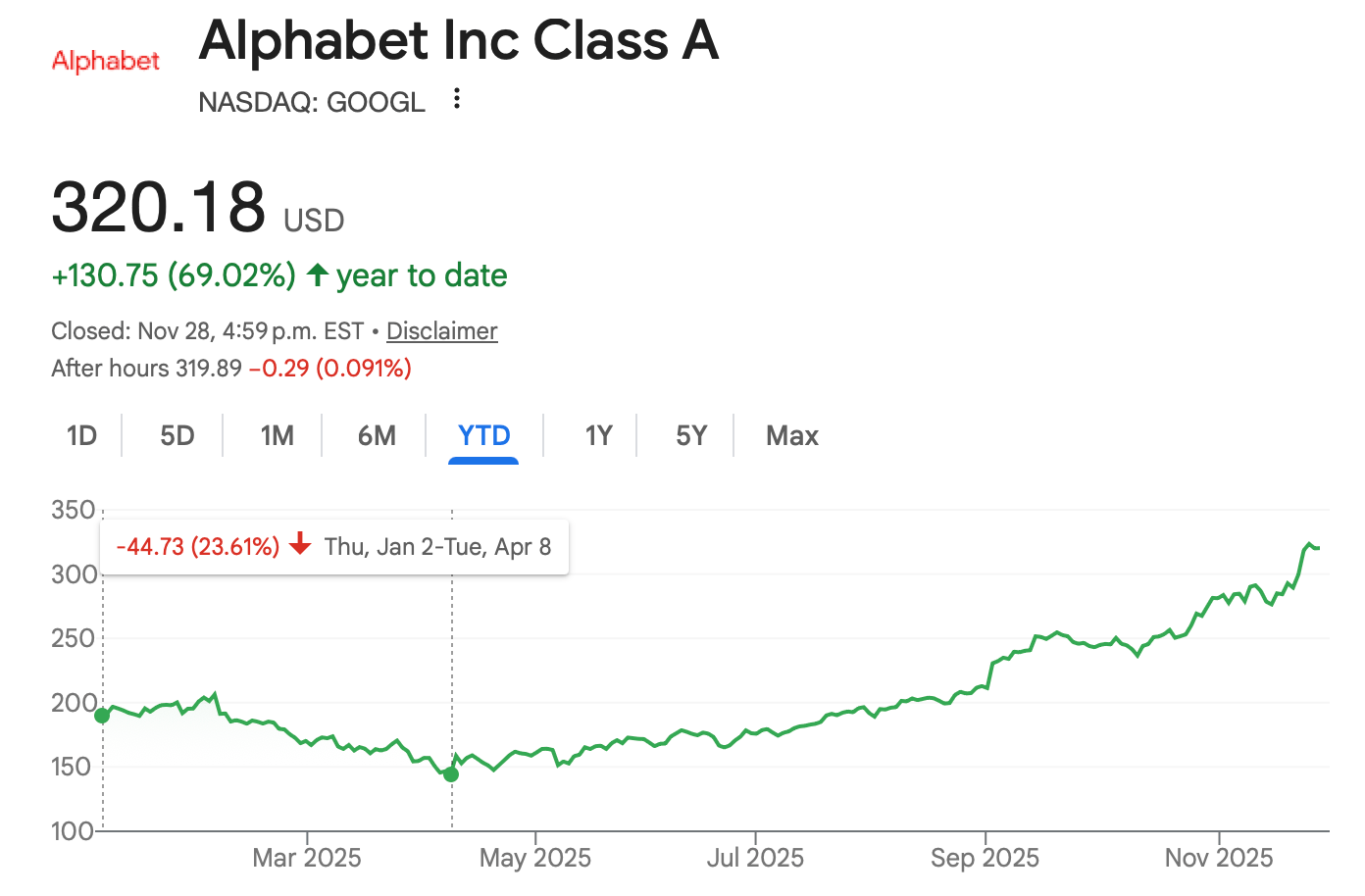

📉 Just seven months ago, Google was trading at near decade-low valuations with the stock dropping down to -23% year-to-date by April as investors worried their search business would be replaced by LLMs like ChatGPT.

🚨 Problems were everywhere: paid clicks were growing at their slowest rate on record, Apple came out saying that mobile search volume was declining for the first time ever, and even Google’s own AI launch became a bit of a laughing stock after making errors during it’s demo, leading investors to feel that it was falling behind in the AI-race.

