- The Weekly Buzz 🐝 by Blossom

- Posts

- 📈 Chip Stocks Soar Over 6% After Taiwan Semiconductor's Earnings (US)

📈 Chip Stocks Soar Over 6% After Taiwan Semiconductor's Earnings (US)

Plus, is the Federal Reserve's independence under threat? And US banks fall over 5% after Trump says he will cap interest rates...

TOP STORY

📈 Chip Stocks Soar Over 6% After Taiwan Semiconductor’s Earnings

🌪️ This week was another hectic one for investors as the world grappled with a tornado of head-rattling headlines coming out of Washington.

⚠️ From worries over the Fed’s independence, to heightened risk of military force in both Iran and Greenland… all only weeks after a U.S. military operation in Venezuela (which we covered last week)… there was certainly a lot for investors to digest.

📊 But despite all the craziness, the U.S. market gave up only some of its yearly gains. Across the indexes:

The S&P 500 fell -0.53%

The Nasdaq 100 fell -0.92%

🤿 Let’s dive into some of the headlines…

😱 Fed Chair Jerome Powell Releases a Shocking Video

😳 Perhaps the most shocking story this week was the Fed Chair Jerome Powell’s bombshell video stating that the Federal Reserve has been served Grand Jury subpoenas threatening a criminal indictment related to renovations to the Federal Reserve buildings that Trump says have gone “billions of dollars overbudget”.

But according to Powell, the threat is not about the renovations at all:

“This unprecedented action should be seen in the broader context of the administration’s threates and ongoing pressure. The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public.”

⚖️ In the US, the Federal Reserve acts independently of the government in setting interest rates. Basically, every government wants low interest rates, as this is good for the stock market and for the economy, but the Fed sometimes needs to keep interest rates higher to manage rising inflation.

🥊 Trump has been applying pressure on Powell to lower interest rates since coming into office, saying, “he is either incompetent or crooked” and that “he’s done a bad job. We should have lower rates.”

😱 Politics aside, the move is certainly a big shock to investors, with JP Morgan CEO Jamie Dimon saying:

“Everyone we know believes in Fed independence. Anything that chips away at that is probably not a great idea… In my view, it will have the reverse consequences, it will raise inflation expectations and probably increase rates over time.”

👀 Powell’s term expires in May, and many believe Hassett, the next frontrunner to replace Powell, could be much more politically motivated to lower rates, compared to the traditionally independent Fed chairs we’ve had in the past.

💸 The main impact this could have on investors is an accelerated schedule of interest rate drops, which could be good news for investors in the short-term, but in the long term, the loss of Fed independence could lead to higher inflation.

🌍 Adding to the storm, more geopolitical volatility arose this Friday after President Trump wrote on Truth Social that he may impose up to 25% tariffs on countries “if they don’t go along with allowing U.S. ownership of Greenland.”