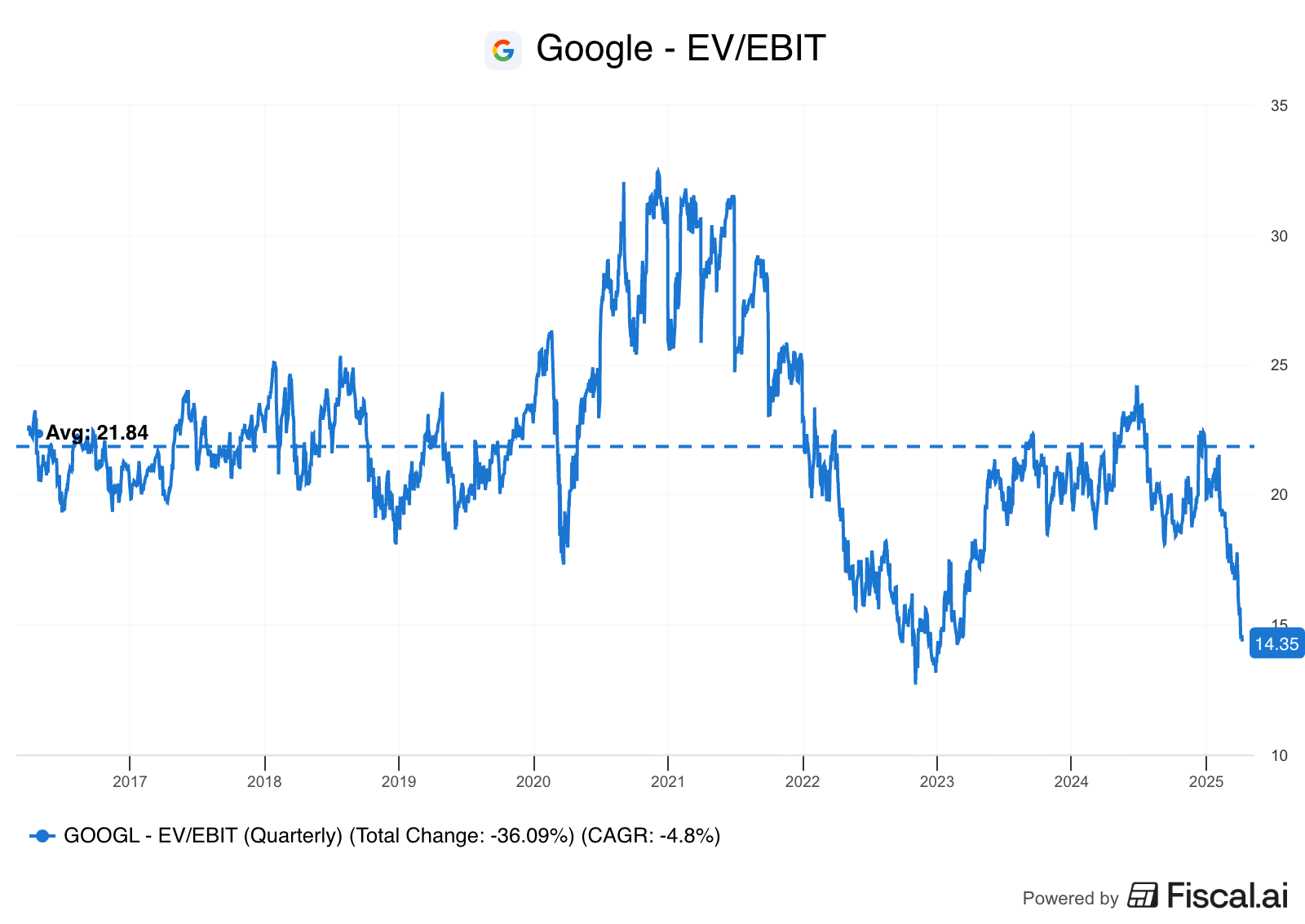

❌ Investors didn’t want to own Google. According to Fiscal AI (an awesome fundamental research tool Blossom has a partnership with), the EV/EBIT ratio (which is a good measure of valuation) had fallen to 14x… essentially pricing them as a legacy tech business.

🧠 But years of behind-the-scenes engineering work at Google DeepMind finally paid off, when in June, around the time of Google I/O 25, Google released Gemini 2.5, which put them on par with ChatGPT for the first time.

🔍 Google also started integrating Gemini into it’s search queries, leading to strong growth in it’s search business that eased fears of Google being replaced.

🚀 Since April, Google has soared an incredible 102%, rapidly shifting it’s narrative from an AI loser to an AI winner, and positioning itself as essentially the only vertically integrated player in the AI race.

📊 Google: The Only Vertically Integrated AI Player

🎯 What the market realized is that more than any other company, Google touches every layer of the AI value chain:

Hardware? It has TPUs, custom processing units highly specialized for AI workloads

Infrastructure to host and train AI? It has Google Cloud.

Foundational LLM models? It has Google DeepMind to develop and optimize Gemini

Data to train its AI with? It has a vast amount via Search, YouTube, Gmail and more.

🌐 Not to mention the many products Google owns that billions of people use on a daily basis, which Google can used to immediately capture value from its AI models (like with Search’s Gemini-integrated AI Overviews).

“Alphabet owns everything. They own the chips, they own best-in-class consumer data, they own the cloud.”

🏆 Google’s Gemini has also jumped to the lead in the AI model race, with it’s new launch of Gemini 3 Pro (trained entirely on TPUs), scored #1 overall in many core LLM categories such as reasoning and multimodal understanding:

💡 One of the key phrases there, which is shaking up the markets this week, is “trained entirely on TPUs”.

👀 This marks a MASSIVE shift, as previous frontier models often relied almost entirely on Nvidia GPUs.

🤿 So let’s dive into what this means for the AI players like Nvidia, and Broadcom, and why Meta is considering a deal with Google for its TMUs…

But first, a quick word from this week’s sponsor Vanguard.

SPONSORED BY VANGUARD

🧬 It’s in Our DNA to Take a Stand for All Investors

📣 We’re lowering the cost of investing. Again.

At Vanguard, we’re committed to doing what’s best for investors and today marks another step forward in that mission.

For the past 15 years, we have helped bring down the cost of investing to the tune of $200 million in savings passed on to Canadian investors through our fee reductions.

We focus on creating value for our clients, not extracting value from them. Every dollar saved in fees is a dollar that stays in an investor’s pocket. And that compounds over time. That’s why we’re excited to announce another significant reduction in our investment fees.

⭐️ Here’s what you need to know:

Lower Fees: We’ve cut the fees on one quarter of our lineup of ETFs and Mutual Funds, ensuring that more of your money stays in your pocket.

Immediate Impact: The changes take effect immediately, so you can start enjoying the savings right away.

Why now? We’re constantly evaluating our pricing and leveraging our global scale to drive operational efficiencies. These efficiencies allow us to reduce costs and pass the savings on to our investors, ensuring that you benefit from our ongoing commitment to lower the cost of investing.

TOP STORY CONT.

🤖 Why Meta Wants Google’s TPU Chips

💥 Since the start of the AI boom, Nvidia’s GPUs have been the dominant chips for training AI models… so when Meta announced that it was in talks to purchase billions of TPUs from Google, the news sent shockwaves through the AI chip sector:

Nvidia fell -2.3%

Broadcom ($AVGO), the company that co-designs and manufactures TPUs alongside Google, rose +18.5%

Google rose +6.9%

📅 According to the reports, Meta is considering deploying Google’s TPUs in its own data centres starting in 2027, with plans to rent the chips via Google Cloud as early as next year.

🎮 Nvidia’s $NVDA AI chips are what’s known as GPUs. GPUs are very powerful pieces of hardware originally made for high-performance games, but able to run rendering, scientific simulations, crypto mining, and anything involving intensive AI training or hosting.

⚡ TPUs, on the other hand, lack every feature a GPU has, except one: neural network math.

“GPUs can do a lot more, but for many current AI loads, TPU is like a bullet train. It only goes from one place to another, but if that's all you want to do, it's very fast.”

🧮 AI training needs data, whether pictures, videos, or text. But an AI model can’t learn like a human because it’s a computer. And computers learn with numbers. Neural network math is how you get those numbers.

🔢 All data trained on AI is really just images and text made into numbers, and TPUs were created with the strict goal of being very good at calculating and understanding those numbers.