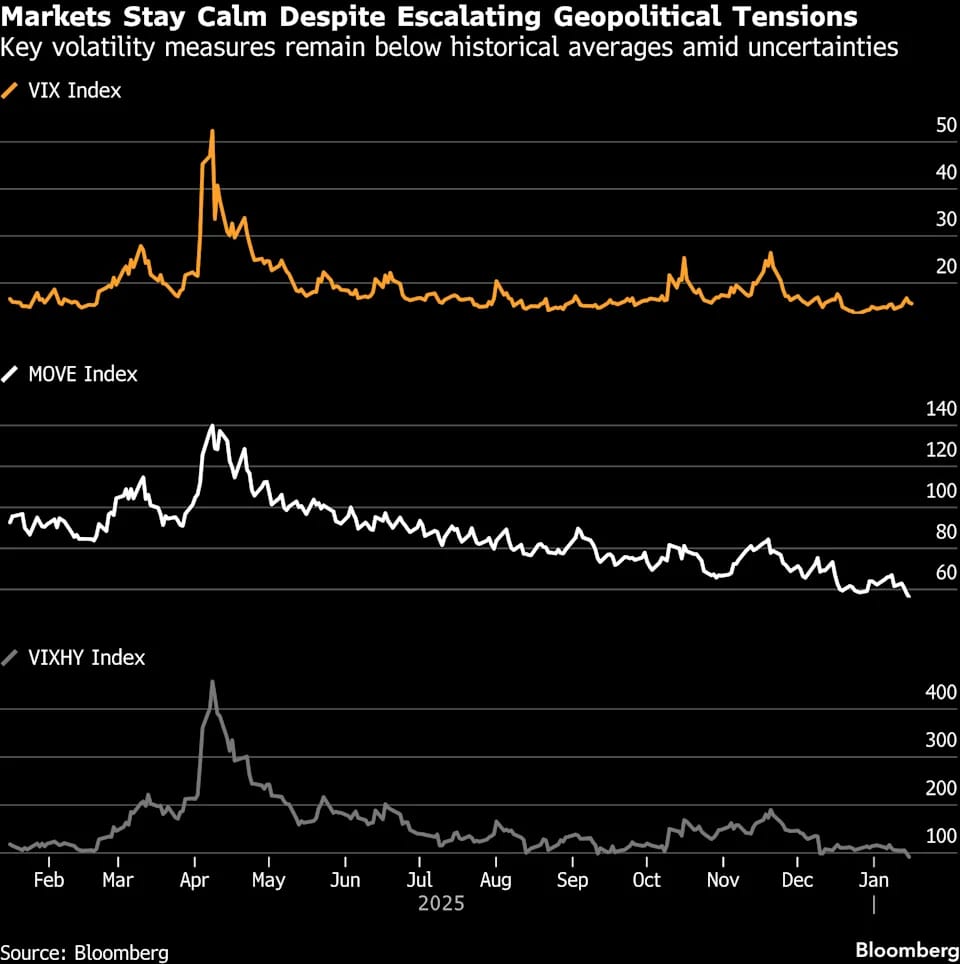

🧘♂️ Despite the Chaos, Investors Remained Calm

💸 But perhaps the most shocking thing this week wasn’t the headlines, but how little impact it had on the stock market:

Key volatility measures remained well below historical averages

January inflows are at 5x the average for the month

Cash allocations have dropped to record lows

🧘♂️ Investors have become almost immune to the shocking headlines, and so far that’s served them well:

“Investors have been so well-rewarded to ignore geopolitical risks that at this point, they will need to see something incredibly tangible to shake their confidence”

🫨 And while I agree panicking over the headlines is rarely a good idea, I think it’s still important to stay informed about them and understand the risks they add to the US market (which is partially why I’ve been diversifying to international ETFs).

👀 Now, with the shocking political headlines out of the way, let’s turn our attention to another big story this week (that may have been part of the reason the markets stayed so solid) - Taiwan Semiconductor’s incredible earnings report, and the broader rally across chip stocks like AMD and ASML!

😎 But before we cover that story, plus break down the rough week US Banks and Credit Card stocks had after Trump announced plans for an interest rate cap, a quick word from this week’s sponsor, Plynk!

PRESENTED BY PLYNK

📚 Browse nearly 2,000 ETFs with confidence on the Plynk app

⬆️ Ready to level up your diversification strategy? The Plynk app helps you do more than just trade. It provides intuitive tools and straightforward education to grow your investing knowledge, cut through the noise, and help you make your next move with confidence.

📊 With nearly 2,000 ETFs, the app makes it simple to explore categories to help you find what's right for you. Think of them as playlists where you can pick your genre. Here’s a preview:

🔁 Allocation: Blends of stocks and bonds.

⛽ Commodities: Direct exposure to physical goods like gold and oil.

🌎 International: Exposure to foreign companies.

💲Small, Mid, & Large-Cap: Organized based on market capitalization, from established giants to emerging companies.

⚕ Sector: Follows specific industries like tech or healthcare.

All about stocks? Those are categorized, too. Turn your interests into potential investments with themes including AI, dividends, fintech, gaming, and more.

Invest commission-free* and start discovering what drives you and the market all within a tool that helps you feel in control.

ETFs are subject to market fluctuation and the risks of their underlying investments, as well as management fees and other expenses. Digital Brokerage Services LLC (DBS), Member FINRA, SIPC. Blossom is a third party unaffiliated with DBS. DBS is responsible for the content of this advertisement only and does not endorse or guarantee the accuracy of any content provided by Blossom. *Other fees may apply. See brokerage fee schedule for details.

TOP STORY

📈 Taiwan Semiconductors Jumps 6% After Incredible Q4 Earnings

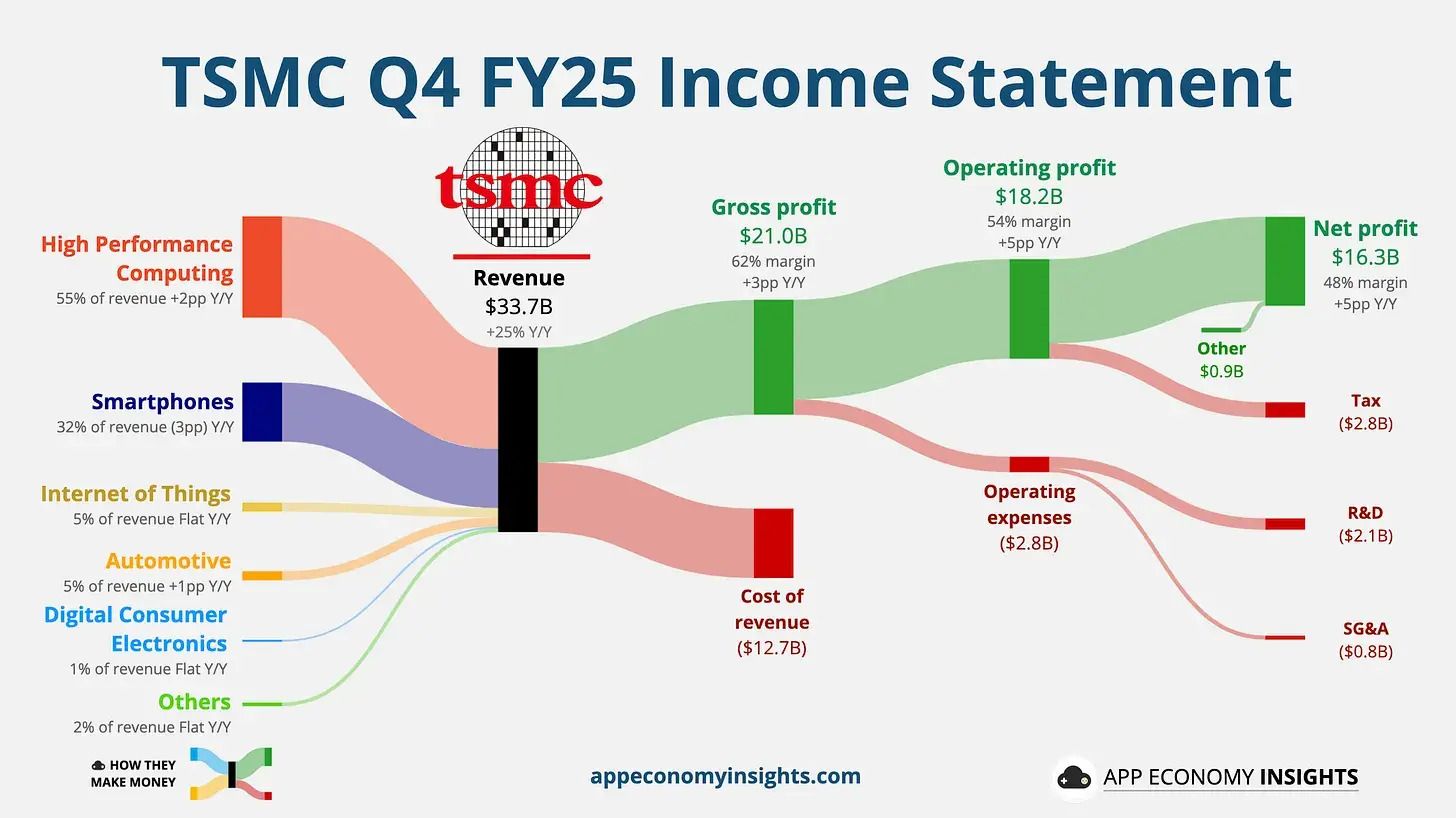

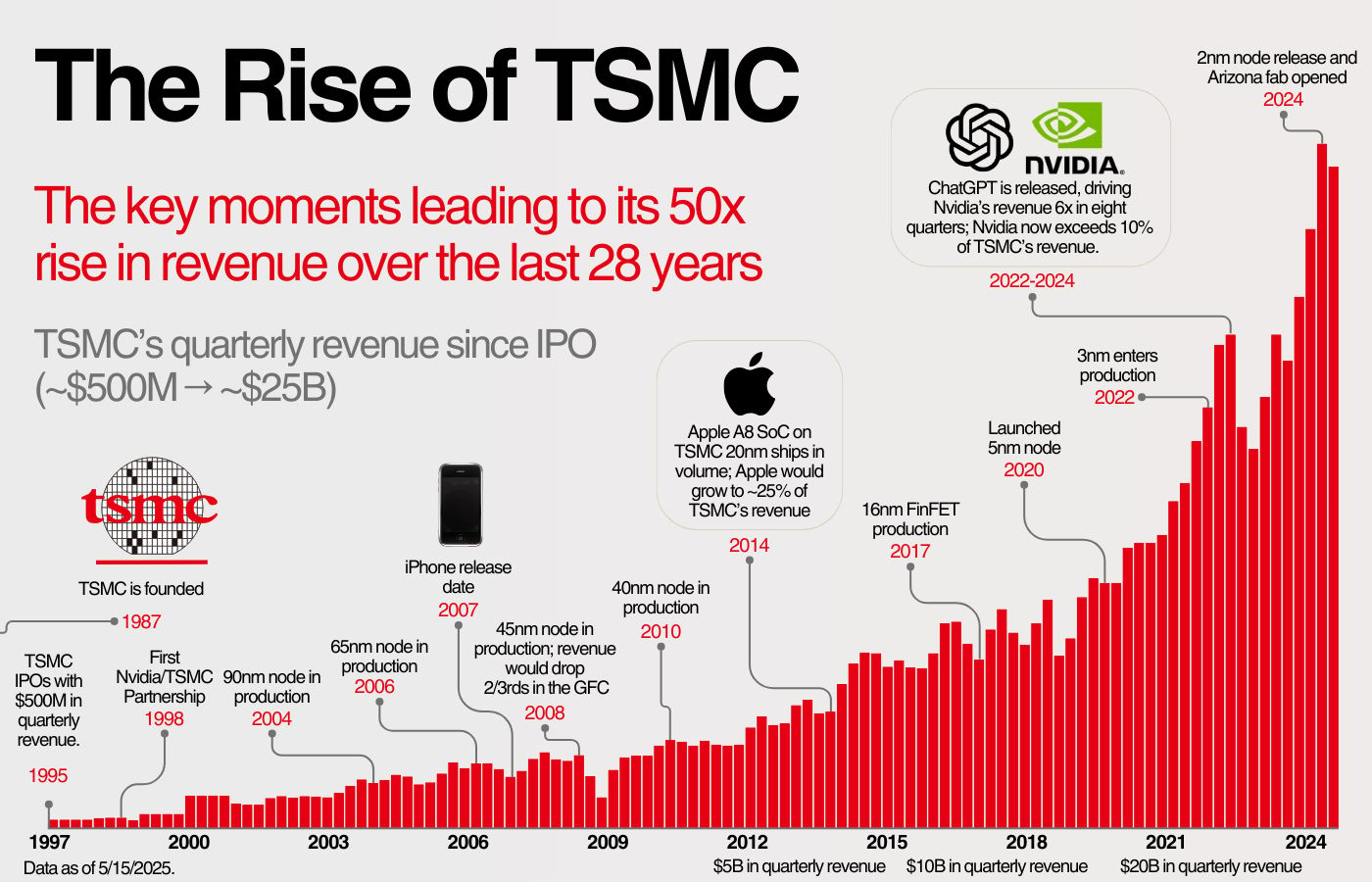

🏭 The king of the semiconductor industry, TSMC ($TSM), reported its Q4 FY 2025 earnings this week, smashing revenue and earnings estimates, and proving the AI spending spree isn’t slowing down as we begin 2026:

✅ Revenue hit $33.73 billion vs. $32.00 billion expected, up 25.5% year-over-year

✅ Earnings per share hit $3.14 vs $2.94 expected, up 42% year-over-year

🚀 Shares of TSMC ended the week up 6%, with Wendell Huang, Senior VP and CFO of TSMC, saying he expects “strong demand” for its products to continue into 2026.

🌊 Other stocks that stand to benefit from the sustained AI chip boom also surged, with $ASML climbing +8% and $AMD jumping +14%.

🤖 The AI Boom Continues

💰 TSMC expects to invest around $56 billion in growing production and expanding capacity in 2026, with plans for $58 billion in 2027. The bulk of this will help expand production lines for the company’s cutting-edge chips, mainly its 2-nanometer and 3-nanometer offerings.