💰 While this is an oversimplification, the point is: TPUs are very efficient at this one task, and as a result, can cost up to 65% less than Nvidia GPUs while providing similar functionality for specific workloads.

🔍 What Does This Mean for Nvidia

⚠️ The risk for Nvidia is if the big AI-spenders start to diversify away from their GPUs and use TPUs instead (even if just for some tasks), it could hurt demand for Nvidia’s GPUs. And as we saw last week, any crack in Nvidia’s earnings could really hurt the stock. According to Wall Street Journal:

“A significant deal with Meta would represent a potential crack in Nvidia’s market dominance for Google and other chip makers to exploit.”

📈 But according to Google, the massively accelerating AI spending is enough to drive up demand for both TPUs and GPUs, with a Google spokesperson saying:

“Google Cloud is experiencing accelerating demand for both our custom TPUs and Nvidia GPUs; we are committed to supporting both, as we have for years.”

💡 But even so, companies using TPUs is a direct threat to Nvidia’s dominance, and with Apple training it’s Apple Intelligence models on TPUs and AI start-up Anthropic signing a TPU deal as part of it’s multicloud strategy, it’s clear TPUs pose a risk to Nvidia’s 90% market share in chips.

🛡️ Nvidia’s Software Moat

Nvidia defended itself, saying:

“We’re delighted by Google’s success, they’ve made great advances in AI and we continue to supply to Google. Nvidia is a generation ahead of the industry, it’s the only platform that runs every AI model and does it everywhere computing is done.”

💽 What Nvidia is getting at is that it’s moat is not just in the hardware, but also in the software. Since 2004, Nvidia began building software known as CUDA which just about all AI researchers know how to use.

🤔 Google’s software in contrast, far fewer researchers know and understand as the technology is still very new. According to many analysts, CUDA is a high wall that will take some time to breach.

💡 My Thoughts

While I think Nvidia’s defence is strong, I also think Barron’s point that “nothing lasts forever” is quite compelling.

😰 It’s become almost taken for granted that Nvidia will continue to dominate, and continue to enjoy the crazy high gross margins of 73% that investors have come to expect. But with the AI spenders now having a real alternative to Nvidia GPUs, this could pose a real threat.

😳 Barrons uses Intel ($INTC) as an example, which dominated the data-centre market in 2021 with over 65% of the market, and has now dwindled to single digits as Nvidia took over.

⚠️ For investors bullish on AI, it’s an important reminder of the risks your taking on when your betting heavily on a single winner, and how quickly things can change in the very competitive AI race.

🧐 So if you’re heavily invested in Nvidia, this isn’t to say you should sell all your shares and buy Google or Broadcom instead, but you should definitely be researching this new development deeply and making sure you’re staying up to date with the shifting tides in the market and what it means for your investment!

🐝 For those new here, my name is Max, the CEO of Blossom, and I write the Weekly Buzz every week to keep you updated on what’s happening in the stock market! I hope you enjoy my weekly coverage of the markets as much as I enjoy writing it 😊 If you want to see what I’m investing in, make sure to follow me on Blossom or follow me on Instagram for weekly video news recaps!

SPONSORED BY QUESTRADE

☀️ The Dawn of Investing Has Arrived: See the New Questrade

The days of slow, complicated trading are over. At the Dawn of Investing event presented by Questrade, we unveiled a radical commitment to putting you in control of your financial outcomes—from daily trading to long-term wealth.

Active Trading, Reimagined: Experience Questrade Pro, the next-generation platform engineered to be 10x more efficient, with Automatic Pattern Finder, 1-second charts, and more.

Ultimate Control: Modify allocations to an existing index fund to create your own personalized basket of securities with Custom Indexing coming in 2026 ****and generate extra income with simplified Covered Calls.

New Asset Classes: We’re making it possible to trade physical gold with no annual fees (for a limited time) from Quest Metals, and will soon open the door to Private Markets access, an asset class previously locked away.

Every announcement—from Self-Managed Options to Cash-Secured Puts in registered accounts—is a deliberate step to help you outperform. See everything we’ve built for your success.

Ready for the next step? Open a Questrade account today and get a $50 bonus

Use the promo code ‘Blossom’ and get $50 when you open a new Questrade account (see terms and conditions here)

*This information is being provided to you for educational purposes only, and should not be used or construed as investment, tax or financial advice.