🧠 TSMC’s 2-nanometer chips are the most advanced in the world, fitting billions more transistors than older 7nm or 10nm chips, making them essential for AI applications that need maximum performance. And they’re in high demand:

“The demand for AI remains very strong, driving overall chip demand across the entire server industry. With TSMC's ongoing 2nm capacity expansion and new production contributing to revenue... TSMC is expected to maintain strong performance in 2026.”

🗺️ Some of the expansions for new production lines will be outside of Taiwan in countries such as Japan, Germany, and America, which have lower geopolitical risk with China.

🇺🇸 On the U.S. side, manufacturing investment is part of a new U.S.-Taiwan trade agreement where TSMC has pledged to invest ~$100 billion into American manufacturing facilities (with $250 billion in total committed by Taiwanese tech firms).

🫧 Overall, this means concerns about a cooling AI boom seem overblown, at least for now. TSMC’s own management team is seeing accelerating demand, not slowing growth.

🎯 Analyst Reactions

📊 Wall Street firms came out swinging with bullish takes after the earnings report, with Bank of America, Needham, and Bernstein maintaining “Buy” ratings while raising price targets as high as $410 (21% above TSM’s current price).

✨ Many analysts pointed out that TSMC holds a growing lead over competitors like Samsung and Intel in advanced chip manufacturing, and that the company’s ability to consistently deliver better performance on cutting-edge offerings has made it the “indispensable” partner for chip designers worldwide.

🏦 All right, before we cover the other big story this week (US Banks falling after Trump’s comments about an interest rate cap on credit cards), a quick word from our other sponsor this week Public!

IN PARTNERSHIP WITH PUBLIC

🎁 Sign up for Public and Get Free Blossom PRO Access!

🔥 Did you know that through our partnership with Public, if you sign up for a Public account and connect it to Blossom, you unlock Blossom Pro for free?

💸 On top of that Public also has some of the best yields in the market, with a High-Yield cash account of 3.3%, a Bond Account of 5.5%, and a 1% IRA match!

⭐️ The app is also jam-packed with useful features like ‘Key Moments’, which share AI-generated summaries on the reasons behind every major stock price movement.

😎 If you haven’t signed up already, definitely check them out!

ALSO IN THE NEWS

🗞️ U.S. Banks Fall After Trump Annouces 10% Interest Rate Cap

🏦 The major U.S. banks also reported Q4 earnings this week, delivering excellent revenue and earnings growth:

✅ JPMorgan’s revenue jumped ~7%, with earnings per share rising ~9% year over year

✅ Bank of America revenue jumped ~7%, with earnings per share rising ~18% year over year

✅ Wells Fargo revenue jumped ~4%, with earnings per share rising ~17% year over year

🫣 But despite the strong earnings, shares tanked…

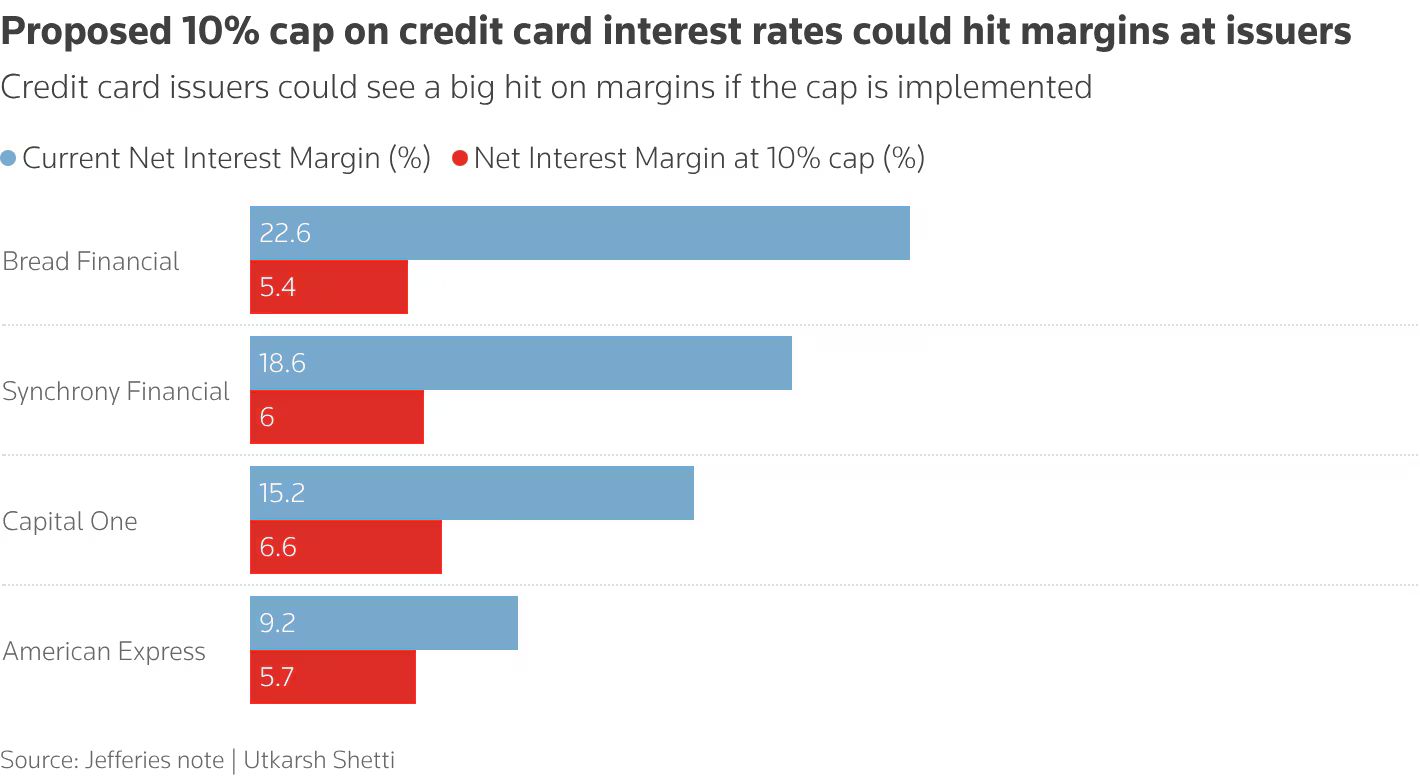

😰The issue wasn’t the earnings results, but President Trump’s surprise announcement late last Friday that he wants a 10% cap on credit card interest rates for one year, starting January 20th.

📉 The market was quick to react:

JPMorgan ($JPM) and Bank of America ($BAC) both fell 5%

Wells Fargo ($WFC) crashed 8%

Visa ($V) and Mastercard ($MA) both fell 6%

💳 A “Potentially Devastating” Impact

💸 Credit card interest is one of the most profitable businesses for major banks. The average credit card rate nationally is currently 19.7%, while rates for subprime borrowers and store-specific cards are even higher.

📉 A 10% cap, even for only a year, would cut credit card margins of major banks in half, with some smaller firms potentially losing over 70% of their profit.

🚫 More notably, a cap could lead issuers to stop offering credit cards to anyone except the lowest-risk customers. And since many Americans depend on credit cards to spend, without new lending, consumer spending (and therefore economic growth) would likely decline.

😬 Citigroup CFO Mark Mason was very direct about the potential damage, saying an interest rate cap “would restrict access to credit to those who need it the most and, frankly, would have a deleterious impact on the economy.”

🔬 But according to a study by Vanderbilt Policy Accelerator, banks may be overreacting to the impact of such a cap, noting that credit cards could still remain profitable, with Americans saving roughly $100 billion in interest.

“The banks are just scrambling because this is their cash cow and suddenly people are paying attention to the fact that they are charging way too much on credit cards.”

💡 So, Will It Actually Happen?

🎢 Markets tend to react to headlines quickly, but there are a few reasons why this cap is unlikely.

⚖️ The first is that it’s unclear how Trump would actually enforce it. An executive order would be expected, but would also face enormous pushback from the industry and potential legal action by the banks.

🏛️ The most straightforward route to achieve such a goal would be legislation through Congress, but that’s not possible by the proposed January 20th deadline.

🤔 Some analysts say the close deadline and such an out-of-the-blue proposal by Trump is to build pressure so banks voluntarily lower rates:

“I'm not aware of an authority that they can use to do this unilaterally in any kind of a sweeping way. As far as I can tell, telling them they have until Jan. 20 is an attempt to create pressure and have them do it voluntarily.”

🎲 It’s still in the air whether Trump will actually follow through on the credit card cap, or if this is another case of him using political pressure to get what he wants, but for now, the banking industry is holding its breath.

💡 And judging by the current response by leadership from some of the large banks, political pressure doesn’t seem like enough to force banks to deliberately cut into their most profitable business line.